The operator plans to invest more than EUR730 million in development of the airport over the period of the concession to increase capacity to 15 million passengers per annum and "make Belgrade the future hub in southeast Europe", according to VINCI Airports' president Nicolas Notebaert.

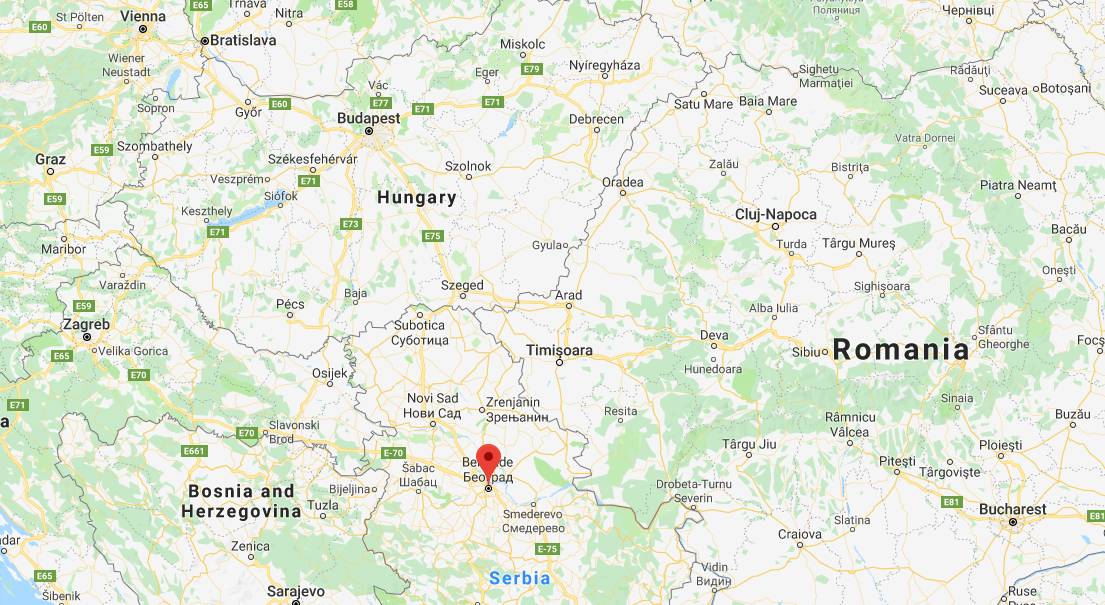

Is that a realistic aim? Firstly one needs to identify Belgrade's location. While it technically is in Southeast Europe, it is in the northern part and close enough to hubs such as Budapest (350km) and the fast-growing Vienna (600km) airports to compete with them as much as it does with Sofia, Zagreb and Sarajevo airports.

MAP - Belgrade is the capital and largest city of Serbia and is located at the confluence of the Sava and Danube rivers and the crossroads of the Pannonian Plain and the Balkan Peninsula Source: Google Maps

Source: Google Maps

In 2015, CAPA - Centre for Aviation identified Belgrade airport's potential for the first time in a report which suggested it was "challenging the hub order in Central and Southeast Europe" after recording +32% passenger growth in 2014. This was unexpected and quite surprising given Serbia's recent political and economic history and the fact that growth had not come specifically from the LCC segment, which is the usual source for 'secondary' level airports in Europe.

SEE RELATED REPORT: Belgrade Airport, with resurgent Air Serbia, challenges the hub order in Central/Southeast Europe

The upshot of that report was that while some problems remained at Belgrade it was going in the right direction, compared with most of its neighbours, helping the Serbian government to privatise it. VINCI won the bidding contest, taking on the concession in Feb-2019 having beaten off big name consortiums such as Flughafen Zurich/Eiffage/Meridiam; GMR Infrastructure/Terna; and Incheon International Airport Corporation/Yatirimlari ve Islatme/ VTB Capital Infrastructure.

The concession contract covers financing, operations, maintenance, renovation and expansion of the airport and its existing runway system, the goal being to increase the airport's capacity and to foster the economic development of Serbia. VINCI Airports expects passenger traffic to rise from five million to 15 million passengers per annum before the end of the concession period.

At the time the concession was signed, Mr Notebaert said: "We believe in the high potential of Belgrade as a leisure, and business, destination and we want to help the airport realise this potential". Helping that realisation means putting EUR730 million (USD826 million) into new infrastructure.

According to the CAPA - Centre for Aviation Airport Construction database this includes 42,000 sqm of new space, refurbished terminals, solar panels, a water treatment plant, a new 3500 sqm runway and upgrading the existing runway. Further developments will include a new 55,000 sqm apron, expansion of its de-icing platform, a new 2,400 vehicle car park, lighting and CCTV camera systems.

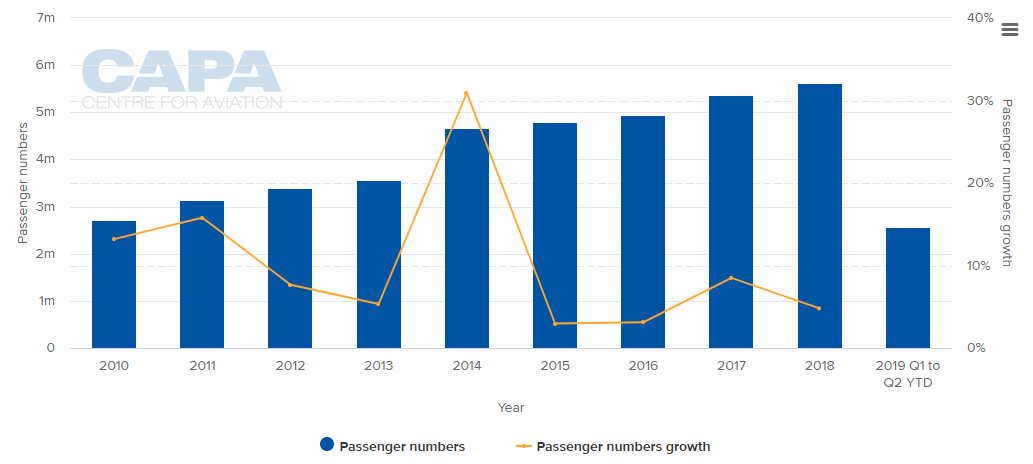

So, what pointers are there to Belgrade's potential since that 2015 report? In the intervening four years, that very high traffic growth has tailed off quite dramatically, going down to just +3% in 2015 and 2016, +8.5% in 2017 and +4.8% in 2018. There has been an uptick since VINCI took over, with +5.9% recorded in 1H2019, to 2.6 million.

CHART - Traffic levels at Belgrade Nikola Tesla airport have grown strongly this decade with a strong spike in annual levels in 2014 Source: CAPA - Centre for Aviation and Belgrade Nikola Tesla Airport reports

Source: CAPA - Centre for Aviation and Belgrade Nikola Tesla Airport reports

This period saw the return of Air France, which resumed its Paris-Belgrade route after a six-year hiatus, and the inauguration of a new Wizz Air route between Belgrade and Lyon-Saint Exupéry, which is also managed by VINCI Airports. Being a French company and operating the airports at each end of a route can be beneficial. But VINCI may be disappointed that is all it has achieved in route development.

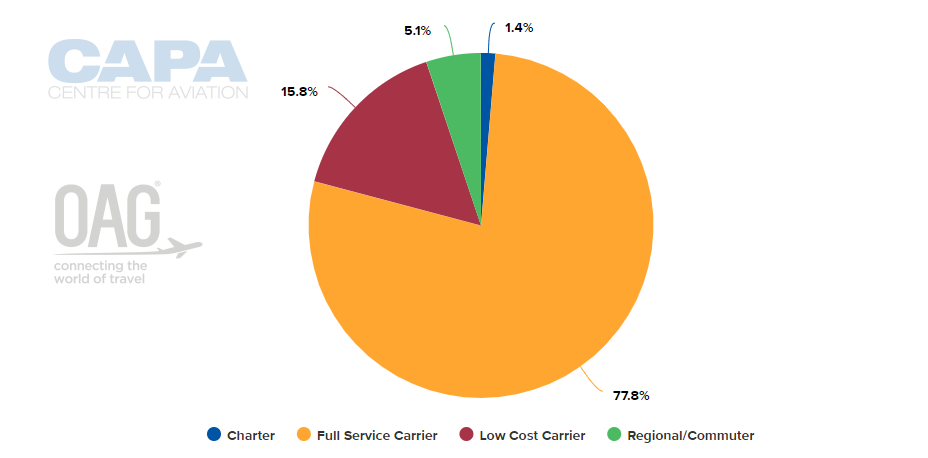

The capacity mix has shifted marginally in favour of low-cost seats. In the second week of Mar-2015, 81.3% of seats were 'full-service' and 12.6% 'low-cost'. In the week commencing 15-Jul-2019 it is 77.8% and 15.8% respectively with the figure for regional flight seats remaining static and charter increasing by a percentage point. Air Serbia remains the dominant airline, ahead of Wizz Air, but the latter is growing more quickly in Belgrade. Cargo capacity has increased by a third since 2014.

CHART - Full service operations still dominate at Belgrade's Nikola Tesla airport, but the LCC share is on the rise Source: CAPA - Centre for Aviation and OAG (data: w/c 15-Jul-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 15-Jul-2019)

Looking at matters from a political and economic perspective, the 2015 CAPA report referred to Serbia's ambition to join the EU in 2020. Those hopes have been dashed - 2025 is possible but neither side seems to be trying very hard to achieve it. The economy has grown a little since 2015, when Serbia's GDP was 27.5% below where it was in 1989.

The most telling statistic is the traffic growth at the two big beasts to the north, in Budapest and Vienna, the latter's gateway now becoming a significant European hub. At Vienna International, passenger growth was +10.8% in 2018 and a staggering +23.9% in 1H2019, much of it in the low-cost segment which accounts for 29.5% of seats despite the Vienna management preferring full service/network carriers. At Budapest the statistics are not quite so dramatic but still impressive at +13.5% in 2018 and +7.5% in 1H2019. 63% of seats at Budapest are low-cost.

In conclusion, it appears in hindsight that the 2015 CAPA report may have painted a slightly rosier picture than the reality has proved and VINCI may have a tougher job on its hands than it envisaged.