While it is difficult to forecast the full impact that COVID-19 will have, it is certain that in the short term, sales in China and other markets in the region such as South Korea, Macao, Hong Kong, Thailand, Taiwan and Japan will be significantly hit in 1Q due to the high level of Chinese tourism in these locations.

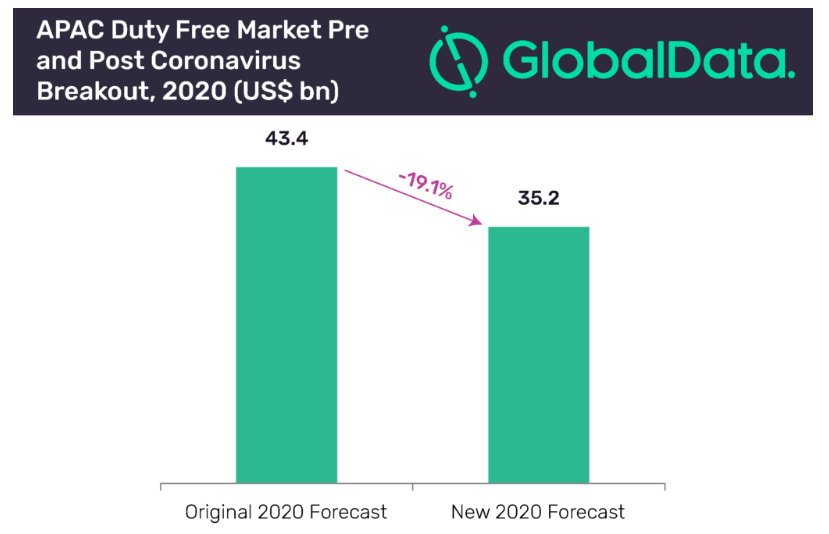

We all know that Chinese travellers like to make purchases and many airports across the world have developed specific strategies to maximise their spend. As such, GlobalData expects the current crisis to have a significant impact on the travel retail sector, especially across Asia Pacific where it suggests that revenues could drop this year by almost a fifth against its initial predication.

Over the full course of 2020, GlobalData now expects the region's duty-free sales to reach USD35.2 billion, which is 19.1% lower than the original (pre-coronavirus) forecast, accounting for over 92.5% of an expected USD9 billion reduction in global duty-free sales. More than half of these losses will come from South Korea alone due to the size of its market and the scale could worsen should the virus spread be prolonged to 2H 2020 or if it spreads to other key duty-free markets in the region including India, Malaysia and Australia.

Global Data says the crisis will force major duty-free operators in the region such as Shilla, Lotte, Shinsegae and China Duty-free Group to "re-evaluate strategies and identify other consumer groups and markets to help offset a weakening in revenue". It predicts that luxury brands and cosmetics operators in major duty-free markets will be the biggest losers given their reliance on high spending Chinese consumers, highlighting how over-exposed the duty-free channel is to this key purchaser group.

Authorities have come up with measures to control the losses to retailers. For instance, concessionaires at Singapore Changi Airport will receive rental assistance - 50% rebate on their monthly basic rental charges for six months effective 01-Feb-2020, but will it be enough?

CHART - GlobalData has predicted that the Asia Pacific duty free market will lose around a fifth of its 2020 revenues due to the coronavirus outbreak as the key and big-spending Chinese stop travelling Source: GlobalData Retail Intelligence Center

Source: GlobalData Retail Intelligence Center

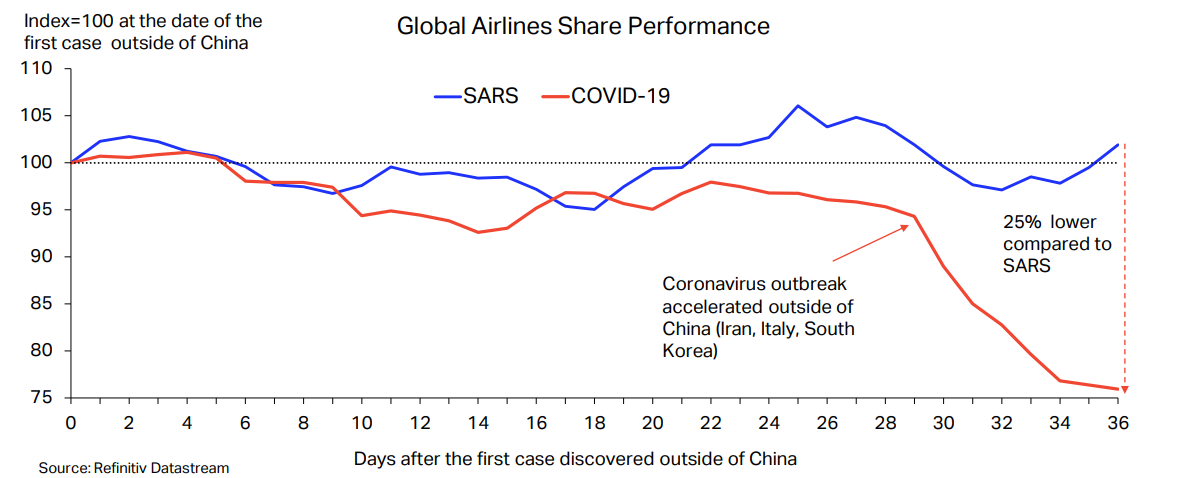

Meanwhile, International Air Transport Association (IATA) has revised its early guidance on the impact of coronavirus on airline revenues and it is a significant shift on its initial analysis from just a couple of weeks ago, highlighting the increasing impact being felt by the world's airlines. The previous suggestion was based on the SARS experience, but this underestimates the impact due to the industry's larger scale, especially China's rise in economic size.

What was plotted as a USD29.3 billion loss of revenues has now translated into USD63 billion in a scenario where COVID-19 is contained in current markets), but almost doubling to USD113 billion with a broader spreading.

This is purely based on the passenger market as no estimates have yet been formulated for the impact on cargo operations. Airline share prices have fallen nearly 25% since the outbreak began, some 21 percentage points greater than the decline that occurred at a similar point during the SARS crisis of 2003, says IATA.

CHART - Financial markets are now anticipating a large fall in airline profits globally, far beyond SARS impact Source: IATA Economics using data from Refinitiv Datastream

Source: IATA Economics using data from Refinitiv Datastream

In its limited spread scenario passenger numbers are predicted to fall across China (-23%), Japan (-12%), Singapore (-10%), South Korea (-14%), Italy (-24%), France (-10%), Germany (-10%), and Iran (-16%). Outside of these markets Asia would in general be expected to see an 11% fall in demand, and Europe and the Middle East a 7% fall in demand.

The extensive spread scenario applies a similar methodology but to many more markets and forecasts a 19% loss in worldwide passenger revenues. "Financially, that would be on a scale equivalent to what the industry experienced in the Global Financial Crisis," it says.

One positive - if you can indeed talk about positives at this challenging time - is that oil prices have tumbled (reducing by USD13/barrel Brent since the beginning of the year). This could cut costs up to USD28 billion on the 2020 fuel bill which IATA says will "provide some relief" but would "not significantly cushion the devastating impact" that COVID-19 is having on demand. This is also based on a zero hedging practice and we all know that risk averse airlines would have already committed to a future pipeline at the historically higher rates.

Most airlines are cutting capacity and taking emergency measures to reduce costs on a short-term basis, but these could quickly escalate into longer medium-term actions. The fall of Flybe into administration this week, while not directly as a result of the outbreak (albeit it may have hammered the final nail), will unlikely be the only airline collapse during this challenging period.