Summary:

- Uzbekistan may issue tenders for the operation of airports by investors;

- It is shifting its stance on the private sector as it belatedly moves away from inherent Soviet bloc thinking;

- There is already a foreign loan agreement in place at Tashkent, and the new terminal will be operated by the state airline.

Mr Abdukhakimov added that there is "serious intent" in relation to air services, with plans to enhance the effectiveness of the deployment of the national aircraft fleet and for the attraction of foreign carriers to expand the network. Uzbekistan also plans to evaluate the government regulation system for air services. (Investors are always looking for light-handed regulation, of course).

Uzbekistan is the only double-landlocked country (i.e. it is surrounded by other landlocked countries) in Central Asia and thus is highly dependent on air services. The population, based on 2017 data, is estimated at 33 million.

MAP - Uzbekistan is one of only two double landlocked countries in the world and is Uzbekistan is bordered by Kazakhstan to the north; Kyrgyzstan to the northeast; Tajikistan to the southeast; Afghanistan to the south; and Turkmenistan to the southwest Source: Google Maps

Source: Google Maps

The Central Asian country has been independent (from the Soviet Union) since 1991 and its new President since 2016, Shavkat Mirziyoyev, has introduced wide-ranging economic and judicial reforms, including reducing its dependence on cotton manufacture, although a Soviet-style command economy has largely been maintained.

Uzbekistan's growth has been driven primarily by state-led investments to date but the government is making attempts to improve the private sector. In the past Uzbek authorities had been accused of freezing or seizing the assets of foreign companies. As part of its economic reform efforts, the Uzbek Government is now looking to expand opportunities for small and medium enterprises and prioritises increasing foreign direct investment.

In the aviation sector, there are 12 airports currently with international scheduled service. The largest is Tashkent Isram Karimov International with 3-4 million passengers per annum (no official figures have been released in the last three years), which would logically be the primary target for any investors. It is the third busiest airport in Central Asia after the Almaty and Astana airports in Kazakhstan.

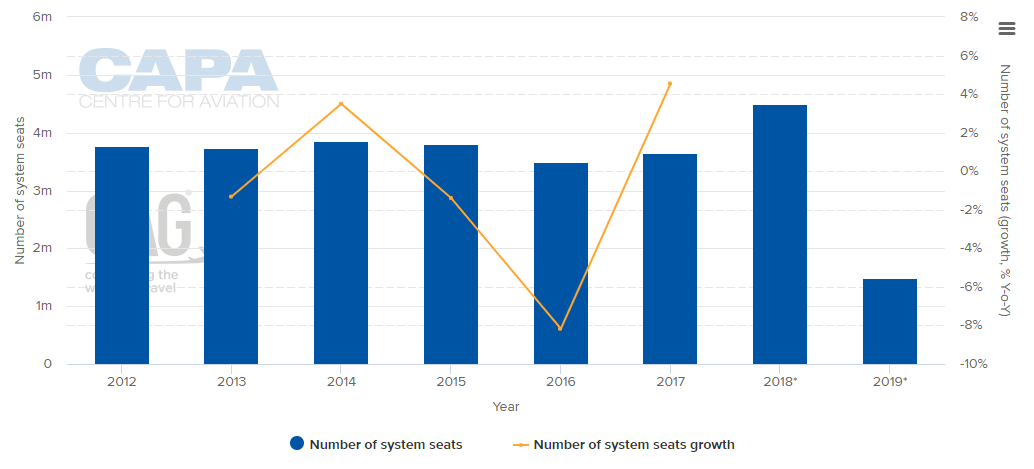

What is known is the amount of seat capacity that has been put in. Capacity was in decline in 2015 and 2016 but increased by +4.6% in 2017 and the increase in 2018 looks to be over +20%, based on published schedules.

CHART - Tashkent Isram Karimov International is Uzbekistan's largest gateway and is seeing capacity levels reaching new heights in 2018 Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Uzbekistan Airways is easily the largest carrier, in terms of seats (72%) and peak movements (89%). There are no low-cost carriers serving the airport and alliance penetration is only 18.4% of seats (the largest is Sky Team on 10%). The airport is well-utilised across the full 24-hour span of the day.

In a way there is already some "external" interest in the airport. In Feb-2017 Uzbekistan's President approved financing from South Korea Ex-Im Bank for the construction of Tashkent International Airport's Terminal 4. South Korea and Uzbekistan had signed an MoU on infrastructure projects in Sep-2016.

Under the agreement, Korea Economic Development Cooperation Fund (EDCF) agreed to invest USD250 million for the construction of the (USD431 million) T4. The project will run for three years and the terminal will span 87,000sqm, handle 1500 passengers per hour, and have capacity for 36 aircraft.

The Uzbekistan Revival Development Fund and Uzbekistan Airways are also partaking in the project's financing. In addition, high level services such as hotels and business centres will be added. Completion of the construction phase and the opening of T4 are scheduled by the end of 2019.

Quite a lot rests on the successful conclusion of this project if foreign investors are going to be attracted to other terminals at Tashkent and/or other airports.