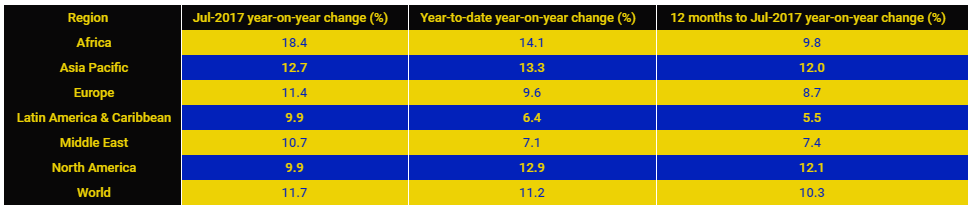

The year-on-year growth rate in the 12 months to Jul-2017 in Europe was 8.9%, 0.8 percentage points higher than the world average. By other measures Europe is the only region to get into double figures.

TABLE - Over the first seven months of 2017 ACI data shows European airports grew at a double-digit rate, the fastest growing region of the world Source: The Blue Swan Daily and Airports Council International

Source: The Blue Swan Daily and Airports Council International

One reason seems to be Europe's relatively stable - and in some cases demonstrating strong growth - economies, especially in the euro zone, and the failure in particular of the UK to collapse into an overhyped but fictitious financial and economic maelstrom.

In fact, the UK economy grew by 0.4% in 3Q2017, more than anticipated, prompting (together with a rise in inflation) the first interest rate rise in 10 years on 02-Nov-2017, the mere prospect of which had already caused the ailing Pound Sterling to soar.

Meanwhile, in Europe the economic performance is even better. The euro zone has recently posted its strongest annual growth figures since the debt crisis in 2011, an annual increase of 2.5% over the comparable period in 2016 with 0.7% growth recorded in 2Q2017 and 0.6% in 3Q2017.

CHART - The EU28 (all EU members, including the UK) and the EA19 (the euro area, a monetary union of 19 of the 28 EU member states which have adopted the euro (€) as their currency have seen recent quarter on quarter GDP growth Source: Eurostat

Source: Eurostat

Meanwhile, with unemployment levels at their lowest in the UK since the 1970s the euro zone jobless rate has also fallen to its lowest level since Jan-2009 (8.9%); in the wider EU it is at its lowest since Nov-2008 (7.5%).

CHART - Both the EU28 and EA19 are following a downward trend in unemployment rates, but levels differ considerably across Europe Source: Eurostat

Source: Eurostat

The benefits are being felt across the continent, even in Greece, often described as Europe's economic basket case and still being bailed out of its debt crisis; it was leant a further EUR8.5 billion in Jun-2017. While the lower of the two charts above clearly identifies Greece as easily having the worst unemployment rate in Europe at 21.8% with over a million out of work (out of a population of 10.75 million) that figure has reduced considerably from the 28% recorded in 2013 at the height of the crisis.

With the blessing of its lenders and as part of the deal under which further financial aid was permitted, Greece has re-entered the bond markets on the strict understanding that further efforts are made to reduce its debt pile. It is unlikely but not impossible that it could exit the current bailout programme within two years.

The next would-be problem for the euro zone is the Catalonian crisis, specifically in respect of a drop in consumer and business confidence in the current economic quarter including the exit of leading companies from Barcelona. There is no guarantee they would relocate to Madrid, Valencia, Seville or anywhere else on the Iberian Peninsula. Spain has been in recovery mode in 2017 but is still not out of the woods, as continuing low apartment prices and rentals confirm and it still has the second highest unemployment rate in all of Europe, at 16.7%, even though 3Q2017 GDP growth reached an impressive 0.8%.

Notwithstanding these potential pitfalls the figures here suggest that air transport will continue to benefit as businesses gain from investor confidence and consumers from more Euros or Pounds in their pocket. Lurking in the background though is the prospect of more interest rate rises which will impact particularly in the UK on mortgage rates, sending consumers scurrying back into a defensive shell as savings rates consequently rise also.

TABLE - Europe's cargo growth trails behind Asia Pacific, North America and Africa, but remains relatively strong over ACI's reporting period Source: The Blue Swan Daily and Airports Council International

Source: The Blue Swan Daily and Airports Council International

Moreover, it should be noted that the story is not the same with cargo growth, which is considerably less in Europe than in Asia Pacific, North America and even Africa. Cargo growth statistics can be confusing to interpret. The general rule of thumb is that if they are seen to decline, either globally or regionally, that can be a warning of a forthcoming decline in passenger growth though it doesn't always work out like that.

And in any case cargo volume generally is still growing quite strongly; the comparatively slower pace in Europe could be influenced by a number of factors such as the volatility in the container shipping industry which has made billions of dollars of losses over the last few years. Those problems continued throughout 2017 with many lines still operating at a loss, potentially to the greater benefit of airlines elsewhere in the world. So perhaps not too much should be read into the cargo figures, at least for now.