Highlights:

- Malaysia's Firefly has launched a new route from its base at Kuala Lumpur Subang to Singapore Seletar after a delay of almost five months;

- Seletar has not had any commercial services since 2010 and has opened a new terminal capable of handling 700,000 passengers per annum;

- Firefly is the only tenant of the new terminal at the moment but other airlines including Malaysia's Malindo Air are also thought to be keen to serve Seletar.

While Seletar is not closer to downtown Singapore than Changi (they are both about 20km from the CBD), its new passenger terminal offers a convenient and very fast in-and-out option. Seletar is mainly a general/business aviation airport and has not had any commercial services since 2010, when its previous tiny passenger terminal was closed. Its reopening to commercial services after nine years provides a new option for airlines operating turboprops, which are no longer permitted at Changi.

Firefly is an all-ATR operator and served Changi from 2009 until 1-Dec-2018, when it was initially planning to move its Singapore operation to Seletar. However, a last second regulatory hiccup forced Firefly to delay the launch of Seletar and suspended Singapore entirely as Changi would not let it continue operating there in the interim.

The regional airline was finally able to operate its first flight to Seletar on 21-Apr-2019 following a resolution earlier this month between the Malaysia and Singapore governments resulting in a new GPS based landing system for Seletar. It is operating two daily flights from its Subang base to Seletar until 29-Apr-2019, when a schedule of six daily flights will be implemented.

The delay in launching Seletar cost Firefly around USD4 million per month. Kuala Lumpur-Singapore is one of the airline's biggest and most lucrative routes. The suspension of Singapore resulted in reduced utilisation for its fleet and crews.

The six daily flights (42 weekly frequencies) still represents a reduction compared to Firefly's operation at Changi - and what it initially planned for Seletar. Firefly in recent years served Changi with 10 daily flights, consisting of seven flights to Subang, two to Ipoh and one to Kuantan.

It is unlikely to resume the Ipoh and Kuantan routes because they became more competitive in 2018 as AirAsia and launched Changi-Ipoh and Scoot launched Changi-Kuantan. Scoot (previously Tigerair) initially broke Firefly's monopoly on Singapore-Ipoh in 2015. While the Kuala Lumpur-Singapore route is large enough to support several airlines and different airport options, Ipoh and Kuantan are much smaller markets that could be difficult for Firefly to sustain given the low-cost competition.

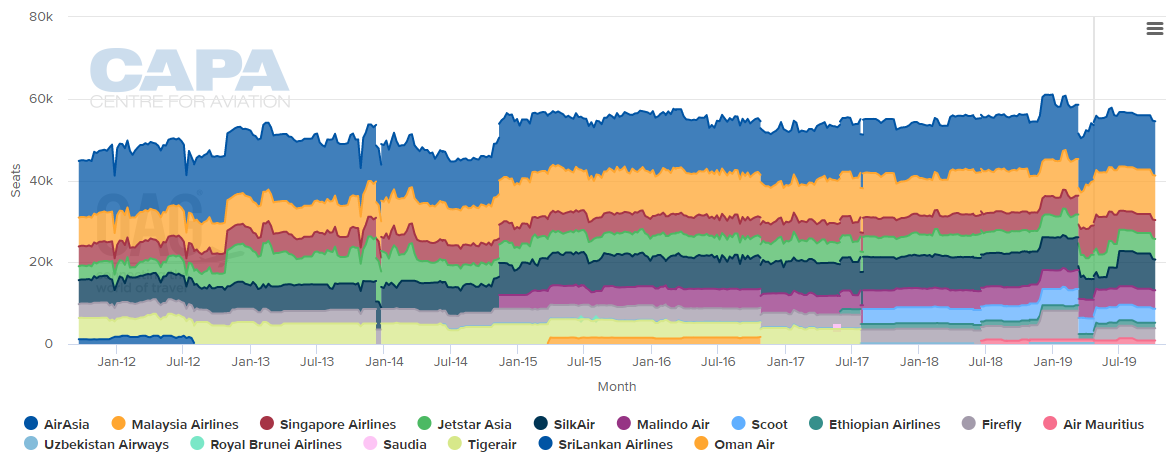

CHART - Kuala Lumpur-Singapore is the largest international route in the world based on seat capacity Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Kuala Lumpur-Singapore is the largest international route in the world based on seat capacity. While the route attracts significant traffic beyond each hub, there is a huge local market due to the lack of a high-speed rail option (plans to build an HSR line from Kuala Lumpur to Singapore were scrapped last year). The Seletar-Subang option is particularly well suited for local business traffic given Subang's proximity to central Kuala Lumpur.

Seletar could eventually attract multiple routes and multiple airlines. As CAPA - Centre for Aviation stated in a Jul-2018 analysis, Malaysia's Malindo Air is particularly keen to serve Seletar. Malindo has not yet been able to secure approval for Seletar as it appears the airport wants to make sure the new terminal is operating smoothly before considering other airlines but ultimately the market should soon open up.

SEE RELATED REPORT: Singapore Seletar airport: new terminal offers niche alternative

Malindo would provide a second option on Seletar-Subang and also potentially serve Seletar from other points in peninsular Malaysia. Its Indonesia-based sister Wings Air (both are part of Lion Group) could operate to Seletar from cities in Sumatra.

As the new Seletar terminal has capacity for 700,000 passengers per annum, it should have the space to accommodate several routes to Malaysia and Indonesia. However, as CAPA highlighted, a lack of connectivity could make it challenging to sustain routes from Seletar to secondary Malaysian or Indonesian (Sumatran) cities due to limited local traffic.

"While passengers arriving in Seletar from Indonesia or Malaysia could in theory connect to flights from Changi by driving between the two airports, such a connection is inconvenient and would dissuade most passengers," CAPA stated.

"Changi should reconsider its ban on turboprops, particularly once a third runway opens early next decade. Turboprops provide a viable platform for linking Singapore with secondary or tertiary cities in parts of Malaysia and Indonesia that currently have limited, or no, services to Singapore. For most of these destinations Seletar is not a plausible option whereas Changi would be viable with smaller aircraft," it added.