Summary:

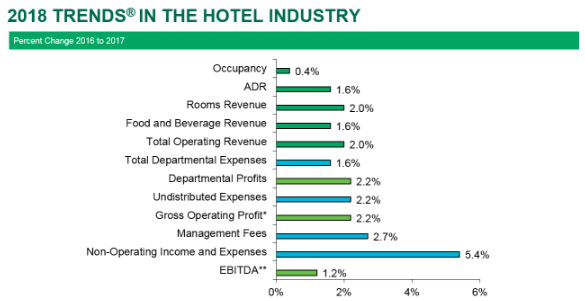

- The 2018 edition of CBRE's 'Trends in the Hotel Industry' highlights 2017's strong performance was driven by limiting cost increases rather than revenue gains;

- The report shows growth in expenses was limited to 1.9% and operating revenues grew 2% to give a 2.2% increase in gross operating profits;

- Hotels are doing a good job managing labour costs, reveals CBRE, but it warns they continue to face upward pressure on wage rates;

- Annual revenue per available room (RevPAR) gains for US hotels are projected to range from 0.8% to 2.5% from 2018 through 2020.

During 2017 total operating revenue grew by 2% for the average hotel in the report's survey sample. Growth in expenses was limited to 1.9%, which resulted in a 2.2% increase in gross operating profits for the year. "It is becoming increasingly difficult for US hotels to achieve both revenue and profit gains," the report concluded.

CBRE's research shows only 59.1% of the properties included in the report enjoyed an increase in total operating revenue in 2017 while just 52.3% generated growth in profits. "Increasing competition from new supply, muted growth in average daily rates and upward pressure on labour costs make the current environment one of the most challenging our firm has seen since we started tracking industry performance in the 1930," CBRE concluded.

One area where hotels are receiving accolades from CBRE is their management of labour costs. The report concluded hotels face a tight labour market, highlighting data from the US Bureau of Labour Statistics (BLS) showing the current level of open jobs in the sector equates to 5.3% of total personnel currently employed.

Challenges hotels face from the tight labour market include upward pressure on wage rates. CBRE stated per the BLS, average hourly compensation for hospitality employees increased 3.8% in 2017, and for hotels in its Trends report salaries (wages sand benefits) grew by 1.8%.

"This implies a reduction in the number of hours worked," said CBRE. "In addition to controlling the schedule, hotel managers gained greater productivity from their staff. With fewer hours, the employees at these same hotels serviced 0.4% more occupied rooms, as well as greater volumes of food and beverage revenue."

Over the years, US hoteliers have historically been able to effectively respond to difficult operating conditions. By matching the 2.0% gain in revenue with the 1.9% rise in expenses, the GOP margin for CBRE's sample increased to 38.3% in 2017. This, it says, is the highest profit margin it has recorded since 1960 and an indication of superlative operating efficiencies and productivity.

According to the March 2018 edition of CBRE's Hotel Horizons forecast report, annual revenue per available room (RevPAR) gains for US hotels are projected to range from 0.8% to 2.5% from 2018 through 2020.

Latest figures for Q1 from benchmarking specialist STR shows a record-breaking performance from the US hotel industry. Compared with Q1 2017, occupancy was up +0.9% to 61.6%, average daily rate (ADR) rose +2.5% to USD127.37 and RevPAR increased +3.5% to USD78.46. The absolute levels for each of the three key performance metrics were "the highest STR has ever benchmarked for a Q1," the company said.

The STR data shows supply (more than 460 million room nights available) and demand (more than 285 million room nights sold) also reached record levels for a Q1, but demand grew at a much higher rate (+3.0% vs. +2.0%), Among the Top 25 Markets, Super Bowl LII host, Minneapolis/St. Paul, Minnesota-Wisconsin, saw the quarter's largest increases in ADR (+18.6% to USD128.27) and RevPAR (+23.8% to USD77.88). Other double-digit RevPAR increases were reported in Miami/Hialeah, Florida (+16.6% to USD216.42); Philadelphia, Pennsylvania-New Jersey (+13.5% to USD79.80); and Orlando, Florida (+10.7% to USD120.17).