China's GDP surpassed expectations in 2017, growing at a rate of 6.9%. According to the Treasury of New Zealand, China's ongoing transition towards consumption-led growth and the need for raw materials and food are expected to underpin demand for even more New Zealand dairy, meat and beverages.

To hear more about the booming New Zealand market, join us at the 2018 CAPA Wellington Aviation & Corporate Travel Summit, register at the following link.

There is however an enormous contrast related to the sense of scale between the regions. First revealed by New Zealand China Council chairman Don McKinnon in Aug-2017, New Zealand does not even crack the top 40 top trading partners for China, despite China being the greatest contributor to New Zealand. New Zealand receives around 20% of its imports from the Chinese, while New Zealand supplies around 0.5% to China.

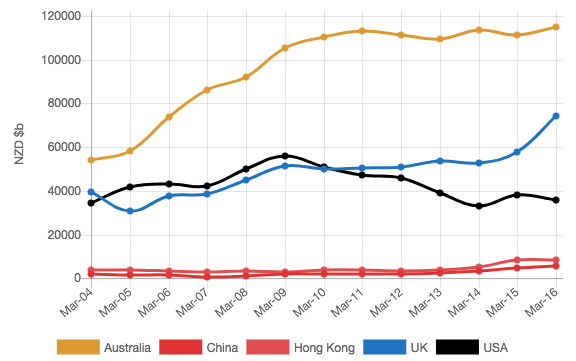

In terms of pure foreign investment into New Zealand, the country is namely the fiscal beneficiary from traditional country partners, such Australia, the US and the UK. Chinese investment is lifting from a very low base, with China's contribution to New Zealand's economy instead highly skewed towards trade.

Foreign investment in NZ

Source: New Zealand China Council

Source: New Zealand China Council

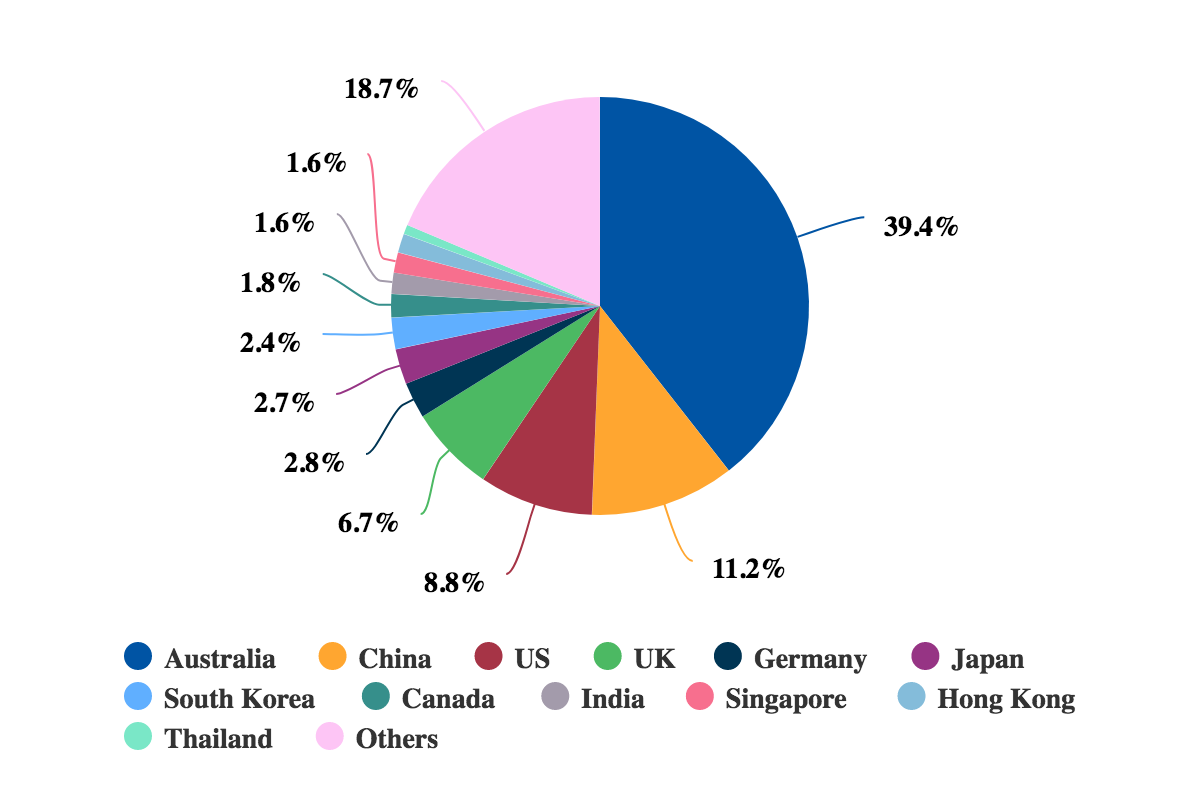

Tourism: China and the US emerge as the most dynamic out of developed markets

International arrivals into New Zealand reached an all-time high of 3.7 million in 2017. Despite the aforementioned discrepancy in investment, China accounts for 11.2% of arrivals into New Zealand and grew 9.4% year-on-year in 2017. The figures place China in an exclusive group with Australia, as the only two nations accounting for double digit percentages of arrivals into New Zealand. The three next prevalent countries: the US; UK; and Germany, collectively account for less than 20%. The two latter regions posted only a 1.3% growth and a 1.9% decline in 2017:

Source: CAPA - Centre for Aviation and Blue Swan Daily

Source: CAPA - Centre for Aviation and Blue Swan Daily

However, the US emerged as the only country in the top five other than China with notable growth, posting a robust 12.2% jump.

Aviation shows growing competition, with Air New Zealand among those slowing expansion pace

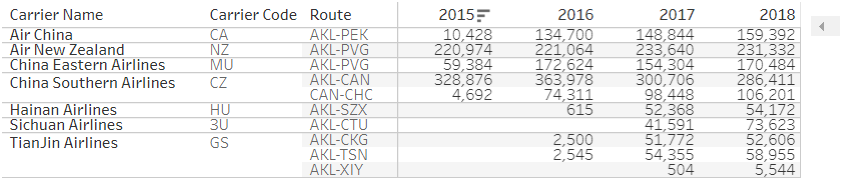

In 2018, China Southern's 286,000 yearly seats on the Guangzhou-Auckland city pair retains its position as the top route by capacity between China and New Zealand. However, seats have decreased by over 40,000 since 2015. Meanwhile, the second most capacity dense route, Air New Zealand's 230,000 seats on the Auckland-Shanghai Pudong sector, has seen a slight slump of its offering by 2000 seats compared to 2017. Air New Zealand's presence on the sector has largely been challenged by China Eastern on the service, with the latter increasing seats from 59,000 in 2015 to 170,000 in 2018.

Capacity by airline and route, China-New Zealand from 2015 to 2018

Source: Blue Swan Daily, CAPA - Centre for Aviation and Stats NZ

Source: Blue Swan Daily, CAPA - Centre for Aviation and Stats NZ