Founded in 2014, Accolade Investment Group is not an investor in airports per se, but in industrial parks for manufacturing and logistics sector companies. It selects sites close to major manufacturers, large conurbations, airports and transportation networks and has realised projects across the Czech Republic and in Europe with a total area of 427,000 sq m, to date.

CHART - Accolade Investments Group generally invests in industrial parks for manufacturing and logistics sector companies but at sites close to airports and transportation networks Source: Accolade Investments Group

Source: Accolade Investments Group

In theory the investment should be of considerable benefit to Brno Turany Airport. While it handled 417,000 passengers in 2016 (-10.4%) that is less than 4% of the total handled at Prague's Václav Havel Airport (11.78 million, +19.2%). While Prague is the 163rd largest airport globally as measured by seat capacity and ASKs, Brno trails at 1,536th and 1,302nd respectively, according to CAPA - Centre for Aviation profile data.

Such huge discrepancies usually point to an overly capital-centric country and a serious imbalance in the distribution of economic activity. Yet that is not strictly true in the case of Brno, a city of 380,000 people in a metropolitan area of 800,000 and situated at a historical crossroads in the southeast of the country and closer to both Vienna (to which it has been historically connected) and to Bratislava, the capital of the Czech Republic than to Prague.

MAP - Brno is is the second largest city in the Czech Republic by population and area, the largest Moravian city, and the historical capital city of the Margraviate of Moravia Source: Google Maps

Source: Google Maps

More to the point, and what is clearly of interest to the Accolade Group, Brno has a strong economy. Traditionally a heavy industrial city, with a solid presence in the arms business, it has made a transition into the information economy, technological R&D and service sectors during the last two decades and now claims to be the largest Czech city in terms of economic output in these sectors collectively.

Two major research centres are located in the city: the Central European Institute of Technology and the International Clinical Research Centre, while the Brno Exhibition Centre is one of the largest in Europe. Engineering and software development are also major industries and the city is home to regional offices of the likes of Red Hat (software), AT&T, Honeywell, Infosys, IBM, and T-Mobile (EE) as well as Lufthansa InTouch (its customer service centre) and the headquarters of kiwi.com the fast-growing online travel agency.

Brno is also home to no fewer than 14 universities, while tourism is also central to the economy, and after Prague, Brno is the most visited city in the Czech Republic. It has a renowned café culture, driven by the high number of students and hi-tech business expatriates.

So with all these advantages in terms of location, economy and tourism why is the airport so small? Bratislava may be the capital of Slovakia but the city is of a similar size. Bratislava's airport handled more than three times the number of passengers at Brno in 2016.

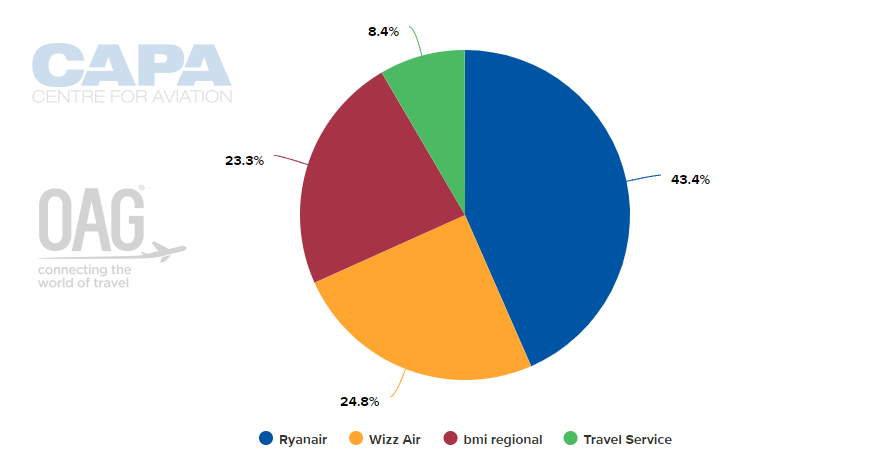

Currently, there are only three regular year-round scheduled routes - one to Munich (bmi regional - a new service only since 2015) and two to London Stansted/Luton (Ryanair and Wizz Air), although there are over 40 seasonal charter routes, operated by three companies and Travel Service Airlines does have some seasonal scheduled routes .

CHART - LCCs dominate the schedule at Brno Turany Airport with Ryanair the largest operator by capacity Source: CAPA - Centre for Aviation and OAG (data: w/c 13-Nov-2017)

Source: CAPA - Centre for Aviation and OAG (data: w/c 13-Nov-2017)

It is clear that without the up to four-times daily connection to and from the Lufthansa hub at Munich Airport, the appeal of Brno to expatriates would be severely diminished. For all its attractions Brno is not an easy place to get into and out of for business or leisure and fares are not cheap. There is a a clear over-reliance on Vienna, the nearest primary airport but which is not even accessible fully by motorway (though airports in Prague and Bratislava both are).

The Blue Swan Daily analysis of traffic data from OAG shows an annual two-way market of an estimated 17,000 passengers flying between Brno and destinations behind or beyond Munich, based on the past 12 months (October 2016 - September 2017). The largest connecting flows are into Spain and within Germany, while Amsterdam is the largest single destination for transfer traffic.

It is too early to consider Accolade Investment Group's plans for Brno, but is badly in need of a range of full service, low cost or hybrid European routes to connect it to cities that fall within the same technological framework or where there are established financial mechanisms for fund-raising. These might include Berlin and Frankfurt (though they are readily accessible via Munich), Paris, and possibly even London City.

As for the airlines, the airport can handle most medium-sized jet aircraft and it is not inconceivable that LCCs could be convinced that Brno might be marketed at least as a weekend break leisure destination. One would think for example that the Air France subsidiary Joon, which set its stall out to target 'millenials' could be sufficiently interested to consider its options there. Long haul connectivity will evolve through better hub connections rather than direct flights, while cargo routes can be stimulated by the development of the airport environs that is envisaged by its new owners.

It is not unusual for airports to be owned by real estate companies (though their number has diminished) or by private equity. According to the CAPA - Centre for Aviation Global Airport Investors Database, of the 822 investor profiles, 42 are of Private Equity firms/funds and 49 of (loosely) Real Estate/Property Development/Infrastructure Investment firms, although not all are active and there is some overlap between the classifications.