Virgin Atlantic plans to challenge IAG's dominance at London Heathrow as it plans to significantly increase its long haul route network and launch a new comprehensive network of domestic and European routes if the airport expands. The new route maps illustrate how the airline's flying programme could grow to deliver a step change in choice for customers, but, these ambitious plans to "become Britain's second flag carrier" hinge on forthcoming Government decision on slot allocation at an expanded Heathrow.

It is a grand promise, but comes with a massive cavaet. It can only be delivered if the Government reforms the way new Heathrow slots are allocated to enable the creation of a second flag carrier at the airport.

The plans represent a fourfold increase on Virgin Atlantic's current international network and includes exciting unserved destinations such as Kolkata (India), Jakarta (Indonesia) and Panama City (Panama), where currently passengers cannot travel non-stop. In total, Virgin Atlantic plans to serve 103 domestic, European and long haul destinations, up from 19 long haul destinations in 2020.

Of the 84 new destinations planned, 12 are domestic, including Belfast, Exeter, Glasgow, Inverness, Manchester and Newcastle; 37 are European, including Barcelona, Dublin and Madrid; and 35 are global, including Buenos Aires, Jakarta and Kunming.

The UK government's Aviation Strategy Green Paper has set a primary objective for the allocation of additional Heathrow capacity to facilitate effective competition between airlines, benefitting consumers through more choice and lower fares. It has also set secondary objectives to improve domestic connectivity and to improve connectivity to international destinations that are currently underserved or unserved.

Virgin Atlantic says the route network plans enable the government to meet all three objectives by bringing new competition across multiple domestic, European and global routes, as well as opening up brand new destinations. "Without a second flag carrier connecting passengers between its domestic, short and long haul services, these important objectives cannot be met," it argues.

The rules governing the allocation of new slots are currently being reviewed by the Government. Virgin Atlantic warns that the new take-off and landing slots "must be allocated in a way that enables the development of a second flag carrier with the necessary scale to compete effectively with IAG". It argues that ministers need "to grasp this once in a generation opportunity to shake up the Heathrow market" so that British passengers and business can benefit from two flag carriers competing hard for their custom.

IAG currently dominates Heathrow, controlling more than half of the total capacity. A new report published last week found one in four passengers flying from the airport - 18.5 million people - have no choice but to fly with that airline group due to a monopoly position on many markets. The report also concluded that these passengers may be paying up to +10% more in air fares as a consequence due to the non-competitive position.

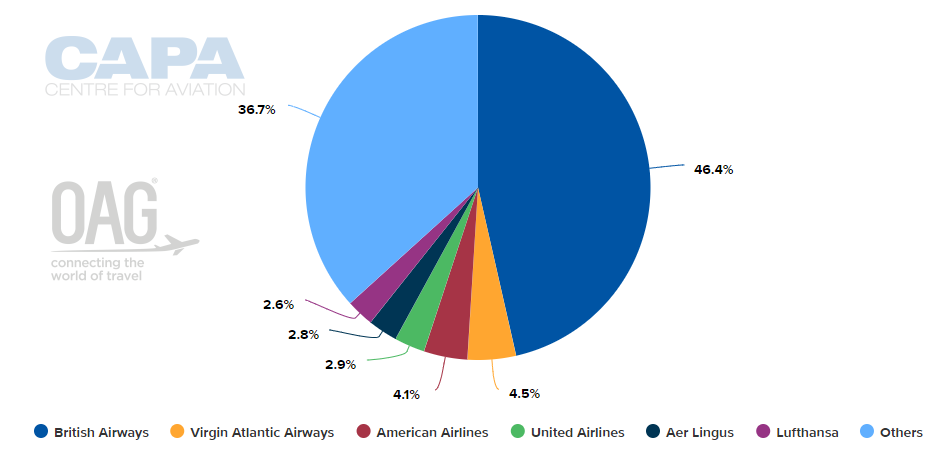

Analysis by CAPA - Centre for Aviation of OAG schedule data for this week (week commencing 23-Sep-2019) shows that British Airways has a 46.4% share of system seats. Its partners boost the figure above half, including American Airlines with a 4.1% share and Aer Lingus with a 2.8% share. Virgin Atlantic is the second largest operator at Heathrow with a 4.5% share.

CHART - The discrepancy in size between the UK's two long-haul airlines at London Heathrow airport is clearly evident in their weekly capacity offering Source: CAPA - Centre for Aviation and OAG (data: w/c 23-Sep-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 23-Sep-2019)

As things currently stand, IAG holds more than 55% of all the take-off and landing slots at Heathrow, with no other airline holding more than 5% of the remaining slots. An analysis of OAG flight schedules shows IAG and its joint venture partners operate just over 75 monopoly routes - Virgin Atlantic intends to compete on around a third of these routes if slot reform is achieved.

Virgin Atlantic says its plans address the urgent need for strong, effective competition at the UK's only hub airport and will reduce the cost of flying for millions of British business and leisure passengers for whom Heathrow is the gateway to the world.

"Heathrow has been dominated by one airline group for far too long… Britain, and those who travel to it, deserve better… Air passengers need a choice and Virgin Atlantic is ready to deliver when Heathrow expands," says Shai Weiss, CEO Virgin Atlantic.

Mr Weiss describes the third runway as "a once in a lifetime opportunity to change the status quo" and create a second flag carrier. "This would lower fares and give real choice to passengers, as well giving Britain a real opportunity to boost its trade and investment links around the world," he says.

"Changing the way take-off and landing slots are allocated for this unique and vital increase in capacity at the nation's hub airport will create the right conditions for competition and innovation to thrive," he adds.

This year has been one of significant growth for Virgin Atlantic, which has followed a focus on the trans-Atlantic market with its joint venture partner and shareholder Delta Air Lines. It as announced new routes from Heathrow to Tel Aviv, Mumbai and São Paulo and formed part of the Connect Airways consortium that recently acquired Flybe.