The holiday firm is one of the most famous names in the travel sector having initially founded the inclusive tour holiday package in the 19th century. But, it has failed to standout in a crowded market and years of mismanagement have taken their toll. Brexit, and its impact has ultimately been the straw that broke the camel's back.

As Thomas Cook Airlines jets now sit on the ground on aprons across UK airports, the task now begins to bring back holidaymakers from across the globe, a mission that will last a couple of weeks in what the UK Civil Aviation Authority describes as the largest repatriation of UK residents since war time. This was position previously held following the collapse of Monarch Airlines at a similar time of the year in 2017.

That airline's closure may have bought Thomas Cook a little more time, Likewise, its collapse will certainly allow others in the UK and European markets breath more easily, although it is too late for Aigle Azur and XL Airways in France, which have also failed this month. Most analysts believe there will be more to follow, with Norwegian's name the top of many lists.

What is certain is that Thomas Cook's rivals TUI and Jet2.com have the most to gain, the latter having successfully re-engineered the holiday package offer that Thomas Cook has originally built, but with a much lower cost structure. Low Cost Carriers (LCCs) will also likely fill some of the capacity voids left by Thomas Cook's closure, albeit capacity is at a premium right now as the summer schedules come to a close and the Boeing 737MAX remains grounded.

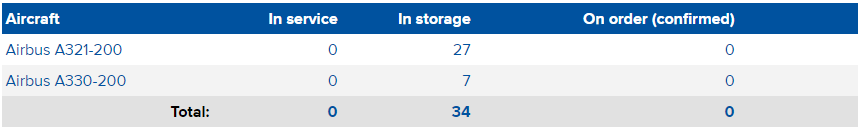

The latter has meant that there is limited spare capacity in the market for single-aisle aircraft, a factor that could impede the repatriation efforts, but which will mean that the Thomas Cook Airlines fleet of 27 A321s and 7 A330s should find new homes relatively swiftly. The A321 fleet is fairly modern and fully leased, but some examples are approaching 20 years of service. Air Lease Corporation, Aviation Capital Group and Industrial and Commercial Bank of China (ICBC) have the biggest exposure, according to the CAPA - Centre for Aviation Fleet Database.

TABLE - Thomas Cook Airlines operated a fleet of 27 A321s and 7 A330s when it collapsed, but also had additional aircraft operating under ACMI lease deals Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

In terms of airports, Manchester is the largest point in the Thomas Cook Airlines network and accounts for a 16.6% share of its weekly seat capacity, based on CAPA analysis of OAG schedules for the current week (week commencing 23-Sep-2019). London Gatwick is second with a 10.6% share, ahead of Birmingham, Glasgow, Bristol, Newcastle and East Midlands. Its strength in foreign markets mean destinations such as Dalaman and Antalya in Turkey will be strongly hit as both are within it five largest markets by departure capacity, with Palma de Mallorca in the Balearics also among the top ten. In fact at Dalaman it was currently the second largest operator, only slightly behind Turkish Airlines, with an 18.6% capacity share.

READ MORE... more insights via CAPA - Centre for Aviation Thomas Cook liquidation: tour operators, airlines and lessors affected

Thomas Cook liquidation: tour operators, airlines and lessors affected

But, while Manchester may be its largest operation, it is Cardiff airport where Thomas Cook Airlines' collapse may be felt the hardest - it is the third largest operator there behind TUI Airways and Flybe with a 12.6% share of its system capacity. At Manchester it is ranked fourth with a 10.6% share, while it has a shrinking share across East Midlands (9.3%), Glasgow (8.9%), Newcastle (8.6%), Bristol (7.7%), Birmingham (7.2%), London Gatwick (4.5%), Belfast International (3.6%) and London Stansted (1.7%).

While Thomas Cook Airlines has suspended its flights, Germany's Condor says it will "continue its flight operations despite the fact that its parent company Thomas Cook Group plc has filed for insolvency." In order to prevent liquidity constraints Condor has applied for a state-guaranteed bridging loan, which is currently under review by the Federal Government.

It is understood that the airline is seeking a similar amount - EUR200 million - to that which Thomas Cook had requested from the UK government ahead of its collapse, the question is will the German government be open to supporting the carrier, which operates a fleet of A320s, A321, 757-300s and 767-300ERs.

Similarly, Thomas Cook Scandinavia was due to return to the air on 24-Sep-2019 after initially being grounded.