The airline has been in a downward tailspin for a long time as legacy costs and union contracts have made it difficult for the airline to change its business model to adapt to the changing dynamics of the European air transport market. To be honest the unprofitable airline has been haemorrhaging cash and has been on life-support for many years. Only the recent support of Etihad Airways and the Italian government have pumped the sufficient funds to keep the ailing business alive.

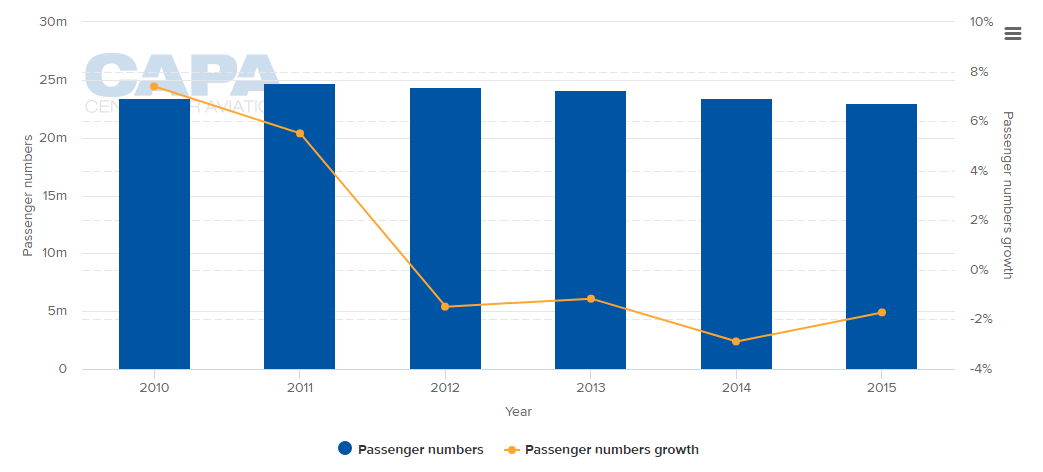

CHART - Alitalia Annual Passenger Trafic (2010-2015) Source: CAPA - Centre for Aviation

Source: CAPA - Centre for Aviation

As the airline this week enters into administration for a second time in less than ten years only a €600 million bridging loan from the Italian government will keep it operating over the next six months while its future is resolved. The filing for 'amministrazione straordinaria'' (extraordinary administration) in compliance with the Italian law was the unanimous decision of the airline's board, having acknowledged the serious economic and financial situation of the company, of the unavailability of the shareholders to refinance, and of the impossibility to find in a short period of time any alternative.

Alitalia says its flight schedule will continue to operate as planned while administrators study whether it can be rescued - it has received more than €7 billion from the Italian state over the past decade to keep it flying.

Under Italian law, the government will appoint supervisors to try to turn the airline around or order its liquidation. The administrators will attempt to present a new strategy within six months that could entail asset sales, reduced operations and job cuts aimed at making it viable. If deemed not possible, it could carry out the liquidation with the Italian government already ruling out nationalising the airline.

Italy's national airline had signed a deal with Etihad Airways in 2014 in which the Gulf carrier acquired a 49% stake, becoming the company's largest stakeholder. The €1.7 billion rescue plan kick-started an ambition restructuring of Alitalia in an attempt to turn the airline into a premium five star airline, overcoming its high cost base to allow it to complement rather than compete with rising competition from low-cost rivals.

However, an aggressive restructuring negotiated with trade unions in the first quarter of this year was rejected by the airline's nearly 12,000 employees in a vote last month and has meant investors, including Italian banks UniCredit and Intesa Sanpaolo, could no longer commit themselves to an almost €2 billion financing package to give Alitalia another lease of life.

The Italian shareholders and Etihad had structured this package based on what they believed was "the strong potential growth of the company" and was based on an industrial plan which included cost reductions of which two thirds were not directly related to labour cost reductions which would have unlock the rescue funds.

Etihad has expressed disappointment at Alitalia entering bankruptcy proceedings, and while acknowledging it has been fully behind the planned rescue package, its president and chief executive officer, James Hogan, says the UAE airline was "not prepared to continue to invest" in what needs to be a "fundamental and far-reaching restructuring" without the support of all stakeholders.

"We are disappointed that despite Etihad's significant investments in Alitalia, alongside those of the other shareholders, the airline was unable to proceed in its current form," says Mr Hogan, noting that Italy remains an important market for the business and plans to continue to work with Alitalia as a commercial partner alongside its own presence in Italy.

According to Mr Hogan, the initial strategy developed by Alitalia at the time of Etihad's investment and implemented from 2015 delivered "significant improvements". However, new marketplace challenges, including greater low cost carrier competition and the impacts of terrorist events on tourism demand, meant further, deeper change was required. "As a supportive investor, we have delivered on our commitments since taking our minority share," he adds.

Alitalia's share of capacity within and from Italy had fallen below 25% by 2015 in the face of competition from low-fare airlines such as Ryanair and easyJet. This slipped further to 22.2% in 2016 according to schedule data from OAG, with market leader Ryanair boosting its own share to 23.9%. The Italian flag carrier lost €460 million last year and a similar loss is predicted for 2017.

READ MORE… Alitalia: Is this the end of the line? An airline that is no longer commercially needed