Summary:

- New Zealand has the lowest international LCC penetration rate among the 20 largest markets in Asia Pacific;

- Following the upcoming suspension of services from AirAsia X, LCCs will only account for 6% of international seat capacity in New Zealand;

- New Zealand was the first market in Asia Pacific with LCCs but has been punching below its weight in terms of LCCs for several years.

Ironically New Zealand - the home for Asia Pacific's first LCC - now has the lowest international LCC penetration rate in the region. LCCs currently account for around 12% of total seat capacity in New Zealand, including 7.5% of international seat capacity and 17% of domestic seat capacity.

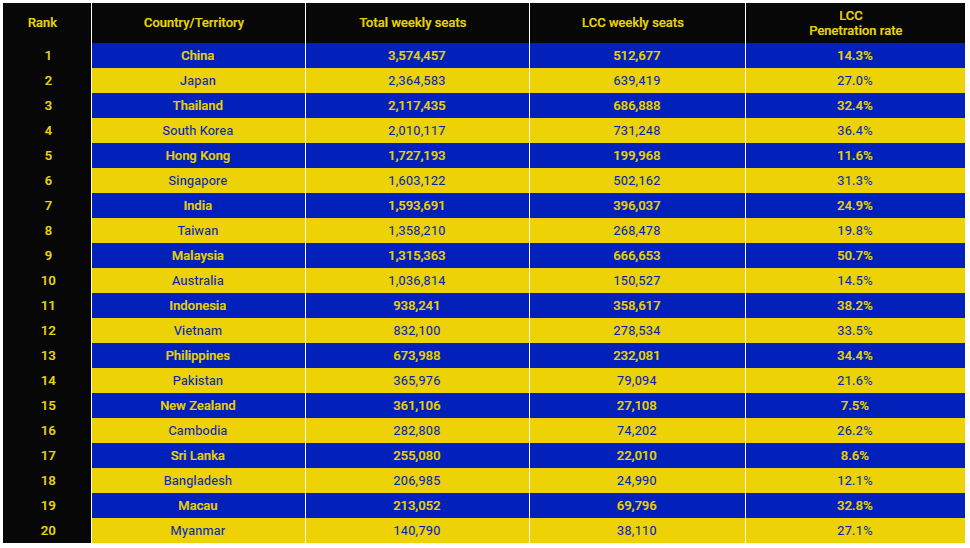

Comparing domestic markets is difficult as several countries have limited or no domestic markets whereas comparing international markets is more straightforward. Malaysia has the highest international LCC penetration rate in Asia Pacific and is the only country where LCCs account for more than 50% of international seat capacity. This is hardly surprising given Malaysia is the original home market of AirAsia and AirAsia X.

Six other markets in Asia Pacific have international LCC penetration rates of at least 30%: Macau, the Philippines, Singapore, South Korea, Thailand and Vietnam. New Zealand and Sri Lanka are the only countries with international LCC penetration rates of less than 10%.

TABLE - China is the largest international market in the Asia Pacific region, but LCC growth is not as strong as its closest rivals Source: CAPA - Centre for Aviation & OAG (data: w/c 19-Nov-2018)

Source: CAPA - Centre for Aviation & OAG (data: w/c 19-Nov-2018)

Sri Lanka has been impacted by the late 2017 shutdown of Mihin Lanka, a local LCC which was folded into full service operator SriLankan Airlines. New Zealand has a geographic disadvantage given its remote location. Widebodies are needed to reach New Zealand from most destinations and LCCs operate a much smaller portion of Asia Pacific's total widebody fleet compared to narrowbody aircraft.

However, New Zealand is still clearly punching below its weight in terms of international LCCs. Its largest international market by far is Australia, which is within narrowobdy range. LCCs currently account for around 13% of seat capacity between Australia and New Zealand - a very low figure for a short-haul market.

The cross-Tasman was the very first Asia Pacific market penetrated by LCCs, initially by independent New Zealand-based LCC Kiwi and Air New Zealand LCC subsidiary Freedom Air. Kiwi was short-lived, operating from 1995 to 1996 while Freedom operated from 1995 to 2008.

READ MORE... on New Zealand's LCC market New Zealand LCC market: AirAsia X pulls out again, leaving only Jetstar

New Zealand LCC market: AirAsia X pulls out again, leaving only Jetstar

The New Zealand-Australia market has had LCC competition for 23 consecutive years as Jetstar has served the market since late 2005. However, the portion of LCC capacity has been steadily declining and will slip further as AirAsia X suspends its Gold Coast-Auckland service, which is operated daily with 377-seat A330-300s, in Feb-2019.

The AirAsia X suspension will reduce New Zealand's international LCC penetration rate from 7.5% currently to only 6%. The LCC capacity share in the New Zealand-Australia market will decline from 13% to 10.5%.

Clearly there are opportunities for LCCs in the New Zealand-Australia market. Tigerair Australia will likely enter this market within the next year or two, which could lead to a resumption of expansion from Jetstar. However, the biggest opportunities could be in the New Zealand-Asia market, which has been growing rapidly but does not currently have any nonstop LCC services. AirAsia X now offers a one-stop product from Auckland to Kuala Lumpur (via the Gold Coast) but this will be dropped in Feb-2019; and it previously also served Christchurch nonstop from Kuala Lumpur in 2011 and 2012.

As Asian LCCs pursue rapid widebody expansion, New Zealand is a natural market. LCCs account for around 20% of capacity between Asia and Australia, which is almost as isolated geographically as New Zealand. Australia overall has 14.5% international LCC penetration rate - and like New Zealand this has been on the decline the last couple of years. However, Australia's international LCC penetration rate is double the rate of New Zealand, a clear indication that New Zealand is punching below its weight when it comes to LCCs.