But what does this mean for the skies?

Often assumed by the unknowing to be an unlimited resource, airspace is instead being considered as a precious commodity in many regions. Legacy air traffic management systems and technologies using visual devices, stemming back as far as World War II, are largely still used today.

Globally, however, there has recently been an uptake in recognising the need for modernisation. The Blue Swan Daily outlines a few airspace modernisation projects being undertaken on a regional basis:

The United Kingdom:

In 2017 the House of Commons launched an industry-wide consultation on airspace and noise policies. The consultation formed the basis for the UK Civil Aviation Authority being able to commission a new airspace change process, being deployed as at 02-Jan-2018. The locations of numerous flight paths and holding stacks in the UK have remained largely unchanged for over 40 years.

UK's air navigation service provider, NATS, is a key partner in the implementation of new airspace initiatives. NATS CEO Martin Rolfe emphasises that airspace in the South East of England "is now operating to its maximum capacity during the busiest times", and is an inhibitor to the efficient operation of the five London commercial airports.

The ANSP expects aircraft movements across the UK to increase from 2.4 million to 3 million flights p.a. by 2030. If airspace modernisation is not addressed, this equates to 50 times more delays and some 65,000 additional cancellations each year, as extrapolated from a NATS analysis based on Government traffic forecasts. This would cost airlines over GBP1 billion, and obviously incur an expense much more painful for the UK's wider economy.

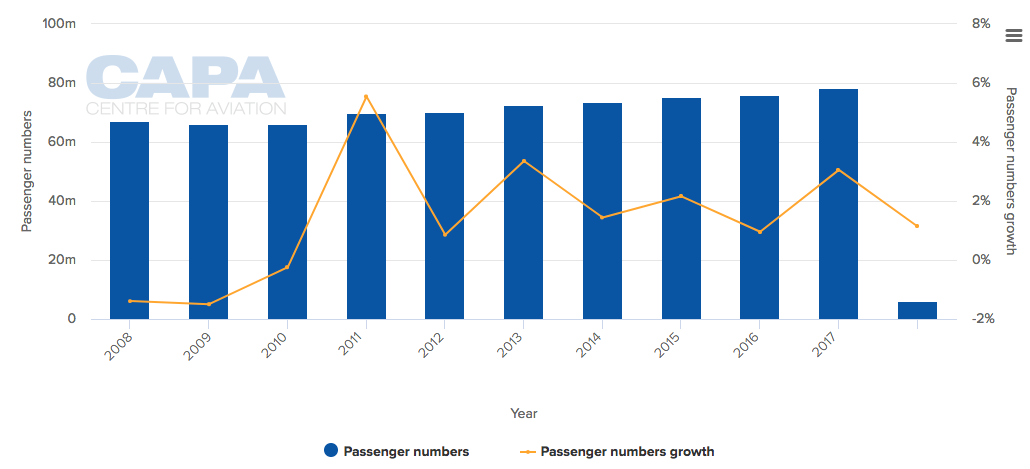

NATS has been busy with responding to the UK's airspace needs, as evidenced at London Heathrow Airport. While Heathrow argues its two-runway system has placed it at full capacity since 2006, traffic has actually grown from 67.3 million in 2006 to almost 78 million in 2017. The drive for this extra capacity has been led by NATS on many accounts, on the back of several efficiency building projects deployed by the ANSP.

These most recently have included the introduction of time-based separation for arrivals, descent angle adjustments, and cross border airspace productivity collaborations under Single European Sky initiatives.

Heathrow traffic continues to grow, supported by new generation ATM technology:

London Heathrow Airport annual traffic passenger numbers from 2008 to 2018

Source: CAPA - Centre for Aviation and Heathrow

Source: CAPA - Centre for Aviation and Heathrow

The Middle East:

A region that has proved relatively forthright in the building of airports and new runways, the Middle East has a real issue in whether its fragmented airspace can keep up with surging passenger demand. Airspace in the Middle East is also generally cordoned for military usage, spurring a recent uptake in measures to increase civil-military cooperation.

Looking to the UAE's General Civil Aviation Authority as a recent example: in Dec-2017 the region implemented an extensive airspace change project for the entire Emirates flight information region to shift completely from sensor-based navigation to performance-based navigation.

In a sister project, Dubai Air Navigation Services has restructured the controlled airspace around Dubai and the Northern Emirates, with the venture establishing 90 new air traffic management procedures, 150 new waypoints, and training for 168 air traffic controllers.

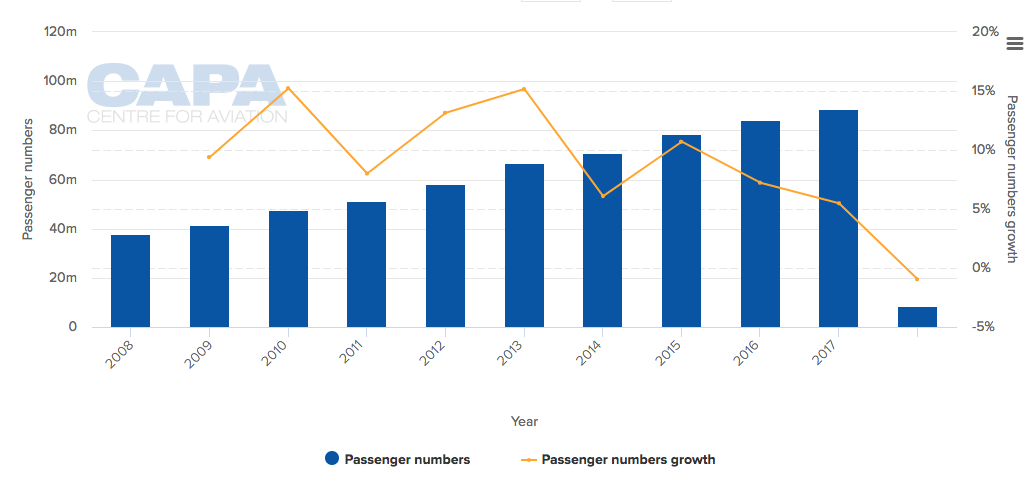

Below shows the prodigious extent of growth in Dubai from 2008 to 2018, with growth amounting to over 50 million passengers p.a.:

Dubai International Airport annual traffic passenger numbers from 2008 to 2018

Source: CAPA - Centre for Aviation and Dubai International Airport reports

Source: CAPA - Centre for Aviation and Dubai International Airport reports