Summary:

- Ukraine's government intends to seek concessionaires for airports including Kiev Boryspil International and Lviv Danylo Halytskyi International;

- Many of the main airports are seeing spectacular traffic growth following previous declines in demand;

- Lviv is emerging as a surprise new city-break destination and its airport gateway could represent an interesting investment opportunity.

Mr Omelyan has previously identified projects including the development of a multimodal, international transport hub at Bila Tserkva airport and the reconstruction of Gostomel airfield as holding potential interest to foreign investors.

Ukraine is trying to establish a Europe-Asia hub in competition with the new Istanbul Airport and established gateways in the Gulf, despite the continuing conflict in the eastern part of the country. Presumably such a development would affect not only Kiev Boryspil, the main airport, but also others which might attract low-cost carriers. That is the theory at least.

SEE RELATED REPORT: Ukraine aims to 'reform' aviation sector by developing regional airports, building a Europe-Asia hub and attracting LCCs

Looking first at the Kiev airport, Boryspil International clearly offers the greatest attraction to investors though it must be borne in mind that the smaller Kiev airport, Igor Sikorsky Kyiv International Airport (aka Zhuliany), which is owned by the city of Kiev, and operated under concession by Ukrainian firm Master-Avia, has been seeking investors for several years now, without success.

That is despite the fact that it has turned around tumbling passenger figures to record average growth of 58% in 2017 and 2018 (currently running at 44.4%), has Wizz Air as its main airline, is the main business aviation airport in Ukraine and one of the busiest business aviation hubs in Europe, and has three new terminals with under-utilised space to grow both aeronautical and non-aeronautical activities. The only negative is that it was unable to attract Ryanair when that airline began operating into Kiev last year; it went to Boryspil, very much to that airport's advantage.

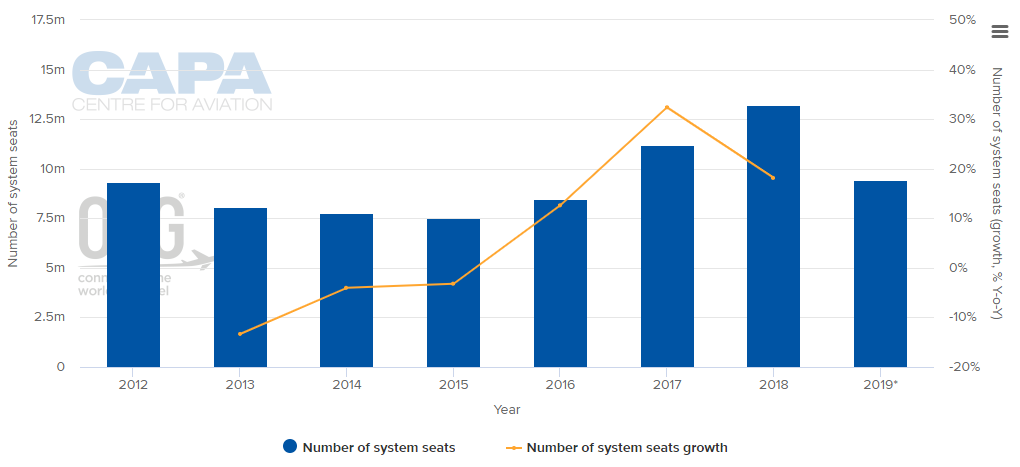

So what are the attractions at Boryspil and Lviv? Like its fellow Kiev facility, Boryspil's passenger traffic is also increasing rapidly, though not at the rate of Igor Sikorsky, averaging 20.75% in 2017 and 2018. Seat capacity is being increased accordingly, by almost a third (32.4%) year-on-year in 2017 and then by 18.1% in 2018 with a similar increase anticipated for full year 2019.

CHART - Kiev Boryspil has seen capacity levels grow significantly since 2015, helping to boost passenger levels Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

The airport is dominated by Ukraine International Airlines (UAI) (63.1% of seats), which will have responsibility for 'hub development'. Only one other airline has more than 5%, and that airline is Ryanair, with a 5.7% share. It can be expected to expand its operations growing the LCC model. The total impact of low-cost carriers amounts to only 10% of seats presently and that is likely to rise considerably.

Operationally, Boryspil is at least '24/7' and the balance between arriving and departing traffic ensures that there are few barren hours though there are four or five in a typical day when the airport could be overstretched. But a consequence of the unaligned UAI's dominance is a lack of any real alliance presence. Collectively, they add up to less than 18% of seats.

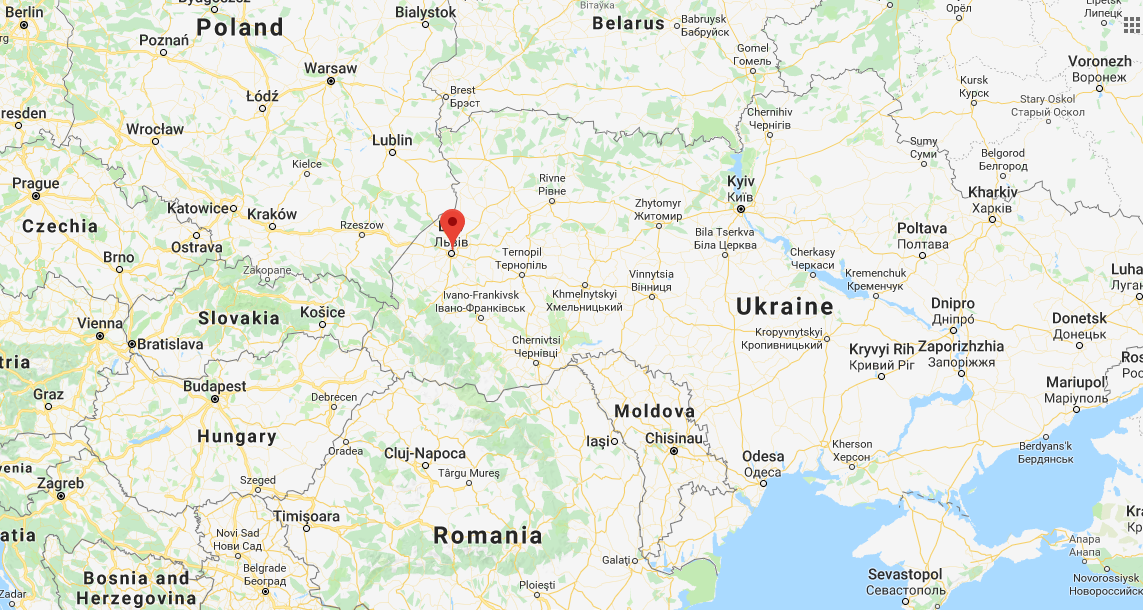

Lviv's Danylo Halytskyi International Airport, which was inaugurated as recently as Apr-2012, might interest concessionaires for a number of reasons. One of them is that at its closest point it is a little over 50km from the Polish border, opening up a secondary market, although that part if Poland is not heavily populated and is served by airports at Lublin and Rzeszow.

MAP - Lviv is located in western Ukraine, around 70 kilometers from the border with Poland Source: Google Maps

Source: Google Maps

Locally, it serves a sizeable city of around 750,000 people which is also a cultural centre. At the beginning of this decade it experienced a tourist boom and there remains the capacity to attract new foreign visitors, especially since Ryanair established services in 2018. Ryanair currently has 15% of capacity, a little behind UIA and five percentage points behind Wizz Air.

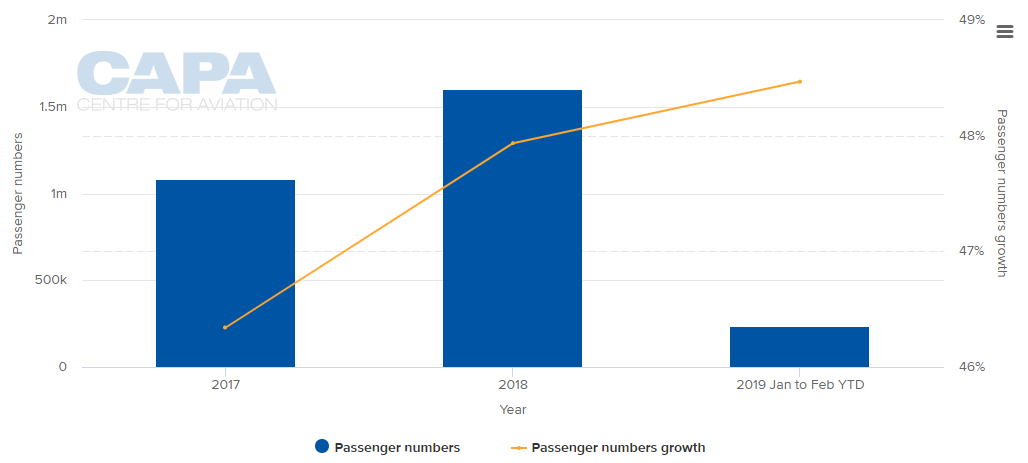

Again, passenger traffic is growing rapidly, by more than 45%. Across the board there is a good mix of full-service, regional, low-cost and charter traffic and as with Boryspil traffic and capacity is well spread-out throughout 24 hours of operation.

CHART - Lviv Danylo Halytskyi International Airport is showing rapid growth with passenger numbers up 46.3% in 2017, 47.9% in 2018 and growing at a rate of 48.5% across the first two months of 2019 Source: CAPA - Centre for Aviation and Lviv Danylo Halytskyi International Airport reports

Source: CAPA - Centre for Aviation and Lviv Danylo Halytskyi International Airport reports