Summary:

- Latest monthly data from the US Travel Association Travel Trends Index shows travel within or to the US grew +3.4% in Mar-2018;

- The US Travel Association Current Travel Index (CTI) has registered at or above the 50 benchmark (showing expansion) for 99 straight months as the industry moves through is ninth year of expansion;

- A solid global backdrop and a weaker USD will support heathy inbound travel, the association says with international inbound travel expected to grow by +3% over the next six months (versus +2% for domestic travel);

- While the performance is positive, the USA is not keeping pace with the booming growth of global travel and as a result continuing to lose market share.

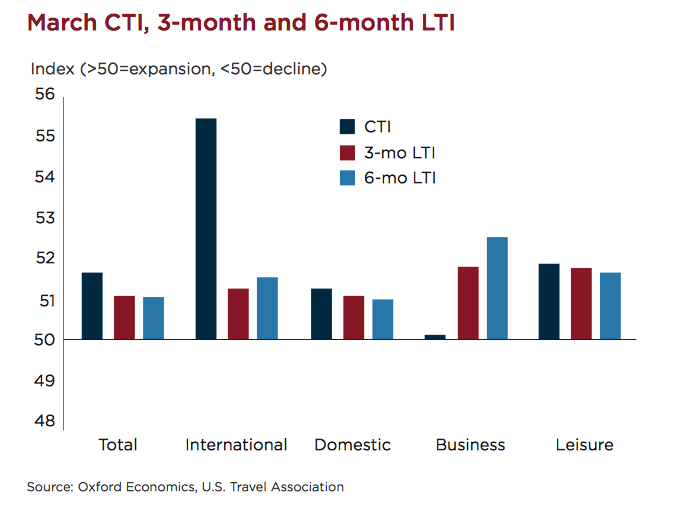

The association's Travel Trends Index shows travel within or to the US grew 3.4% in Mar-2018, and the Current Travel Index (CTI), registered 51.8 for the month. A score above 50 indicates expansion.

Driven in part by the timing Easter, US international inbound travel spiked in Mar-2018, with a CTI of 55.5, the highest since Apr-2014. The overall CTI has registered at or above the 50 benchmark for 99 straight months as the industry moves through is ninth year of expansion.

The association's research shows the Leading Travel Index (LTI) continues to project an upbeat outlook in inbound travel, which has the potential to surpass growth in the domestic market over the next six months.

A solid global backdrop and a weaker USD are expected to support heathy inbound travel, the association stated. Over the next six months, international inbound travel is expected to grow by an average of about 3%, more than the rate anticipated for domestic travel.

"On the positive side, we are not experiencing a decline in international inbound travel as many had feared..." said US Travel Association SVP Research David Huether. "On the negative side, the US is not keeping pace with the booming growth of global travel. As a result, we are continuing to lose market share."

US travel economists note that the US is likely squandering a massive economic opportunity by failing to keep pace with the international travel boom. The US share of the global international market has slid from a peak of 13.6% in 2015 to 11.9% last year.

Domestic travel is anticipated to grow by an average of +2.0% year-over-year through September 2018, spurred mainly by growth in consumer spending and business investment. Looking ahead, in a reversal of recent trends, domestic business travel is expected to outpace domestic leisure travel through mid-2018. however, the US Travel Association warned headwinds remain as trade tensions, higher interest rates and elevated gasoline prices, along with gradually firming inflation, likely to weigh on consumers and businesses alike.

The latest data comes at a time that it appears that a long-running dispute between the US and the Gulf nations of Qatar and United Arab Emirates (UAE) is coming to an end after revised air service agreements were agreed in principle. The US Travel Association president and CEO Roger Dow said he hopes the deals mark "the end of three years of division" and will allow "all parties to return their collective attention to policy pursuits that grow travel to and within the United States".

"An abundance of healthy airlines-both domestic and international-are a critical component of American job, GDP and export growth. We're deeply appreciative that the administration engineered a deal which honours that principle and seems pleasing to all stakeholders," he added.