On 03-Sep-1981 the first BAe 146 regional jetliner took to the skies from the British Aerospace airfield at Hatfield, Hertfordshire. The aircraft - and its later-build successor, the Avro RJ - was destined to become Britain's most successful jet airliner with its performance enabling it to fulfil a niche in the regional market. A total of 394 aircraft were built, with the final new-build aircraft delivered from the Woodford, Cheshire production line 22 years later in Nov-2003.

With long-standing European operators are now retiring the type many believed it is the end of an era for the British-built quad jet. Swiss International Air Lines is replacing its Avro fleet with the Bombardier CSeries, recently retiring the aircraft off the Zurich - London City market, a mainstay for the aircraft. Elsewhere, Irish regional carrier CityJet is replacing its aircraft with the Sukhoi SuperJet and others also introducing modern generation airliners to their fleets that bring enhanced efficiency and performance to the market.

This may be the case in terms of scheduled commercial passenger operations in Europe, but the aircraft's flexibility, continued utility and economic attractiveness is seeing the type fulfil many key missions in developing markets across the globe. Recent new operators and applications for the aircraft include a prestigious overnight freight operation in Australia, an established airline in Africa, a new start-up airline operator in the Caribbean, and further aircraft for the aerial firefighting role in North America.

Around 200 BAe 146/Avro RJs remain in service, fully supported by BAE Systems Regional Aircraft - the Original Equipment Manufacturer. More than 12 million flight hours of service have been accumulated across its service life. "We strongly believe that this aircraft has many years of productive service yet to offer," says John Stevens, head of customer support, BAE Systems Regional Aircraft.

Over the past year aircraft previously operated in Europe have been placed with new operators in Australia and the USA. Two BAe 146-200QT freighters previously operated by ASL Aviation Group on behalf of the FedEx-TNT combination are now flying for Pionair of Sydney, Australia, which in September last year started overnight freight services on behalf of Virgin Australia which has won a five-year US$575 million contract from TNT Express.

An increasing number of BAe 146/Avro RJs are now operating or being converted for the vital aerial firefighting role with three North American operators. As the later-build Avro RJs also start to come out of European service, so they too are now finding new homes. Established Ghanaian airline Starbow took delivery of its first RJ100 last year adding to its existing fleet of BAe 146 and ATR-72-500 aircraft.

With excellent short-field performance and its quiet engines enabling it to serve many inner city airports the BAe 146 and Avro RJ have helped establish a number of key business routes and have played a key role in facilitating growth at airports such as London City and Stockholm Bromma in Europe.

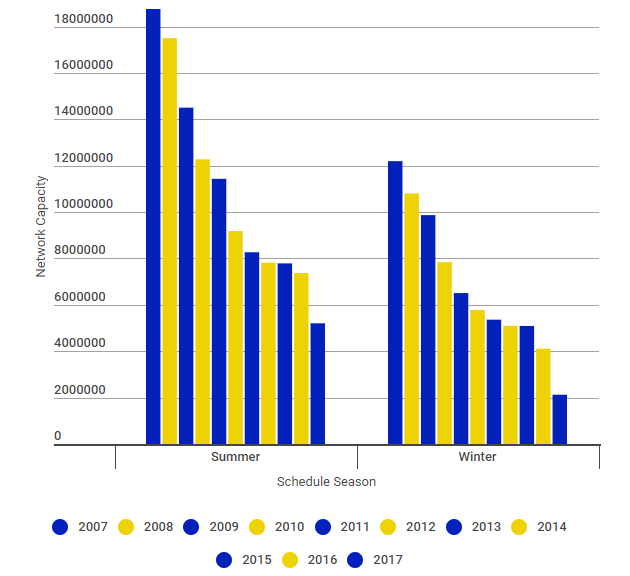

CHART - There has been a -29.4% reduction in BAe 146 and Avro RJ seat capacity this summer, increasing to -48.3% in the forthcoming winter schedule Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

A look at published timetables for the current summer 2017 forthcoming winter 2017/2018 seasons from OAG shows that while there is a -29.4% and -48.3% reduction in BAe 146 and Avro RJ seat capacity, the types are still scheduled to operate over 55,000 one-way flights between April 2017 and October 2017, offering over 5.2 million seats and around 22,000 one-way flights between November 2017 and March 2018, offering over 2.1 million seats

Since last summer, Braathens Regional Aviation (formerly Malmo Aviation) has overtaken Swiss as the largest scheduled operator of the BAe 146 and Avro RJ with a 18.4% share of available scheduled capacity for the forthcoming schedule period. This is up from a 12.9% share in summer 2016 with a 0.5% growth in its own inventory.

The data highlights significant capacity declines for the types in the Brussels Airlines and Swiss fleets in Europe, but there is a growth in Air France operations and the reintroduction of the type into KLM operation through the expansion of CityJet's wet-lease activities and the reduction in the use of the aircraft across its own scheduled network.

Like other European operators CityJet was originally expected to retire the type, but is now expected to keep hold of the aircraft into the next decade. "We originally thought we wouldn't be using them by 2018 or 2019, but we see more opportunity for them," said Pat Byrne, chief executive officer, CityJet, earlier this summer. The aircraft will be refurbished and upgraded for likely operation until 2021.

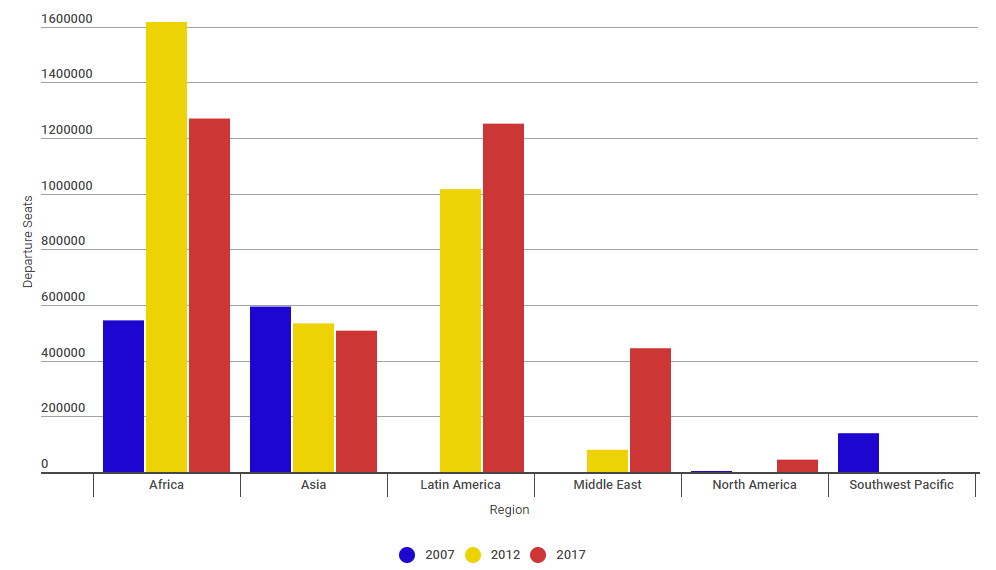

CHART - While European Avro RJ and BAe 146 capacity is declining, the aircraft is seeing growth in passenger flying in developing markets such as Latin America and the Middle East Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

A total of 216 airports are due to see BAe 146 and Avro RJ scheduled flights across the current summer 2017, down from 224 in last year's schedule. Despite the reduction in European operations of the type, the region still dominates with seven of the top ten markets for the type in the Continent.

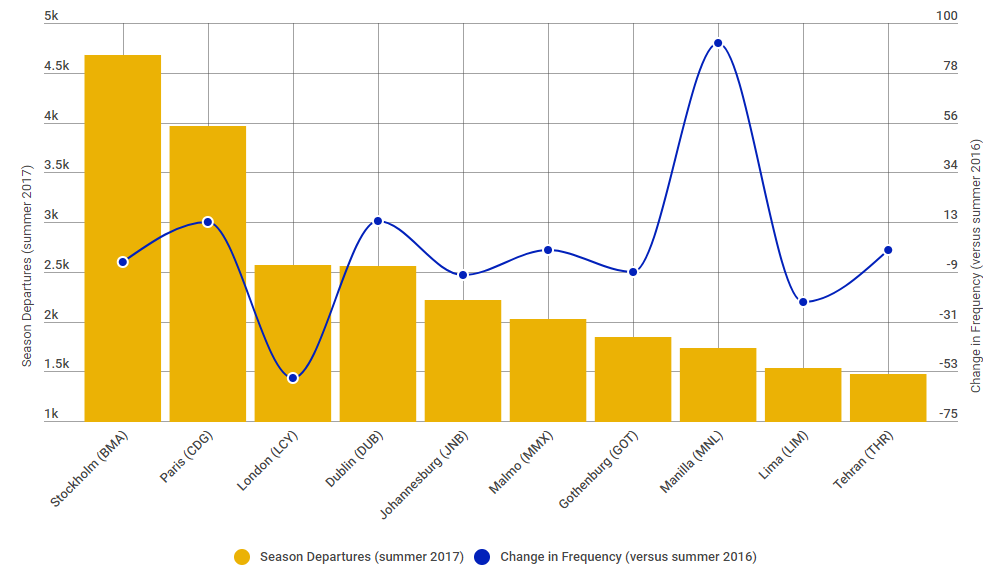

Similar to the airline side, the gradual replacement of its Avro RJ fleet with new C Series equipment at Swiss and Brussels Airlines' retirement of the type means that Stockholm Bromma, Paris CDG and London City have jumped above Zurich and Brussels as the busiest airports for regular BAe 146 and Avro RJ operations.

The only non-European airports include OR Tambo International Airport in Johannesburg, South Africa, Jorge Chávez International Airport in Lima, Peru and Ninoy Aquino International Airport in Manila, Philippines, the latter also showing the largest rate of growth over the past year (+97.6% versus summer 2016) through the operations of SkyJet Airlines. Tehran's Mehrabad International Airport, a new location for scheduled operations with the type, makes the top ten through the flights of Faraz Qeshm Airline and Taban Air.

CHART - Stockholm Bromma is the busiest airport for Avro RJ and BAe 146 operations this summer Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG