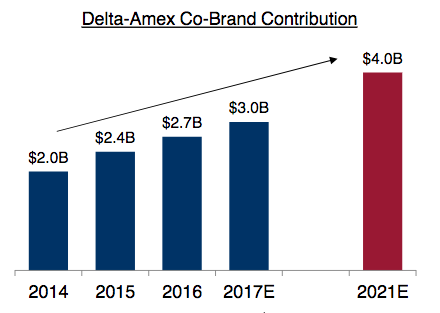

American expects to generate roughly USD550 million in revenue from its agreement with Citigroup in 2017 and USD800 million in 2018. Delta has estimated its deal with American Express should produce USD4 billion in benefits by 2021. Delta reworked its partnership with American Express in 2014, and details included American Express agreeing to pay 15% more per mile in 2015, and up to 20% over the contract period.

CHART - Delta has estimated its deal with American Express should produce USD4 billion in benefits by 2021 Source: Delta Air Lines and AMEX

Source: Delta Air Lines and AMEX

"Our partnership with American Express produced an additional USD90 million of value in the quarter [3Q2017]," Delta president Glen Hauenstein recently explained. "This growth highlights the value of combining a high quality credit card partner and a premier loyalty programme." Previously, Delta has estimated its partnership with American Express should generate USD300 million in incremental value in 2017.

Prior to reaching its new deal with Citigroup in 2016, American estimated that agreements its competitors renegotiated with banks supporting their co-branded credit cards drove up to three points of positive unit revenue for those airlines.

United recently estimated American and Delta's credit card deals could be driving up to a 1.5 points of margin benefit for those airlines. "We do think there is an opportunity to improve that part of the business," United president Scott Kirby stated. "..we are working with our partners...to get results that look like our competitors".

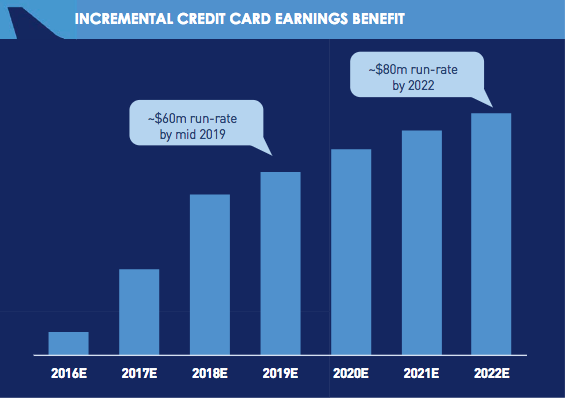

Airlines of all sizes and across all business models aim to reap the benefits of co-branded credit cards. jetBlue Airways, which held a 5.5% US market share for the 11M ending Aug-2017, estimates a USD80 million run rate revenue benefit from its credit card agreement with Barclays by 2022. jetBlue estimates the size of its credit card portfolio has grown more than 60% since its partnership with Barclays began in 2016.

CHART - jetBlue estimates the size of its credit card portfolio has grown more than 60% since its partnership with Barclays began in 2016 Source: jetBlue Airways

Source: jetBlue Airways

United obviously aims to increase the amount JP Morgan pays for miles, and jetBlue believes there are opportunities to unlock more valuation from its credit card agreement as its loyalty programme matures. "TrueBlue itself is really only about five or six years old," said jetBlue EVP commercial and planing Martin St George. "I think the benefits that we've seen from moving over to Barclays and the incredible growth rate we've seen from them, I think is indicative of the fact that it's not a mature programme. I think that we see that as a great opportunity for us."

Although United is eager to close the competitive gaps with American and Delta on margins from branded credit cards, the airline is warning the deficit won't disappear overnight. "I'm not sure when we're going to be able to have the kind of tailwinds that American and Delta have had," said Mr Kirby. "But I'm optimistic we'll get there."