Summary:

- Departure capacity from Germany (+16.3%) is growing at twice the rate as market leader United Kingdom (+8.5%) this winter, an analysis of OAG schedule data shows:

- At these rates Germany could overtake the UK as Europe's largest winter market by departing seats, but growth rates have been influenced by recent airline failures;

- The Blue Swan Daily research suggests that the UK's position should be safe for the short-term at least, but Brexit process could quickly move the goalposts.

A look at flight schedules for the current winter period would provide little clue on any impending doom with UK departure capacity up a notable +8.5% on the previous winter. Of course, this year-on-year figure has been influenced by the collapse of Monarch Airlines just ahead of the start of the winter 2017/2018 schedule, but still shows positive signs.

As we are just weeks into the new schedule period, it is not always easy to compare against a completed schedule. As the saying goes… 'We are not comparing apples with apples'. However, comparing the growth rates among other countries does have merit and provides some interesting reading. Most notably that Germany, Europe's second largest winter aviation market, is forecast to grow at almost twice the rate of the UK this winter - a +16.3% rise. This year-on-year comparison is again impacted by the collapse of a major airline. In Germany's case that was airberlin.

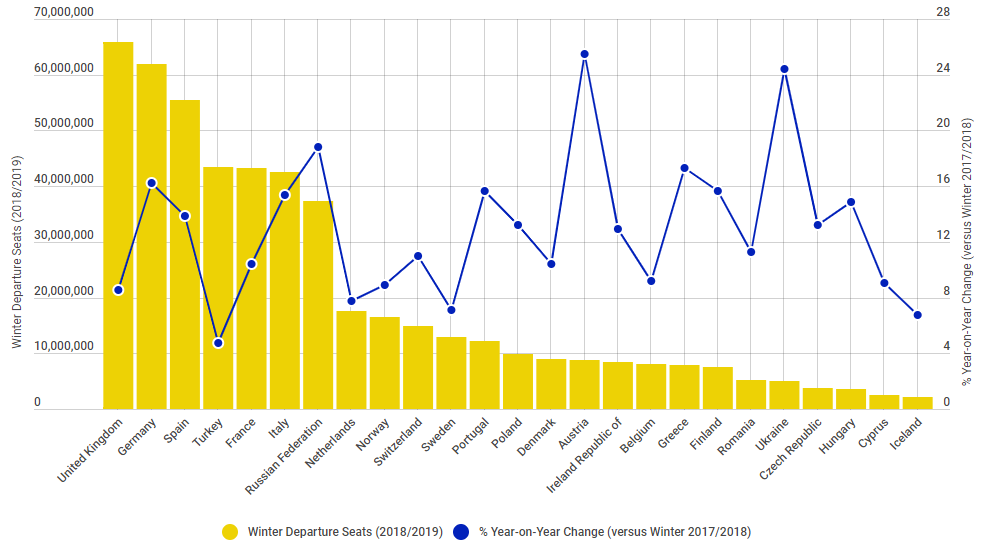

CHART - United Kingdom remains Europe's largest winter aviation market, but Germany is closing. Austria is the biggest annual mover among the nations climbing above both the Republic of Ireland and Belgium Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

The German rate of capacity growth this winter is only bettered among Europe's ten largest aviation markets by Russia, which is expected to grow +18.8%, based on published schedules. In fact it is among the top four fastest growing of Europe's largest 25 country markets, behind Austria (+25.5%), Europe's latest LCC battlefield, Ukraine (+24.4%) and Greece (+17.2%).

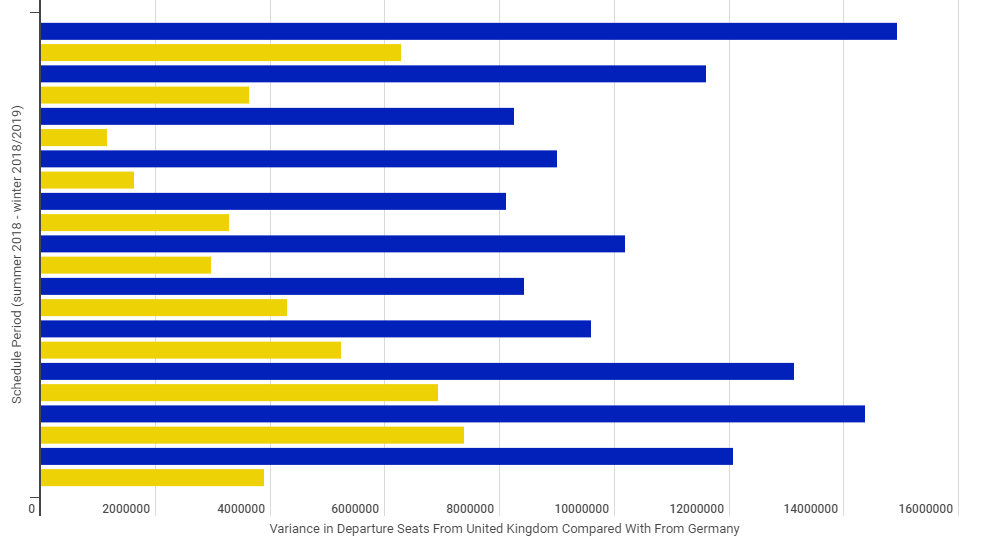

So could Germany overtake the UK? Well, just like the Brexit plans, nobody truly knows. What is clear is that the difference in departure seats this winter at just under four million seats may be half the level seen in the 2017/2018 season, it is certainly not the lowest level seen this decade. Back in 2010 the gap was just over one million with the 2017 figure - one we have acknowledged was impacted by airline failures - actually being the largest gap recorded this decade.

CHART - The variance in departure capacity between UK and Germany has fluctuated between 1.1 million and 14.9 million seats over the past ten years with significant differences between the summer (blue) and winter (yellow) schedules Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

Over the past ten years winter departure capacity from the UK has grown at a slightly slower rate to that recorded by Germany - +19.1% versus +26.4%. However, when you look at the same data for this decade alone, the UK's winter departure capacity has actually grown at a faster rate - +29.5% versus +24.6%.

In the summer the variance in departing seats is much wider and has varied from a low of just over eight million seats at the start of the decade to over 14 million this summer, when Spain actually pushed Germany down to the third largest European market by departing seats.

On a level playing field it appears that the UK will remain Europe's largest aviation market, at least for the short-term. However, it could be argued that there is no such thing as a level playing field in air transport terms and Brexit remains an obvious anomaly that may or may not change the European aviation landscape forever more. It is certainly a case of watch this space!