This had meant that quite often what could have been a two-stop connection that would take the best part of the day to even fly a short distance (region to domestic hub to foreign hub to foreign region) was a mere non-stop hop. Even if the frequency may not have been what corporate travellers were ultimately seeking, the convenience meant that they proved successful in both the leisure and business markets

From a network development perspective airlines were in complete control with airports fighting for every potential new air link. The arrival of a new short-haul airliner could bring the opportunity for four or five new services per day and airports (in partnership with local stakeholders) would fight for some of the aircraft's time and a valuable new connection or frequency.

But where do we stand now as we start to emerge from the Covid-19 crisis? Will we ever see similar connectivity? Will previously served routes return? Is there and scope for new city pair connections that we had not seen previously or perhaps had not been served for some time?

Respected air service development consultant David Stroud warns that there is no certainty that the networks that existed prior to Covid-19 will be rebuilt in the same image, albeit demand will obviously be the principal driver.

"It has always been about demand, and yes it always will be," he says in the latest edition of ASM's 'Route to Recovery - route development beyond Covid-19', where he is managing director. Part 5 of the series looks at the developing discussions between airports and airlines.

"This year will force major changes to the norms the industry has established. The requirements for starting air service, whether resuming or new, are now different," he explains, noting that the data that had underpinned previous discussions was no longer relevant.

"A recovery is about the magnitude and pace of traffic restoration, in that regard the data we have all relied on so heavily will for now just be a depiction of the past with trends that are no longer relevant... We are all going to have to think again about how the route and air service development job is done," says Mr Stroud.

Although a commercial partnership collaboration has always been key between airlines and airports after all each is reliant on the other to a high degree. Trust and confidence will become even more paramount now than it has ever been. Assuming that consumers have the confidence to resume flying and restrictions are lifted to allow the resumption of flights, Mr Stroud says it is the job of route development professionals to articulate trust and confidence measures to the airlines and city pair partners they are trying to build partnerships with. "This will be no easy task," he warns.

The power appears to remain with the airlines. Throughout the recovery period, however long that lasts, ASM believes airlines will continue to demand increased levels of incentives to resume, start and maintain air services. "Airports, for all intents and purposes, right now are closed… Those that don't remain competitive in the support arena are likely to be left behind," the air service development experts explain in the whitepaper.

But, it is clear that all is not equal between airlines and their emergence into the post Covid-19 world and airlines will emerge in different positions of strength. "We believe the future will open opportunities again," explains Mr Stroud. "A fresh start is likely, and with it the creation of a more listening culture."

As such, he acknowledges that it may be time for destinations and airports to redraw their strategy principles. "The changing nature of consumers in the aftermath may require a refined positioning towards new target audiences," he outlines.

Many airports have suffered from high catchment leakage as travellers gravitated to better connected facilities even if ground travel was longer in duration. Leakage was always a major component in selling a route development opportunity to any airline, and Mr Stroud believes this could now "pivot to be a new key strength and a levelled playing field market".

We are already seeing airlines outline their initial 'new normal' plans. Many are focusing on the core routes that have delivered them historic success, but some are showing signs of adapting to current conditions. We are seeing some airlines boost their domestic flying as that market recovers quicker and that includes some new city pairs, while some new international routes are also already confirmed.

The time to act is now, according to Mr Stroud. "Those that dwell too long run the risk of being left behind in the race to rebuild. We urge everyone across route development to start the process of working together, forging stronger partnerships than before, to accelerate the rebuild of route networks as fast as we possibly can," he says.

So, how have routes being impacted by the pandemic? We have seen frequencies and capacity fall by upwards of 70%, but route connectivity has not been as impacted. A quick study of OAG schedules shows a route reduction of around a third year-on-year in May-2020.

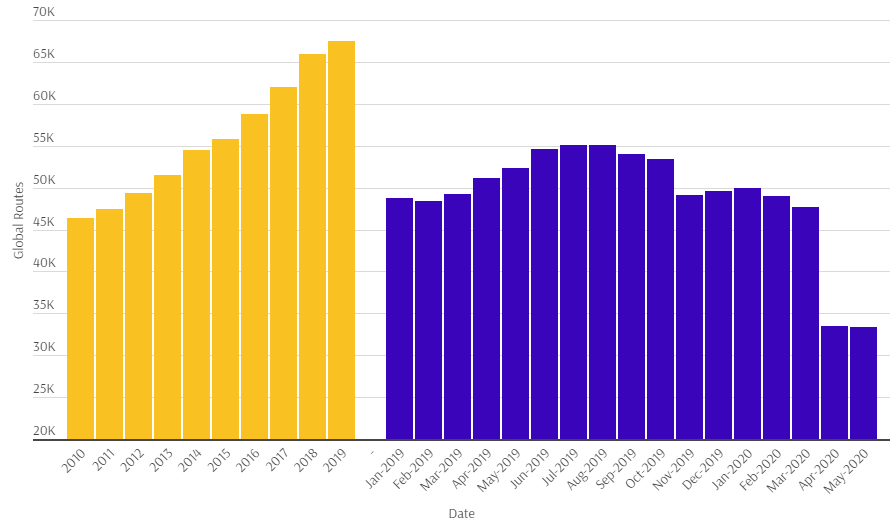

This is not an in-depth investigation and simply compares route pairs that have seen at least one frequency, but it gives us an idea. This shows that over the past decade we have seen route pairs increase by around half, up 45.5% between 2010 and 2019.

As we have seen with capacity, 2020 had started in a positive fashion with +2.3% and +1.5% year-on-year growth in the number of global routes during the first two months of the year. The decline began in Mar-2020 with a -3.1% reduction in routes, escalating to a -34.6% fall in Apr-2020 and increasing to -36.3% for the full month of May-2020, based on current published schedules.

CHART - The number of global routes had grown by almost half over the past decade based on a rough analysis of airports connected by at least one flight during the year Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG