Why "surprisingly"? Well, because the city council is split on the issue and a referendum might still be held on whether to proceed further. Interested parties will recall that the last attempt to privatise a major US city airport (St Louis was the home of Howard Hughes' Trans World Airlines - TWA) ended in failure in Chicago, twice.

On the other hand airport 'privatisation' has received a boost in the US from the growing number of public-private partnership (P3) deals to build and operate terminals and other airport infrastructure. It isn't far from the truth though to say that this proposed lease is a case of drinking in the last chance saloon and if it falls through other municipalities who are thinking on the same lines might lose interest permanently.

The Blue Swan Daily previously looked at the St Louis sale scenario in an earlier article.

https://corporatetravelcommunity.com/st-louis-takes-a-step-forward-with-lambert-international-privatisation-but-some-politicians-pledge-to-oppose-any-deal/

Now a significant step further down the line, the RFQ responders represent almost all continents, only Asia Pacific is missing. Several of them are consortiums mainly of US firms and some of those are completely new to the sector.

Amongst the 'big hitters' are AENA Internacional, AMP Capital, Global Infrastructure Partners and Corporación América Airports, all 'solo' at this stage at least. Also Royal Schiphol Group, which once enjoyed that status, but which has latterly focused on Amsterdam Schiphol. At least it does have experience of operating a terminal at New York JFK airport.

AENA Internacional has amassed a great deal of experience in Latin America but none in North America. Australian investor AMP Capital is restricted to airports in Australia and the UK but one of them, London-Luton, is of a similar size and scope to SLLIA. Corporación América, which is stock market-listed in the US, is focused heavily on Latin America but operates a few airports in Europe and West Asia. GIP has scaled back in recent years, disposing of London City and reducing its holding at London Gatwick but it used to pitch often for US leases when they were thicker on the ground.

Australia is represented by the aggressive IFM Investors, together with MAG Overseas Investments Limited, on behalf of Manchester Airports Group. IFM is a 35% shareholder in MAG and they worked together (though solely under the IFM banner) in a bid for the second lease attempt on Chicago Midway airport. MAG has a US division, MAG USA, which engages in airport P3s, airport lounges and car parking services.

It is the classic operator/investor dual bid scenario except that the consortium is formed from the same organisation and both previous lease bid experience and the US operations could count in their favour, in our opinion.

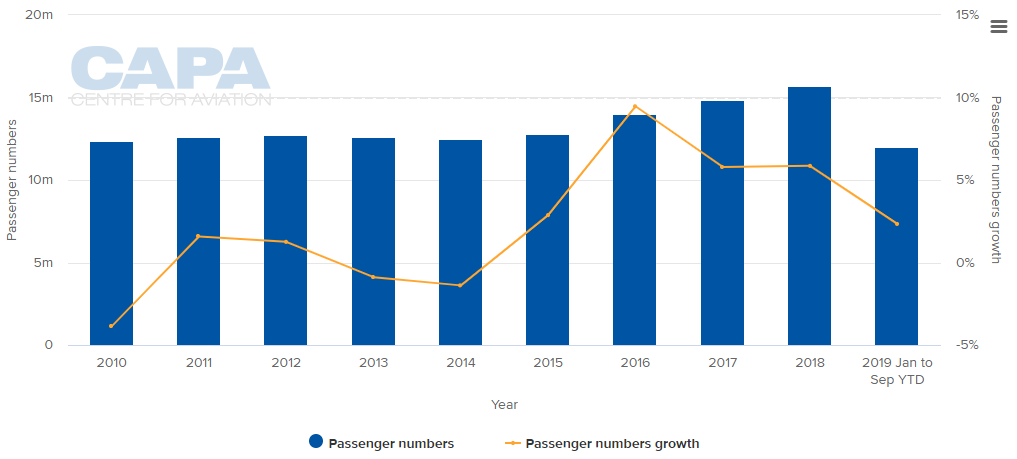

CHART - After a flat first half to the 2010s, passenger traffic at St Louis Lambert International airport has been rising during the second half of the decade Source: CAPA - Centre for Aviation and St Louis Lambert International airport

Source: CAPA - Centre for Aviation and St Louis Lambert International airport

The Canadian pension funds are represented by Ontario Teachers' Pension Plan Board, with its subsidiary Ontario Airports Investments Limited and Copenhagen Airports International, which it part owns (Copenhagen Airport as an individual entity was once an investor in Latin America).

Also OMERS, the Ontario Municipal Employees' Retirement Scheme, which is active at just two airports in Canada and the UK, in partnership with Fraport, which is active at over 30 airports worldwide including several in the US where, like MAG, it operates in-terminal services, mainly retail malls.

Finally, the list includes Canada's Public Sector Pension Investment Board (PSPIB) or PSP Investments as it is known, which is involved with nine airports around the world including a 40% stake in the so-far successful lease on the San Juan Luis Munoz Marin airport in Puerto Rico (which could count in its favour), together with the German AviAlliance which was sold to PSP in 2013 and which has interests in Germany and Greece.

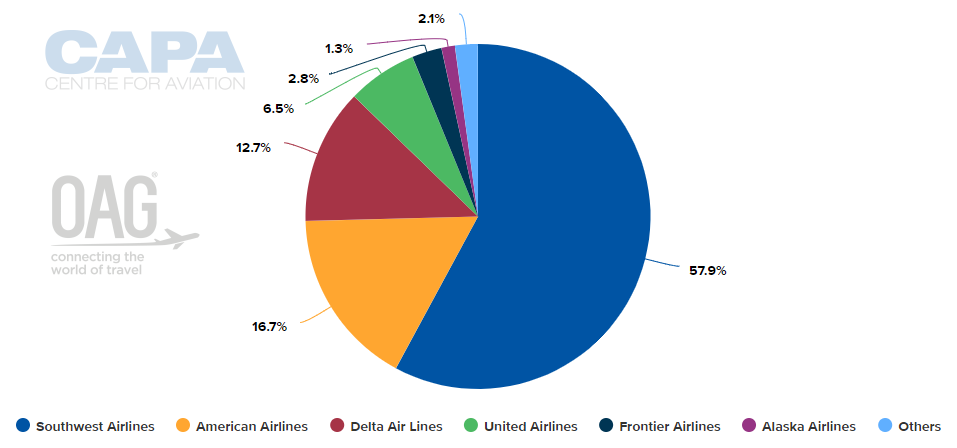

CHART - Southwest Airlines is the largest operator at St Louis Lambert International Airport by movements with a 57.9% share of capacity Source: CAPA - Centre for Aviation and OAG (data: w/c 11-Nov-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 11-Nov-2019)

Canada's Vantage Airport Group, which has spread its wings beyond Canada into the Caribbean, Europe (two airports in Cyprus) and management contracts in the US, has also notified interest along with its own investment arm, Corsair.

From Europe, the Italian investment holding company Atlantia, which has equity in 10 Italian and French airports, has shown its hand for the first time in the US.

Meanwhile, there are three smaller operators in the mix on their own. The Colombian Odinsa (Grupo Argos) which is so far limited to two airports in its home country; daa international, which has limited investments in Germany and Cyprus and which specialises in duty-free stores; and New Zealand's Morrison & Co (Infratil), which was once quite a large investor in small European airports but which retrenched to Wellington airport some time ago.

At the other end of the scale three big consortiums are also vying for the lease.

Lambert Gateway Partners is made up of Groupe ADP (which has been entering into other multi-firm agreements for P3s in the US), and Blackstone Infrastructure Partners, the private equity house which has amassed a USD14 billion fund and which has been on the fringe of airport investment for many years without quite getting there.

]Making up the numbers are Bridgeman Hospitality Group, the Louisville firm behind the Wendy's chain; Cleveland Avenue, a seed investor for food and beverage operators; another pension fund, the Public School and Education Employee Retirement Systems of Missouri; and the unknown Hall of Fame Group.

Momentum Aviation Partners comprises Mexico's ASUR group, which again has an involvement at San Juan, Puerto Rico; the Californian builder AECOM Hunt, which pitched for a P3 terminal at Kansas City in 2017; and the Swiss private equity Partners Group.

STL Aviation Group is the largest of all, involving Oaktree Capital, a one-time investor in London City; JLC Infrastructure, which is part of the consortium building the central terminal at New York LaGuardia; Ullico, a labour-owned investment company; Vinci Airports; TBI Airports, the remnants of the firm taken over by the now defunct Abertis and which has management contracts at several US airports, and others.

To complete the picture there is an outsider registering solo interest, GRID Realty, a private real estate group with interest in St Louis.

It is still an early stage in the process, but what this list confirms is that there is a much healthier degree of interest in the airport sector in the US than perhaps considered, both from within the sector and outside of it.