That was a conclusion reached by Certify, which is part of expense management firm Emburse, in its '2019 SpendSmart Year in Review' report. It highlights key data insights and trends in corporate travel spend, and identifies the most popular airline, meal, lodging, and transportation services among North American business travellers, based on more than 50 million receipts and expenses submitted by Certify users.

The report shows that food delivery posted the fastest growth among corporate road warriors, with a jump of 86% year-on-year in 2019. Doordash surpassed Grubhub as the most expensed food delivery service, representing 29.5% of all transactions followed by Grubhub with a 27.3% share.

Seamless was found to be the most expensive food delivery service with an average receipt of USD86.09 followed by Grubhub at USD69.52. Doordash took the third spot with USD54.13. Although Seamless was the most expensive, it had the highest user rating among road warriors.

The report's curators concluded that Scooter receipts registered a major increase in use, with a jump of 222% year-on-year. Lime was the most expensed service with a 50% share, and was the second least expensive among the providers with an average cost per ride of USD4.85. Lime also had a reasonably solid user rating, placing second behind skip.

Overall, ride hailing overtook meals as the most expensed category in 2019, the report concluded, representing 17.5% of all transactions. "This is the first time the meals expense category hasn't been number one since 2015 - reinforcing the value of reviewing and analysing your company's spending every year," the authors stated.

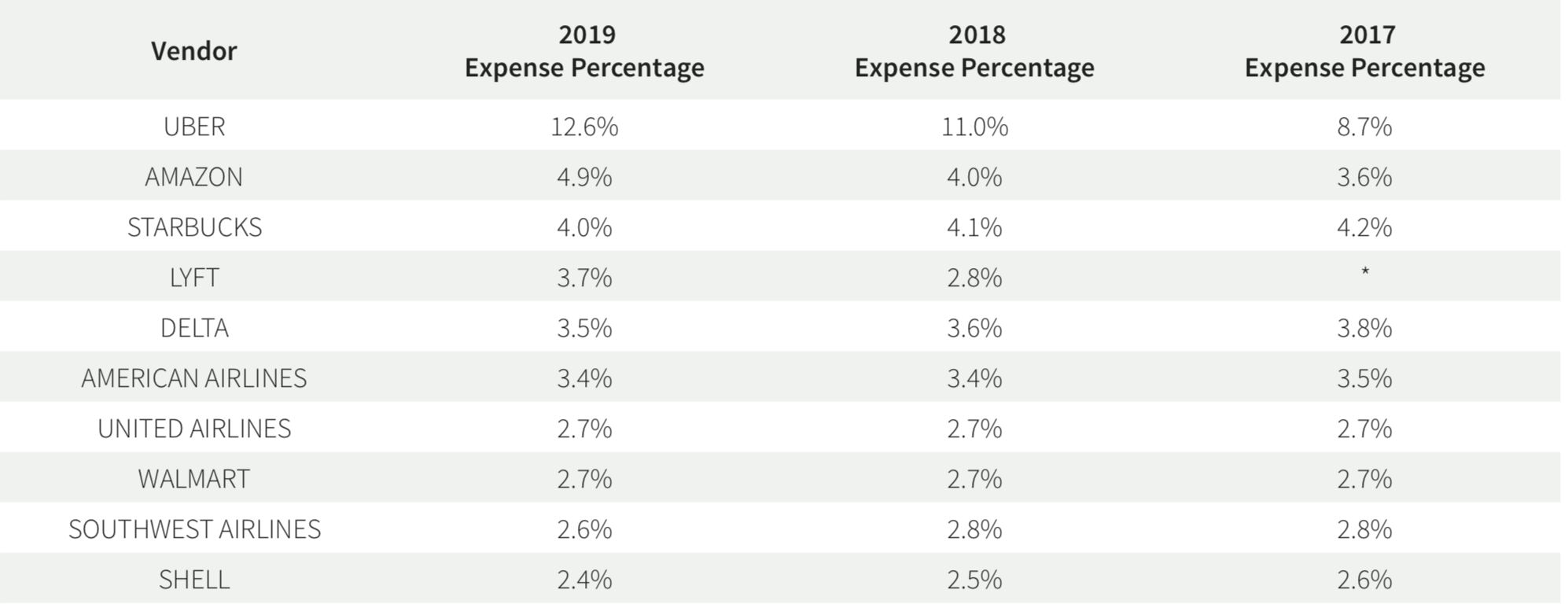

The top five most expensed vendors across all categories in 2019 were Uber at 12.6%, Amazon with a 4.9% share, Starbucks at 4%, Lyft at 3.7%, Delta Air Lines at 3.5% and American Airlines with a 3.4%. share.

TABLE - The most expensed brands for North American corporate travellers in 2019 Source: Certify's '2019 SpendSmart Year in Review' report

Source: Certify's '2019 SpendSmart Year in Review' report

On the whole, US airlines held their own in 2019 among the top expensed brands by North American corporate travellers, and Southwest Airlines topped the list for highest average rating among road warriors.

Delta, American and United Airlines were the fifth, sixth and seventh most expensed brands overall, according to the report, and Southwest Airlines took the eighth spot. Over a two year period, Delta's expense percentage had the largest drop among airlines, falling from 3.8% in 2017 to 3.5% in 2019.

Delta's average cost of USD439.51 was the highest among airlines, while Alaska Airlines recorded the lowest cost of USD285.69. It was Southwest that emerged as the customer favourite, with an average user rating of 4.6, just slightly higher than Alaska Air Group's and Delta's rating of 4.5. United posted the lowest user rating of 4.1.

The Certify report concluded that 10 out of 13 expense categories posted an increase in average expense costs, and "airfares saw the largest increase in average cost". Curators of the research concluded that the average expense cost of airfare in 2019 was USD308.40, an increase of USD30.75 from the year prior.