What is clear is that the likelihood of a stable and quick recovery of travel demand is likely to be greater for destinations that rely more heavily on domestic and short-haul travellers. Lower cost of travel, remaining international travel restrictions, uncertainty around transport availability as well as a heightened risk aversion is likely to increase consumer preference for travelling closer to home.

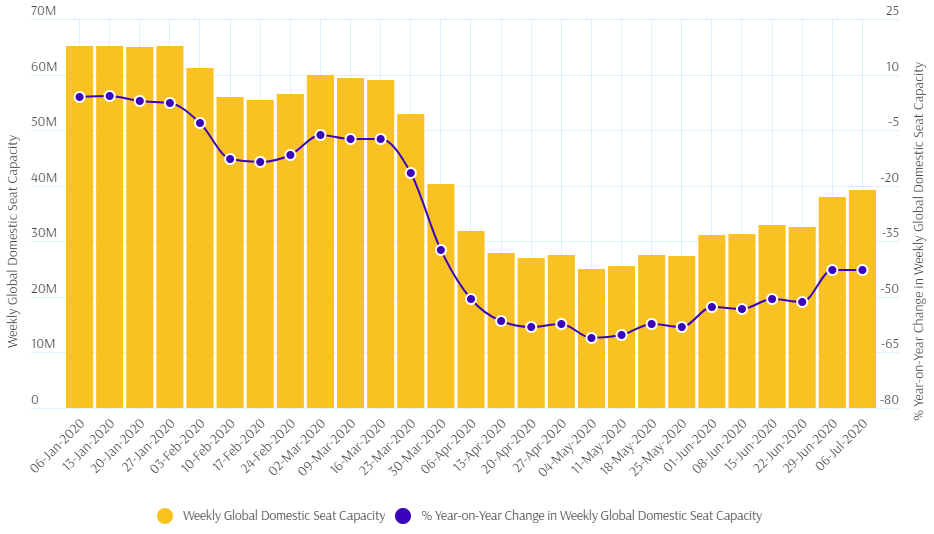

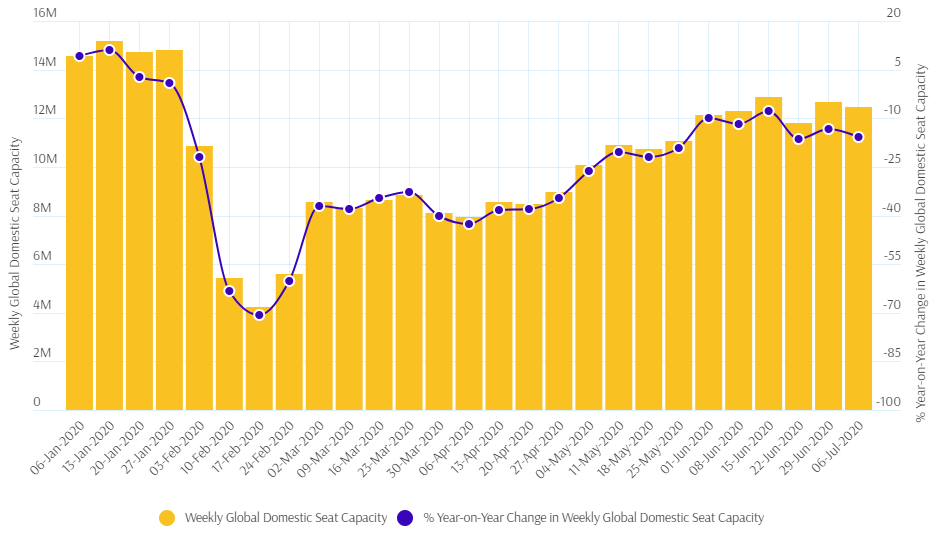

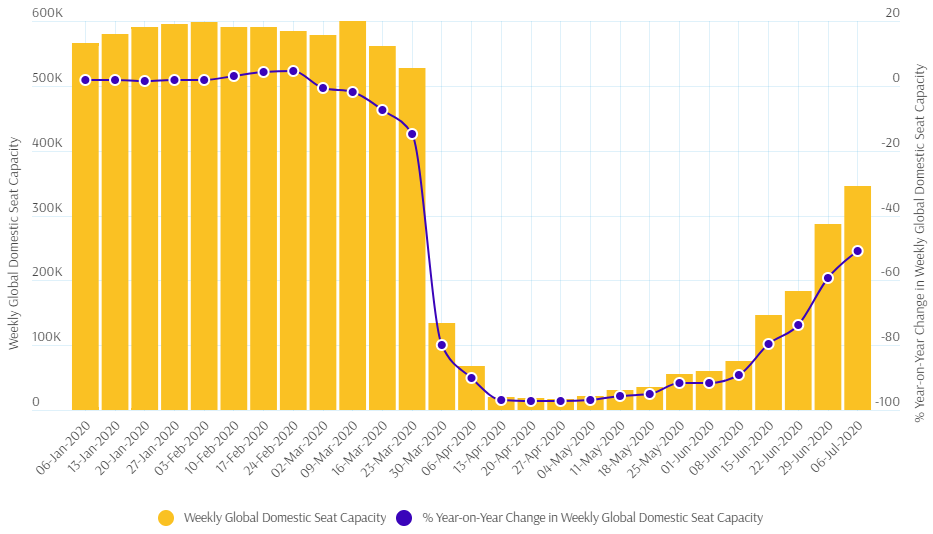

The Blue Swan Daily has looked at the world's largest 25 domestic country markets, based on local capacity last year and compared domestic flight schedules filed with OAG for both 2019 and year-to-date in 2020. On a global level, domestic air capacity has now recovered to 58% of levels seen this time last year.

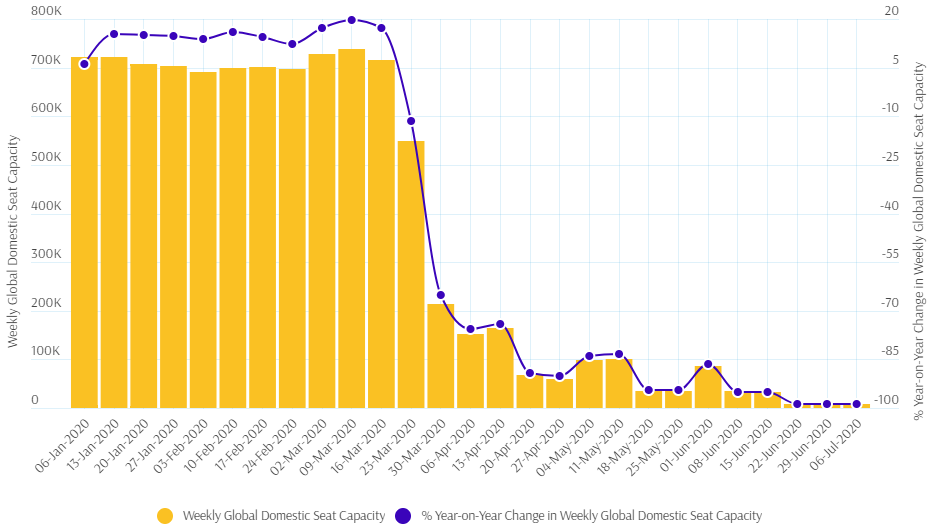

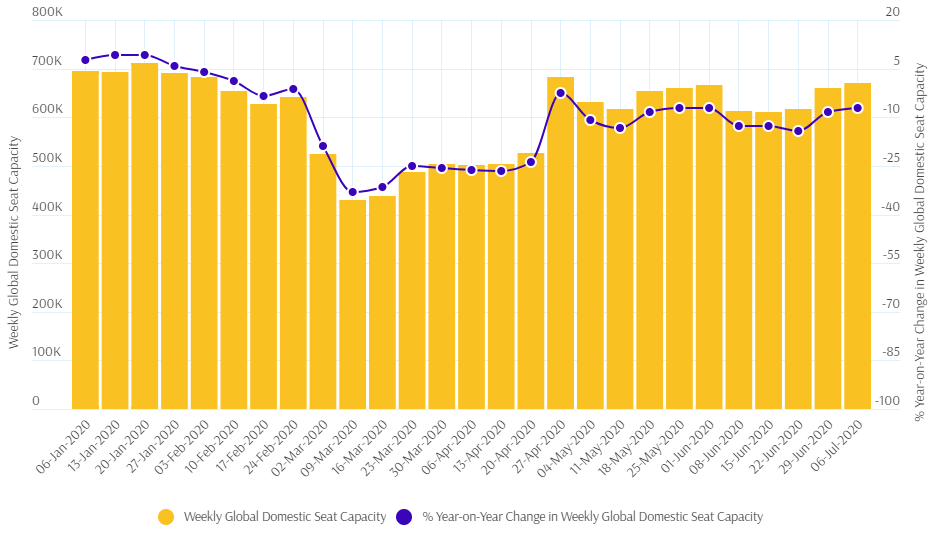

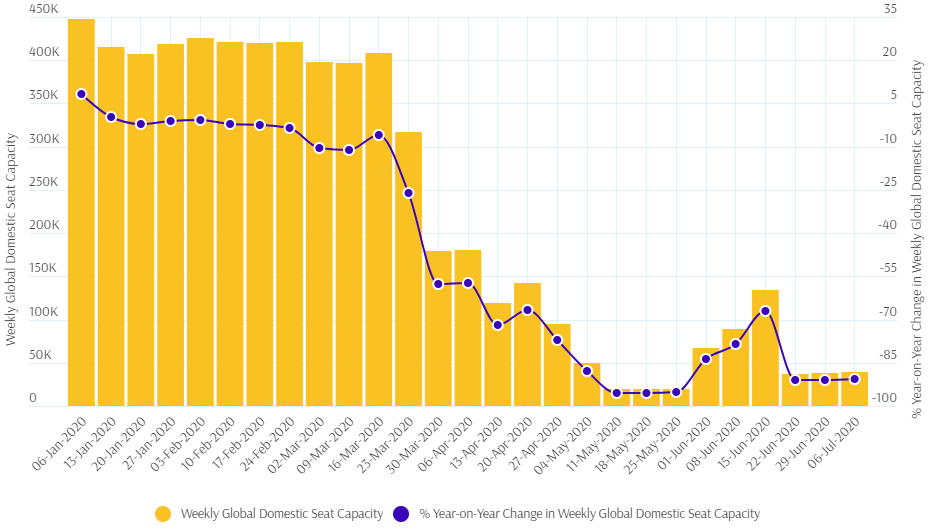

CHART - Global domestic air capacity started to be impacted by Covid-19 from the middle of Jan-2020, but started its recovery in early may-2020 and is back above 50% of levels seen at the same time last year Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

In Jan-2020 the first indications of the coronavirus started to impact domestic capacity as through the month weekly growth levels started to slip from up +4.0% and +4.3% to +2.9% and +2.5%. In Feb-2020 that fell into negative growth territory and that is where they have remained. They hit the bottom of the curve in the week commencing 04-May-2020 when a -61.1% year-on-year decline was recorded but have subsequently begun to recover, climbing above half as we entered Jul-2020.

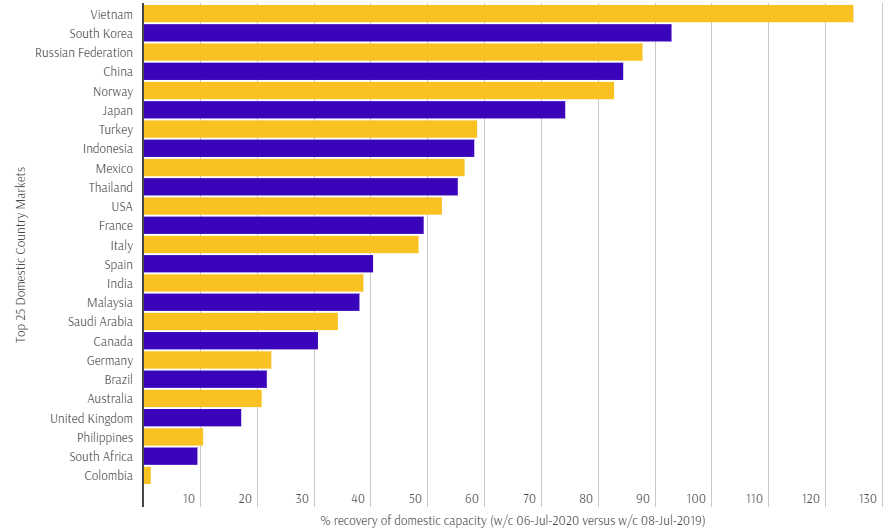

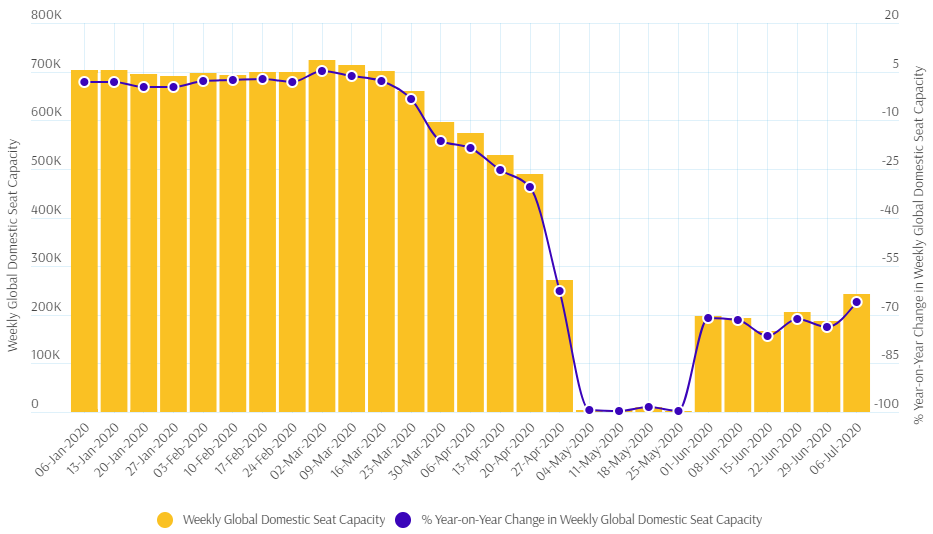

But which markets are seeing the strongest recovery? Who are the domestic leaders, who are following revival trends and who are perhaps lagging behind? Our research puts Vietnam, South Korea and the Russian Federation, with Vietnam already recording positive growth in domestic capacity. In fact for our analysis period domestic capacity was up a quarter on those levels recorded this time last year.

CHART - Vietnam has seen domestic air capacity levels already exceed last year's levels, but the rest of the world are at different stage of recovery Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

Here's some commentary on some of those domestic markets:

Vietnam - 124.8%

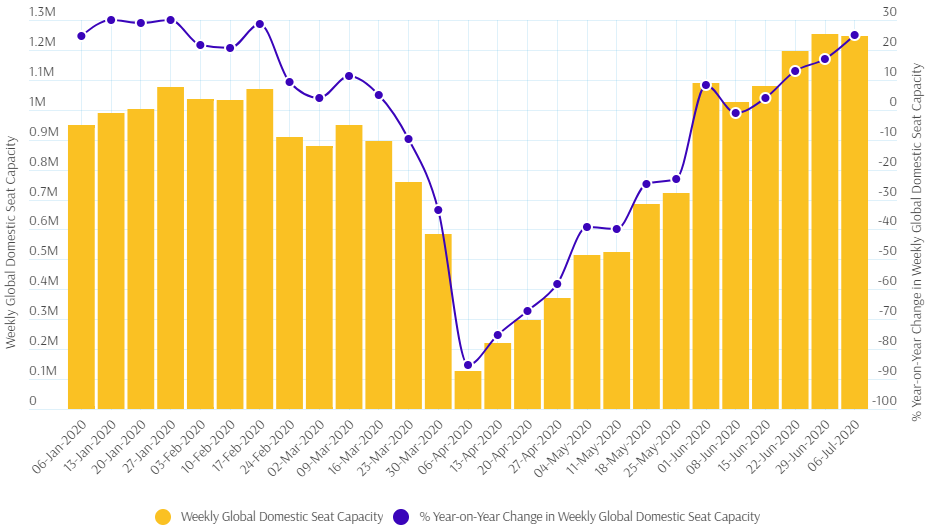

It is certainly a 'V' for Vietnam with the Southeast Asian country clearly showing a 'V-shaped' recovery. In fact we are actually right back to where we were at the start of the year with an almost quarter rise in domestic weekly capacity. The emerging economy was seeing strong domestic capacity growth in January, peaking at a year-on-year rise of +35.9% at the end of the month. Like most countries domestic capacity decline was swift, declining -85.4% at the start of April, but recovery came immediately and by the middle of June the market was back delivering year-on-year growth.

South Korea - 92.8%

At quick glance you would not even consider that South Korea's domestic market had been impacted by the pandemic. At its lowest levels capacity declined less than a third, down to -32.9% at the start of March. Just has the decline has been shallow, the recovery has been quick and schedule data shows that at the end of April domestic levels were down just -2.6%. That was a one-off and weekly levels have subsequently been down between -7% and -13% year-on-year, currently standing above 90% of levels seen this time last year.

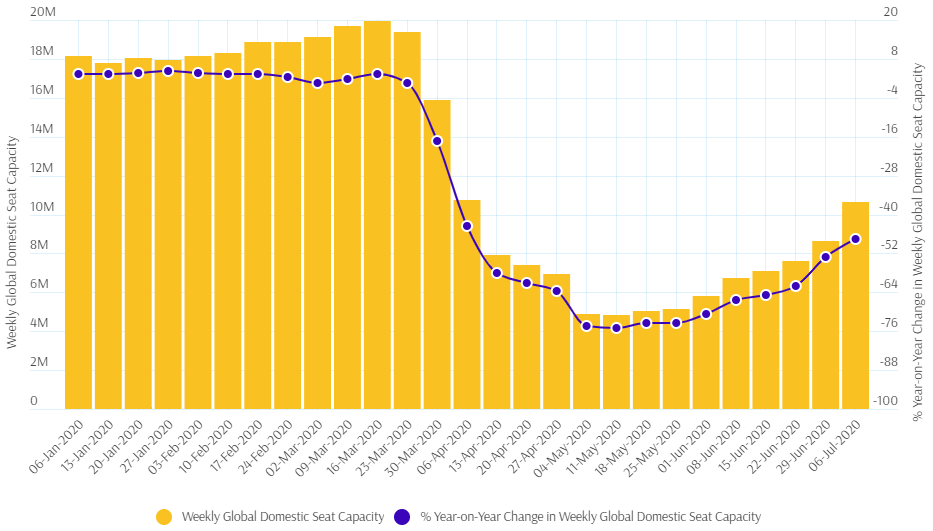

China - 84.3%

Many have looked to China to get a better understanding on the recovery process for domestic air transport. It was the first nation to enter any Covid-19 lockdown and the first to see the return of domestic air capacity, before some and even seen the worst of their own infections. It its worst in mid-February weekly capacity fell to around a third normal levels, the bottom occurring during the week commencing 17-Feb-2020 when capacity was down -70.7%. The recovery in domestic skies has been quick, but the gradient remains relatively shallow with capacity levels being readjusted from week to week to meet local demand. At its best capacity return to just single-digit declines, but currently stands at around 85% of the levels this time last year.

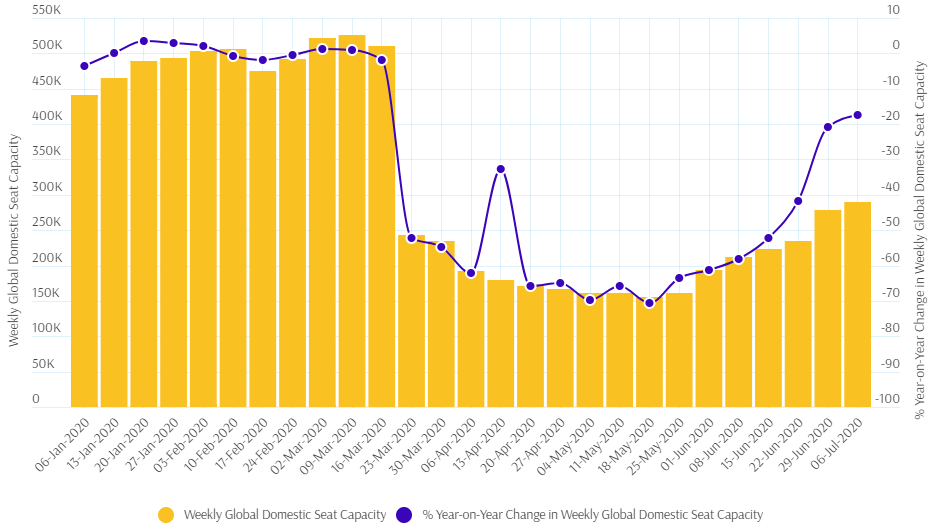

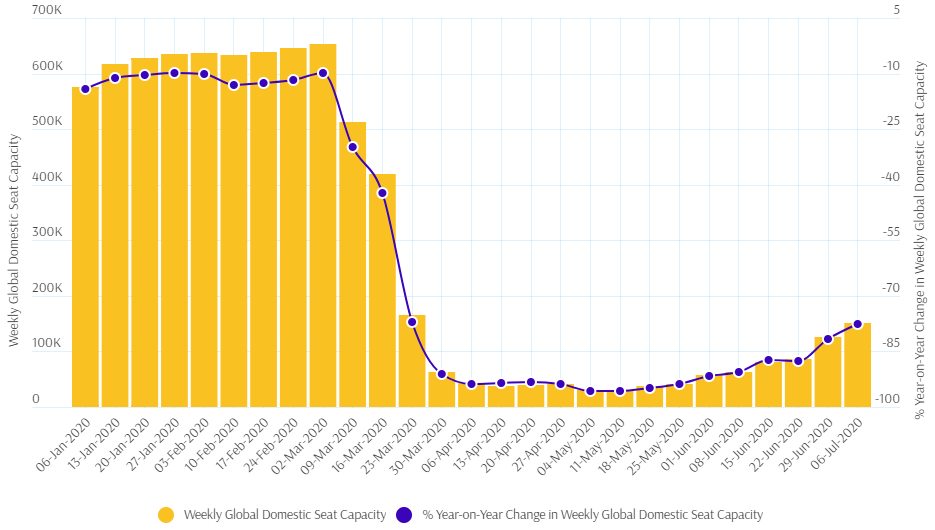

Norway - 82.7%

Domestic air travel is an essential service in Norway to maintain vital connectivity in the country and as such a higher level of capacity has remained active throughout the nation's own Covid-19 lockdown. This meant domestic levels only fell to -70.5% in the middle of May. Its recovery commenced in June and at a fast pace rising to around 80% of last year's level as we entered July and then up to 82.7% last week.

United States of America - 52.4%

The world's largest domestic market has now recovered to more than half the levels seen on the corresponding week last year, but it still ranks below China at the current time due to that country being ahead of it in the recovery. In early July it passed the ten million domestic seat figure for the first time since early April but the integrity of its schedules remain unclear with many late cancellations meaning that level may not be as high as they appear. It its worse domestic capacity levels fell three quarters, down -75.0% in May.

France - 49.2%

The French domestic air market will see permanent changes due to the pandemic as part of the measures used by the Government to provide economic support to flag carrier Air France. The market had seen year-on-year growth during the first two months of the year and like European counterparts fell to almost nothing, down to -97.3% in April. Domestic capacity levels started to rise again in May and are now almost at 50% of the levels seen last year following the resumption of flights in July.

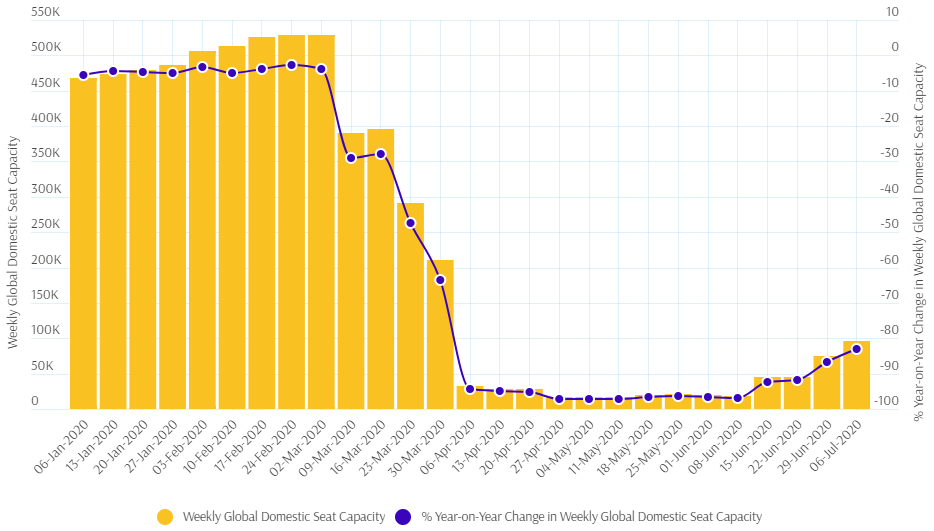

Saudi Arabia - 34.1%

The domestic capacity chart for Saudi Arabia looks a little different to the others. There was year-on-year growth in weekly capacity during the first two months of the year, but declines started to be seen through March and April, before travel restrictions ended all domestic operations from the start of May. That meant only a small number of repatriation flights remained and weekly capacity fell to -99.7%. The phased resumption of flights from the start of June has seen a recovery of around one third of capacity.

Germany - 22.4%

Germany is another nation that has seen year-on-year declines in domestic capacity throughout 2020. The decline and slow recovery it has seen follows the general market trend with a low uptick in its local air offering. While it may not have been hit so hard by Covid-19 as some of the other major European countries its lockdown saw capacity fall below-90% for all of April and May, falling to -95.8% at its worse. A slow slope of recovery is evident from mid-May and some encouraging steps have been taken as we enter July to see domestic capacity levels now back up to a fifth of levels seen this time last year.

United Kingdom - 17.1%

Domestic capacity has been in negative growth every week this year when compared with the corresponding period last year despite seeing some growth during the middle stages of the first quarter. That all quickly changed towards the end of the first quarter and levels declined to a low of -97.1% in late April and early May. In fact, domestic capacity levels were down below 10% of year-on-year levels for 12 weeks up to the week commencing 29-Jun-2020. levels are now starting to recover, albeit remain lees than fifth of those seen in Jul-2019.

South Africa - 9.4%

South Africa, the largest domestic market in Africa, saw weekly domestic capacity levels decline mainly in single digits during the first quarter of 2020, but hit its own cliff in late March with levels hitting a low of -95.3% in mid-May. The resumption of scheduled domestic operations in June has seen levels rise to around two thirds of last year's level in the middle of the month before stabilising at around 10% of last year's levels for the past three weeks.

Colombia - 1.2%

Colombia was a strongly performing domestic market over the first quarter of the year. While some of the world was being impacted by the pandemic, the air sector in Latin America was still flourishing and the home market in Colombia was recording double-digit year-on-year capacity growth. How things change! Recovery is not yet on the cards in Colombia with the nation recording its lowest domestic capacity levels over the past three consecutive weeks with levels hitting -98.9% and remaining below -98%.