United recently stated that demand for China flights is down 100%, but it and other airlines have cancelled flights to China since the spread of the virus, and has cited a roughly 75% decline in near term demand on other transpacific routes. United has recently also recently withdrawn its full year 2020 financial guidance, given the uncertainty on demand from the virus.

The airline is the largest US airline operating between the US and Asia, but other global US airlines are also refining their schedules. Delta Air Lines is cutting flights from Minneapolis to Seoul and decreasing service to Seoul from its hubs in Atlanta, Detroit and Seattle.

The COVID-19 effects are also affecting the meetings and events sector. Cowen & Co. analyst Helane Becker recently highlighted that the Mobile World Congress in Barcelona was cancelled. We have now seen the massive ITB trade fair in Berlin go the same way, as has the Geneva Motor Show.

"This week [starting Monday, Feb-24] several companies pulled out of a San Francisco conference, and that conference was cancelled. We were notified Friday and yesterday that other industry conferences scheduled for other parts of Asia have been either been postponed or cancelled", Ms Becker explained.

Ms Becker highlighted that in one of Cowen & Co's broader firm updates on COVID-19, the company expects "China to lose a year of air traffic growth," and if people are afraid to travel outside of their own borders, the USD30 billion impact to revenue that IATA cited last week "will be low". "We believe that a complete recovery in traffic by the fourth quarter could be optimistic, and that it may take until 2Q2021 at the earliest for traffic to return to normal. We definitely think if people stay home, there will be pent-up demand…", she explained.

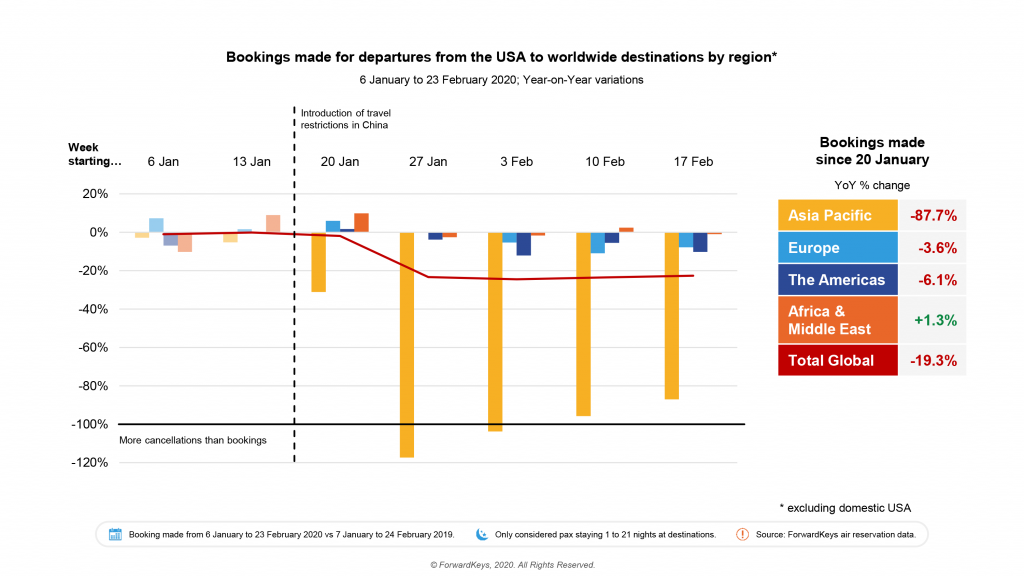

The impact on the US has been reinforced by travel analytics company ForwardKeys, whose research shows the travel setback caused by the coronavirus outbreak has now hit the US market. Its analysis of bookings highlights that in the five weeks following the imposition of travel restrictions on outbound travel from China (w/c 20-Jan-2020 through w/c 17-Feb-2020), there was a -19.3% decline in the number of bookings made for travel from the USA.

As you would expect given global events, the majority of the decline has been caused by a collapse in bookings for travel to the Asia Pacific region, down by -87.7%. But, the setback in outbound bookings from the USA during that time has not just affected the Asia Pacific region; a similar but milder trend has affected other parts of the world too.

According to the analysis from ForwardKeys, bookings to Europe have fallen by -3.6%, and to the Americas, have fallen by -6.1%. However, bookings to Africa & the Middle East, which has only a small (6%) share of outbound US travel, have increased by +1.3%.

ForwardKeys breaks the world down into 15 different regional destinations - its research shows all have seen a drop in bookings from the USA, in the past five weeks, with the exception of North Africa, Sub Saharan Africa and Central America, which have seen their bookings rise by +17.9%, +4.4% and +2.1% respectively.

In the order of least to worst affected, bookings were down as follows: to Western Europe by -1.7%, to Southern Europe by -2.8%, to North America by -3.3%, to South America by -3.4%, to the Middle East by -4.2%, to Northern Europe by -5.5%, to Central/Eastern Europe by -7.7%, to the Caribbean by -12.5%, to Oceania by -21.3%, to South Asia by -23.7% and to South East Asia by -94.1%. In the case of North East Asia, "there were more cancellations than new bookings," it identifies.