Summary:

- The merger of Icelandair and WOW air throws a prospect of uncertainty into the infrastructure plans for Keflavik International Airport;

- The two carriers dominate movements with their hub business models that supports not just local traffic but transfer demand;

- But after recent rapid growth, there has been a severe stalling of tourism growth.

As highlighted by The Blue Swan Daily last week (see 'WOW! Icelandair takes control of its LCC rival, but mixed fleet is among reasons why both are retaining their individual identities') both airlines will continue to operate as separate brands despite offering very similar business strategies.

Both carriers, and especially Icelandair as it serves more primary cities, have a critical role in facilitating the movement of Icelanders abroad, for business and leisure purposes, and in bringing tourists to Iceland. They also offer sixth freedom travel opportunities between Europe and North America, though that remains a subsidiary role and is more appropriate to winter as the main focus in the short summer period (May to September) is on the higher fare-paying visitors to the country.

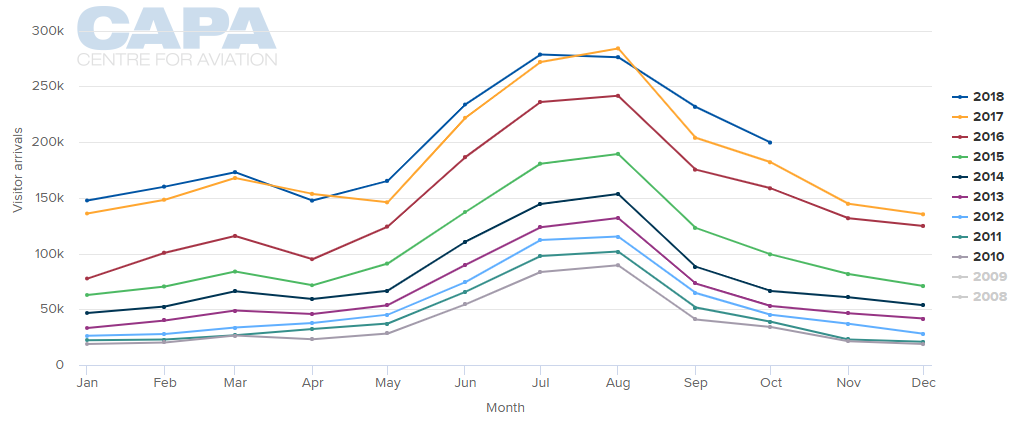

CHART - There is a significant disparity between visitor numbers to Iceland in Dec/Jan compared to Jul/Aug Source: CAPA - Centre for Aviation and Icelandic Tourist Board

Source: CAPA - Centre for Aviation and Icelandic Tourist Board

The Icelandic Transport Minister is of the opinion that the 'merger' will contribute positively to the tourism sector in Iceland. But there will be an impact at Keflavik International Airport and on transport infrastructure projects in Iceland. The two carriers hold over three quarters of seat capacity and over 80% of (peak hour) movements at Keflavik, but growth has stalled in 2018, occasionally dipping below the 2017 performance.

The projected visitor increase for 2018 is +7% and for 2019 +5%. Neither figure may be reached. Meanwhile at Keflavik, where statistics include the transit passengers, growth has halved in the first 10 months of this year.

There are a number of factors behind this, such as rising costs, lack of accommodation in the country, overcrowding at the main tourist sites. The fact is Iceland has been the #1 tourism hot spot (pardon the pun) in the western hemisphere for the last seven years - during which time visitor numbers quadrupled. It cannot carry on like that forever (it does not have a high incidence of repeat visits), and even the first signs of a nascent anti-tourism philosophy is being seen in the local population.

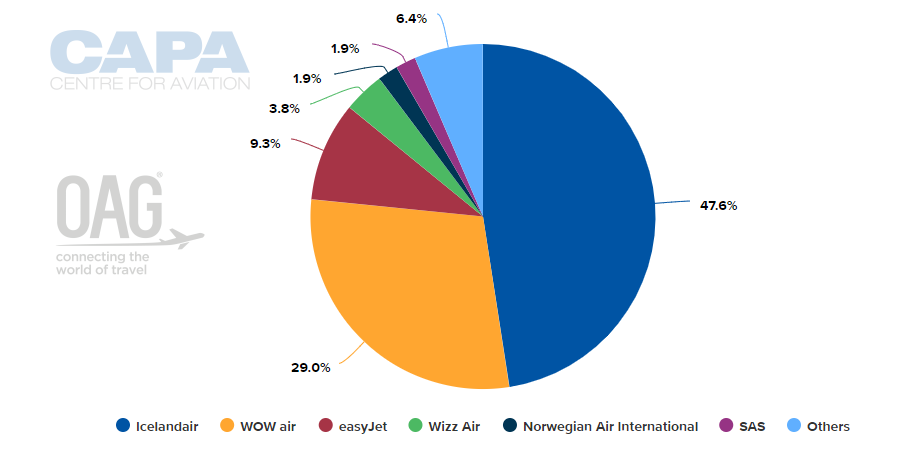

CHART - Despite a recent growth in airlines serving Iceland, Icelandair and WOW air remain the dominant operators at Keflavik International Airport Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

So Keflavik Airport must adapt its business plan to a suddenly uncertain future. The 'merger' is a huge event locally. With over four-fifths of movements and the likelihood they will work closely together despite the continuation of separate brands they will need, and demand dedicated terminal facilities.

At present, the only terminal construction project is expansion of the southern building of the terminal, a project partly financed by a European Investment Bank loan. The 2016 Master Plan majors on an additional runway, with a larger airport terminal in place only by 2040. While Isavia, the airport authority, has been criticised for its failure to build infrastructure that may actually turn out to be a wise move.

There is the possibility that some domestic flights could start to operate directly from Keflavik rather than Reykjavik, to Akureyri in the north and Egilsstaðir in the east for example, to try to "redistribute" foreign visitors away from what has been described as "Disneyland" in the south; even that there might be WOW air flights to those places directly from European cities at least.

But a Keflavik-Akureyri service by Air Iceland has already been discontinued for lack of interest. Iceland's main tourist draws, the Gullfoss waterfall, Geysir hot springs, Þingvellir National Park and Blue Lagoon are all within a day trip's distance of Reykjavik, with its legendary nightlife, and that is where tourists want to be.

There are also implications for the proposed EUR150 million New Reykjavik Hvassahraun Airport (would it be needed if Keflavik starts to take domestic flights?) and the high-speed rail line from downtown Reykjavik to Keflavik which is bound up with it.

The Icelandic authorities were accused of being ill-prepared for the tourist boom which arose out of the devaluation of the Króna, followed by the 2010 volcanic eruption under the Eyjafjallajökull glacier. In time, they may be accused of a similar lack of attention to capacity needs at Keflavik. On the other hand this airline merger might prove them to have been right to hold their horses.