At least 21 people died when Islamist al-Shabab militants stormed a luxury hotel compound in the Kenyan capital, Nairobi. A 19-hour siege of the DusitD2 hotel and business complex on 15-Jan-2019 ended with all five attackers being killed.

ForwardKeys notes that while the previous 2013 terror attack "had a clear and immediate impact" on both international flight bookings and physical arrivals, the "effects faded after about six weeks". But, with he latest siege ending more quickly and the incident receiving far less global media attention, it has prescribed a much shorter impact period.

Looking at the earlier incident, in the first week after the siege started (21-27-Sep-2013), it says international bookings to Kenya dropped by 64.6%. This negative trend continued until the week of 19-Oct-2013, according to its data, and during this six week-period, international bookings were down more than a quarter (29.0%) than the equivalent period the year before. However, bookings quickly picked-up again in November and for the period 26-Oct-2013 to 29-Nov-2013, they grew 3.5% against the same period in 2012.

The events in Nairobi clearly had a short-term impact on bookings to the East African country, but didn't appear to have put off as many travellers that had already purchased flights to Kenya. The ForwardKeys data shows that while they started to drop from 24-Sep-2013 and the trend continued until 05-Oct-2019 with international arrivals down 9.3% over this 12-day period, they rebounded quickly and for the rest of the month (6-31-Oct-2013) arrivals grew by 5.4%.

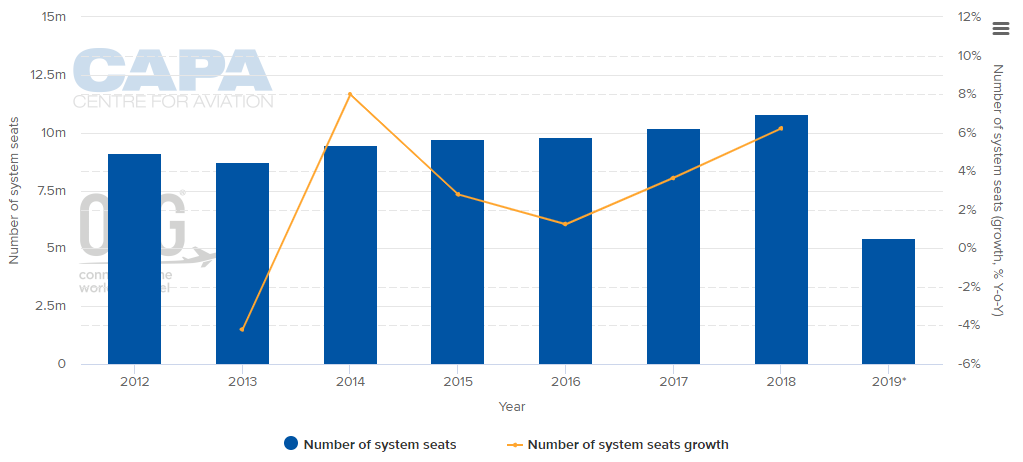

The public faces of Kenya's airports are those at Nairobi and Mombasa as they are the most 'international'. Schedule data for Nairobi's Jomo Kenyatta International Airport shows there have been airline capacity increases each year since 2014, with 6.2% growth between 2017 and 2018.

CHART - Nairobi's Jomo Kenyatta International Airport has seen capacity increases each year since 2014, with 6.2% growth in 2018 Source: CAPA - Centre for Aviation and Nairobi Jomo Kenyatta International Airport reports

Source: CAPA - Centre for Aviation and Nairobi Jomo Kenyatta International Airport reports

According to weekly capacity data from CAPA - Centre for Aviation (fed by schedules provider OAG), Kenya Airways is the largest carrier with 53.9% of the capacity but LCCs Jambojet (part of Kenya Airways) and Fly540 play a small part (83.6% of capacity is on full-service/network carriers). Both Emirates Airline and Ethiopian Airlines, each with a little less than 5% of capacity, offer an alternative hub and spoke network to that of Kenya Airways. The SkyTeam Alliance, of which Kenya Airways is a member, accounts for 58.1% of capacity and is the dominant one.

The CAPA Airport Construction Database says infrastructure investment to the value of USD429 million is mooted at NJKIA. A second runway will be built, using part of a loan from the African Development Bank and enabling full load trans-Atlantic flights. Meanwhile, Terminals B, C and D will be redesigned to increase capacity to around 12 million passengers per annum. As highlighted in a previous The Blue Swan Daily report, negotiations are underway for Kenya Airways to be the concessionaire for the main terminal.

https://corporatetravelcommunity.com/kenya-airways-on-the-verge-of-a-concession-to-operate-nairobis-main-airport-but-it-wont-be-plane-sailing/

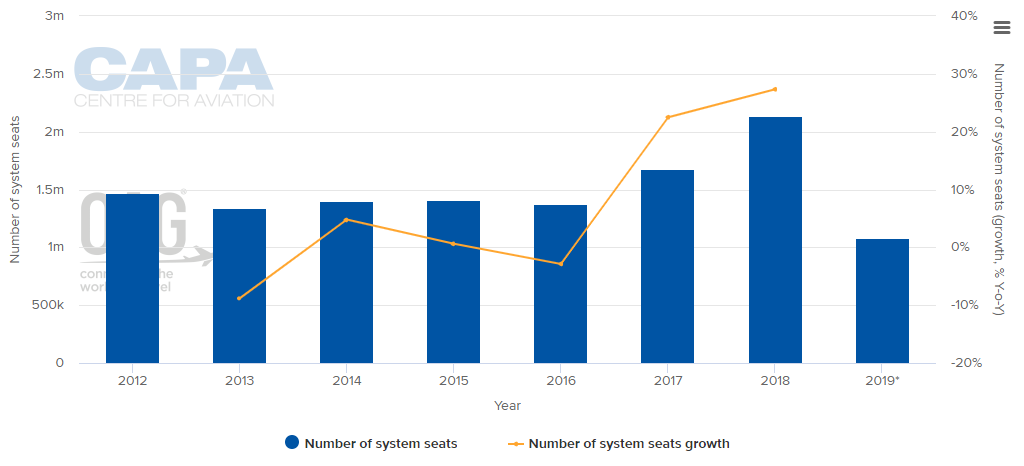

Mombasa's Moi International Airport (MMIA) is understandably smaller than the capital city's gateway one, handling 1.2 million passengers in 2015, the last year for which there are official figures. Its growth profile is similar in nature to that of NJKIA, but the capacity increase has been even greater between 2017 and 2018, at 27.3%, building on the 22.5% rate recorded in the previous year. Kenya Airways is nothing like as dominant with 28.4% of seat capacity with the low-cost Fly540 and Jambojet holding a much stronger position than at NJKIA. Indeed over one fifth of capacity is low-cost and SkyTeam is down to just over a quarter of it.

CHART - Mombasa's Moi International Airport has recorded significant rates of capacity growth over the past couple of years Source: CAPA - Centre for Aviation and Mombasa Moi International Airport reports

Source: CAPA - Centre for Aviation and Mombasa Moi International Airport reports

It is perhaps of some concern that well over six million of the 10.1 million Kenyan arrivals total for 2017 flew into or out of Nairobi's main airport, in a country of 48 million people that does have important regional industrial cities. There are 57 commercial airports in Kenya, some of them in national parks and many only grass strips. Even the secondary airport in Nairobi - Wilson - only generates 300,000 passengers a year.

But there are difficulties even in the capital. The Transport and Infrastructure Cabinet Secretary said recently that construction of a 20km railway line connecting NJKIA with the city centre is slated to begin in Mar-2019. The KES10 billion (USD97.6 million) railway is expected to take 15 months to finish, and once complete, will reduce the travel time to and from the airport from an up to three hours(!) by road to 20 minutes. But, we've been here before. Construction was reported to be underway as long ago as 2010 on a rapid rail connection and various pronouncements have been made on it since.