Airlines have moved quickly to make the necessary cuts to try and minimise their own exposure to what has become a global economic crisis. But now, having come to terms with the current situation, attention turns to the way out.

As China, where the virus originated late last year, ends its domestic lockdown, other nations across the globe have yet to hit the bottom. The journey there has been fast, the climb back up appears more challenging with suggestions that in the short-term we will not reach back up to the where we were when this frightening situation began.

While industry commentators may not be able to meet in person due to social distancing measures and travel restrictions across many countries, they have been appearing online among the many webinars that now dominate our daily outlook calendars. This week much of the attention has been on the road to recovery and how the sector could look in life after COVID-19.

While we may be wishing away the virus that has caused the biggest impact on human life in modern times, there is no guarantee it will ever go. We may have to learn to adapt and live with it. Who knows, potential siblings COVID-20 and COVID-21 could be even more of a problem?

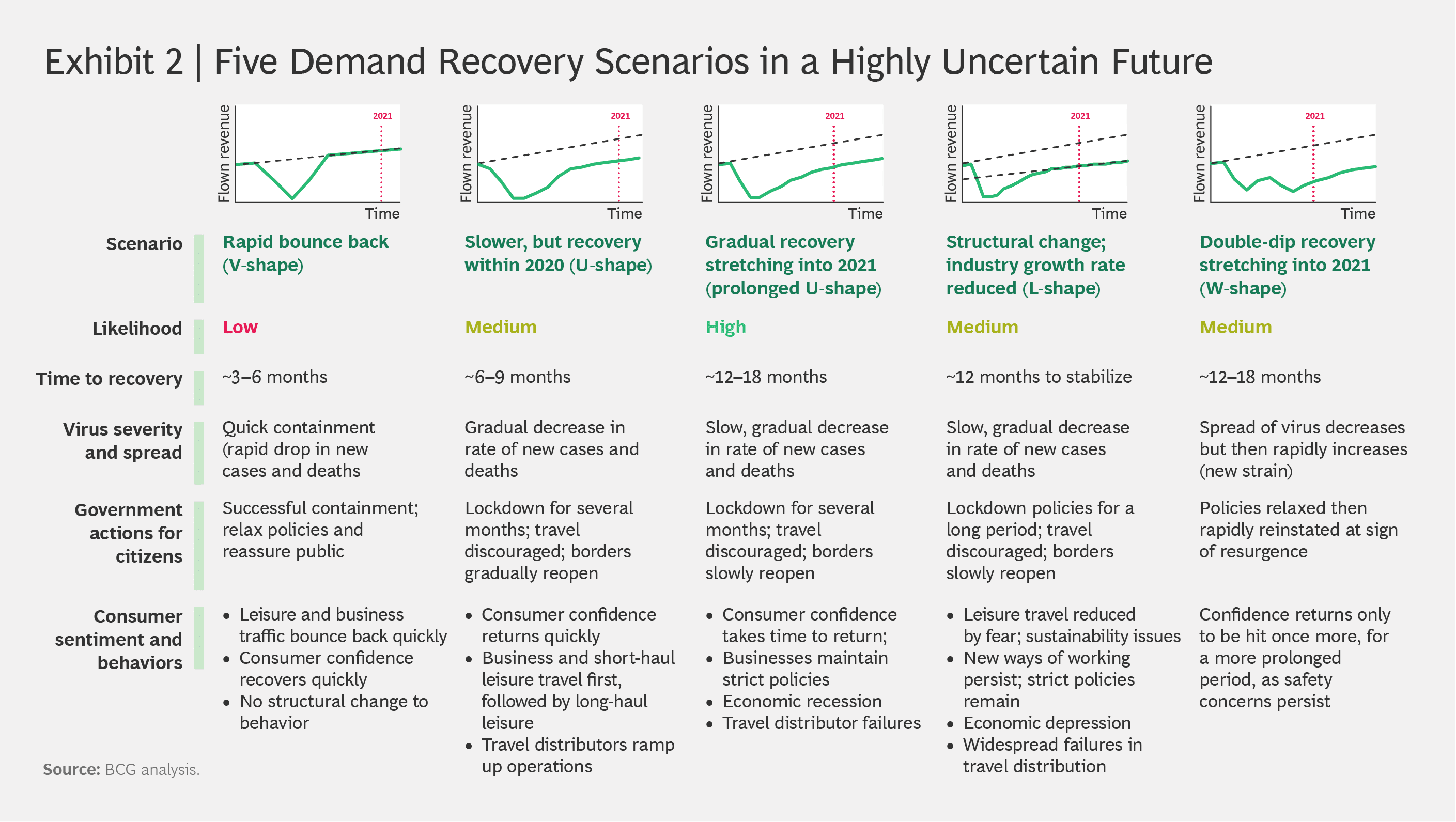

The best first step to recovery is stability and that may be the best we can hope for in the short-term. It will be a bumpy ride - literally! - as capacity is tweaked along this unchartered path to meet actual demand. But, what will the path to recovery look like? We initially hoped its would be a 'V' or at worst a 'U' as seen with previous milestone events in the aviation industry, it could be a 'W' with a second dip, but increasingly it is looking like it could be a slightly miss written 'L'.

The following chart from the Boston Consulting Group provides more details on these different scenarios.

The green shoots that are displaying in China are a big positive, but it could suggest that any recovery in Europe and North America could start after the peak summer months as we approach the northern hemisphere winter schedules, already a tough period for most airlines and a time they would not be wanting to introduce significant capacity increases.

In fact, Peter Harbison, founder and chairman emeritus at respected intelligence provider, CAPA - Centre for Aviation said on its first CAPA Masterclass webinar this week that it will be a "long road back". "We are not going to see an industry like last year for five years, perhaps longer," he warned. "What we have coming out of this tunnel is a supply and demand issue - capacity wise there will be fewer airlines and demand wise we will have a very weak economy."

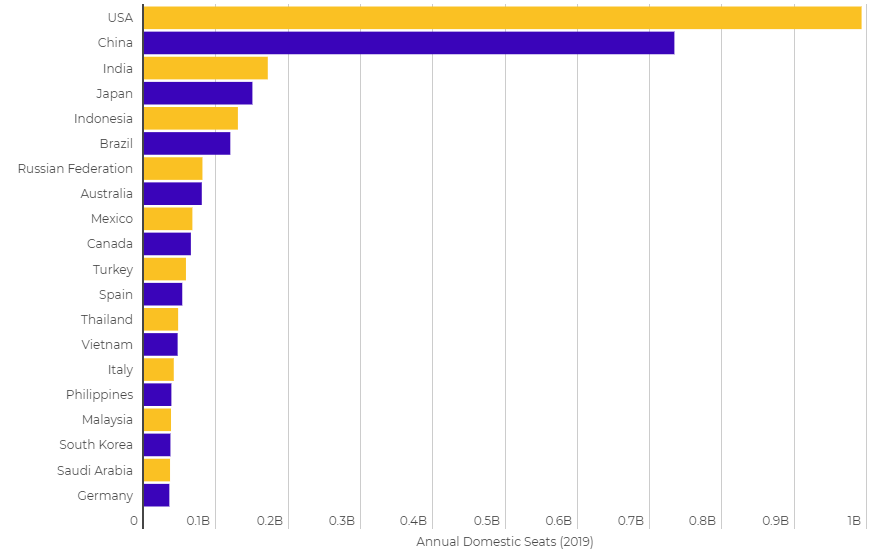

It is widely believed that domestic flying will act as the industry's life support system and countries with the strongest domestic markets - and the airlines that operate there - will likely be on the strongest ground. Travel restrictions will continue to limit international activity, while consumer perceptions will be very different when it comes to travel.

CHART - The world's largest domestic markets by capacity in 2019, a different world to where we are currently today Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

"Health has come to the forefront in aviation. Whatever happens with the coronavirus, there is the belief this event will occur again. We are looking at the impact like 911. It will change how we behave and what we do, impacting both airlines and airports," explained Mr Harbison.

Announcements this week from Lufthansa and airBaltic have provided some guidance on how the airlines are thinking. The German flag carrier has revealed plans to cut its aircraft fleet, including larger and older widebodies as well as some short-haul capacity. It does not expect the aviation industry to quickly return to pre-coronavirus crisis levels of demand and that it will take "months" until global travel restrictions are completely lifted and "years" until global demand for air travel returns to pre-crisis levels.

Latvian carrier airBaltic has said it plans to resume operations with a shrunk fleet of five A220-300s and gradually add one aircraft per week as demand returns. It will bring forward plans to discontinue deployment of Boeing and Bombardier Q400 aircraft to simplify operations which will cover a limited network in the near future. Its CEO, Martin Gauss, has said the current situation will result in consolidations in the industry, including unexpected partnerships, as airlines merge out of necessity.

During the 'Aviation and travel beyond COVID-19 edition' of the CAPA Masterclass series, Christoph Mueller, a former airline CEO at Malaysia Airlines, Aer Lingus, Hapag-Lloyd and the Sabena Group, who has a positive reputation for business turnaround and recovery, highlighted what a sad time it is for airlines that have worked hard to deliver liquidity, which is now "melting like snow in the Sahara".

The CAPA Masterclass covered some key topics on the future outlook of the industry. Will we get back to position where government's are controlling all the big airlines? Mr Mueller believed there would be scope for "positive government engagement," such a system like the Chapter 11 protection in the United States that would allow freedom of a couple of months for restructuring. If they were to invest in airlines, he believes it should be temporary and non-intrusive operating at an arm's length.

What about aircraft? Well, the current crisis will likely see the accelerated retirement of older generation aircraft. "The classic fleets will be grounded, possibly for the long-term, if not forever," observed Mr Mueller. This, he believed, would be supported by a postponement of future deliveries.

But, it is the health and safety aspect and how travellers and the industry adapt that could perhaps be the main factor in what path to recovery we will see. As an example, Vietnam Airlines has revealed it is limiting the number of passengers permitted on services to Ho Chi Minh City through to 15-Apr-2020 in compliance with a request from the Civil Aviation Authority of Vietnam. The airline says it will carry a maximum of 180 passengers on Boeing 787 and A350 aircraft, and no more than 120 passengers on its A321s.

The recovery post-911 resulted in a huge surge in screening efforts and we still see much of that in operation today. A similar reaction now could mean the airline business will take a hit. Can social distancing be introduced at airports and on aircraft. "An aircraft is just like Harrods. It as about revenue per square foot. Ticket prices would need to go up," acknowledged Mr Mueller.

Aircraft with their modern filtration systems are perhaps not the problem. "In a lot of ways you are safer in an aircraft than in the airport in terms of what or who you touch," highlighted Mr Harbison.

Both respected industry commentators are clear that a standardised solution would be required to what could be a significant issue for the industry. "We need an international response not national and based on medical expertise. We need consistent measures across the world developed by medical experts," outlined Mr Mueller.

On the path to recovery, we can certainly learn from 911, SARS and the global financial crisis. But, COVID-19 is setting a new blueprint and despite all of our beliefs and best guesstimates, it will still be weeks, months, even years before we truly know what path the industry will take.