Highlights:

- Urumqi Airline is set to become the fifth Chinese airline to launch services to Singapore in six months;

- The Singapore-China market will have services from 14 Chinese airlines and four Singapore-based carriers;

- The market is growing rapidly driven mainly by Chinese visitors to Singapore.

Four Chinese airlines have launched services to Singapore over the last six months - Guangxi Airlines, Hainan Airlines, Juneyao Airlines and Shandong Airlines. Urumqi Airlines is launching services to Singapore in May-2019, which will expand the number of Chinese airlines competing in the Singapore market to 14 compared to only nine in May-2018.

Hainan Airlines resumed services to Singapore at the end of Nov-2018 - following a more than three-year hiatus - and is operating three weekly flights from Haikou using Boeing 737-800s. Guangxi Airlines launched three weekly flights to Singapore from Nanning in Dec-2018 using Airbus A320s and increased the service to daily in late Jan-2019.

Shandong Airlines launched Singapore in Dec-2018 with three weekly 737-800 flights from Jinan. The carrier temporarily suspended Jinan-Singapore service in mid-Mar-2019 but is resuming the route at the beginning of May-2019 (according to OAG data).

Juneyao Airlines launched Singapore on 1-Feb-2019 and has had the biggest impact as it is serving Singapore daily from Shanghai with its new fleet of 787-9s. Singapore was the first international widebody destination for Juneyao.

Urumqi Airlines plans to launch a thrice weekly 737-800 service from Urumqi to Singapore via Wuhan on 18-May-2019. The other nine Chinese airlines serving Singapore are: Air China, China Eastern, China Southern, Hebei Airlines, Shenzhen Airlines, Sichuan Airlines, Spring Airlines, West Air and Xiamen Airlines.

Total Singapore-China seat capacity has increased by nearly 15% over the last year. Singapore now has 30 nonstop passenger destinations in mainland China. Chinese airlines have driven most of the growth - both new entrants and expansion from some of the existing competitors. Chinese airlines currently account for 42% of Singapore-China seat capacity compared to 35% a year ago.

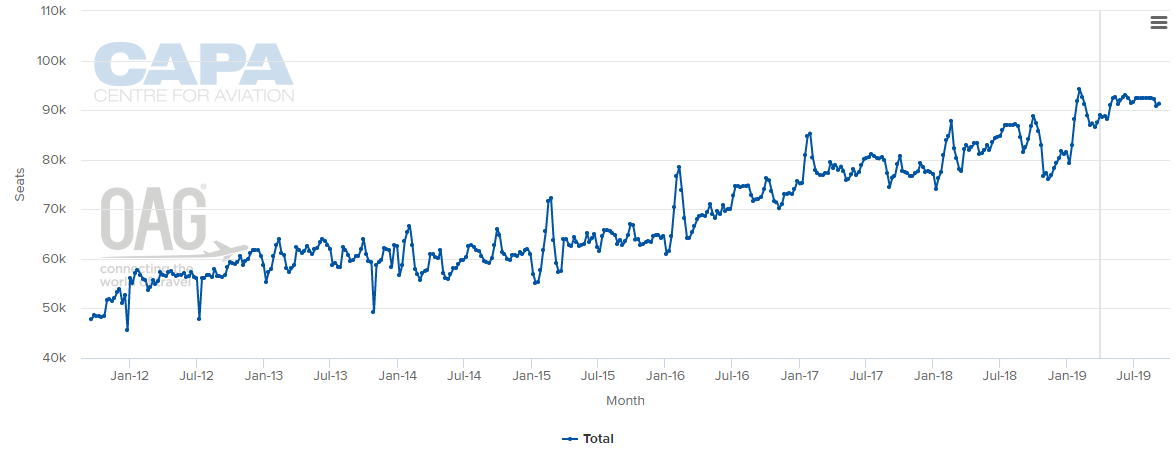

CHART: - There will be around 92,000 weekly one-way seats from Singapore to China in May-2019 compared to 80,000 one-way weekly seats in May-2018 Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

The rapid expansion from Chinese airlines has impacted Singapore-based airlines, which have experienced load factor and yield declines on their Chinese routes. All four Singapore-based carriers serve China - Singapore Airlines, SilkAir, Scoot and Jetstar Asia.

Singapore-China is a huge market with strong local traffic as well as significant transit traffic beyond both Singapore and China. Inbound leisure traffic (Chinese visitors to Singapore) is the single largest component and has been growing. However, the growth rate has been slower than the rate of capacity growth, resulting in the pressures on yield and load factor.

China is the largest source market for Singapore's tourism industry, accounting for 18.5% of total visitors to Singapore in 2018. Chinese visitor numbers to Singapore increased 5.8% in 2018 to 3.4 million while total visitor numbers increased by 6.2% to 18.5 million. Chinese visitor numbers by air increased by 5.0% in 2018 to 2.4 million. Chinese residents accounted for 16.5% of total visitors that arrived at Changi Airport in 2018.

Of the remaining 1 million Chinese visitors to Singapore in 2018, around 800,000 crossed by land and around 200,000 by sea. Chinese visitors to Singapore often cross by land from Malaysia in at least one direction as part of holiday packages that combine the two countries. Most of the Chinese visitors that arrive by sea are on cruise ships; these visitors are typically counted twice as they land at Changi and subsequently take cruises that start and end in Singapore.

China is Singapore's second largest international market after Indonesia based on seat capacity, accounting for an 11% share. The portion of visitor arrivals at Changi is higher (16.5%) because the Singapore-China market proportionally relies on a larger share of inbound passengers than other markets.

The Chinese market is also important for Changi. Singapore's ability to continue to attract more Chinese visitors - its casinos and shopping malls are particularly popular with the Chinese - is helping drive overall growth in the market. However, due to the rapid capacity expansion there are plenty of available seats for other segments including business traffic, outbound traffic from Singapore and transit traffic.