During the last quarter of 2018 when the US stock market was in a period of wild volatility, United posted a 6% increase in domestic unit revenue, which the airline attributed to strong business traffic and robust close-in yields.

Offering some insight into demand trends, United president Scott Kirby recently stated during the first week of 2019 when business customers typically start booking travel, United's business bookings were up 11% at a slightly higher yield during that time period.

"Business bookings for the first week of the year are reasonably good forward indicator for the health of economy," Mr Kirby concluded.

The partial US government shutdown in the US now has the distinction of being the longest shutdown in the country's history, and Delta Air Lines has calculated it could lose roughly USD25 million in revenue in Jan-2019 directly from the shutdown.

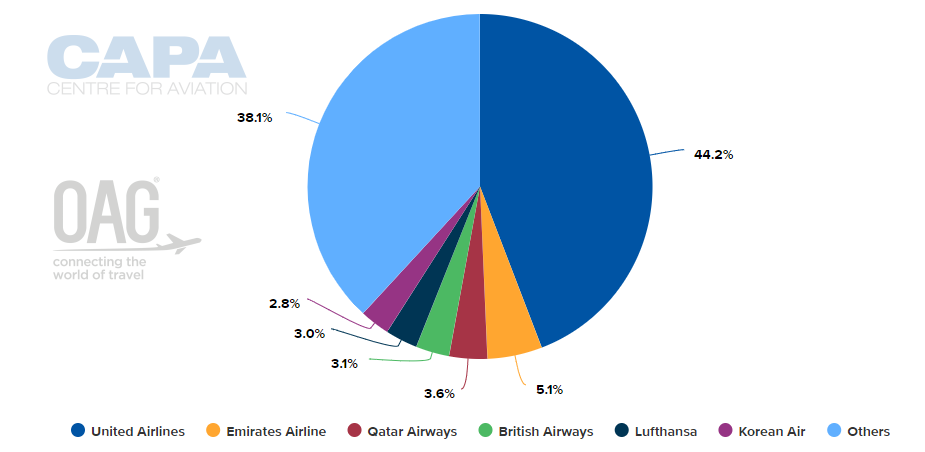

But United is not ready to quantify the shutdown's effects on its business. Mr Kirby acknowledged United has a large exposure in the Washington, DC market. Data from CAPA - Centre for Aviation and OAG shows United's share of system ASKs at Washington Dulles is 44%.

CHART - United Airlines is the largest operator at Washington Dulles International Airport Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

"It's hard for us to know what the impact is right now or what it's going to be. We also don't know how long it's going to go," Mr Kirby stated. "…maybe after the quarter when it's all over, we'll try to look back and see what the impact was. But right now we're not going try to pin a number on it".

Recently, Delta executives explained that in the company's most recent survey of travel managers, 90% expect to maintain or increase travel spend in 2019, which is a two point improvement from the last survey the airline conducted a year ago.

"For January, on-hand corporate bookings are already up 7% year over year, with both fares and passenger volumes continuing to improve," said Delta president Glen Hauenstein. Domestic capacity growth for the industry and for Delta is moderating compared to 2018, and Delta is seeing improved competitive outlooks at its hubs.

Delta has attempted to offer some quantitative effects from the government shutdown, noting it would result in roughly USD25 million in lost revenue for Jan-2019. It is not clear how much the shutdown will affect Delta's 1Q2019 revenues given uncertainty over the shutdown's duration.

Obviously another big headline for Delta from the shutdown is the delay of service entry for its Airbus A220 aircraft and its A330neo widebodies.

"With non-essential work at the FAA shutdown, our Airbus A220 start date is likely to be pushed back due to delays in the certification process," said Delta chief operating officer Gi West. "This is also hampering our ability to put seven other new aircraft deliveries into service, but it's our customers who are seeing the biggest impact with longer lines at airport security."