Summary:

- Saudia has a small presence in Europe compared to its Middle Eastern peers and currently only serves 12 European points;

- Saudia plans to expand in Europe over the next few years with additional frequencies to existing destinations and new destinations;

- Narrowbody aircraft will drive the expansion as Saudia takes delivery of 15 A321neoLRs with lie flat business class seats;

Saudia is the 27th largest airline in the world based on current seat capacity. Some much bigger names - including Gol, Qantas, KLM and Korean Air - are smaller. Similarly, it is the third largest airline in the Middle East after Emirates Airline and Qatar Airways but it is only slightly smaller than the latter and more than double the size of Etihad Airways.

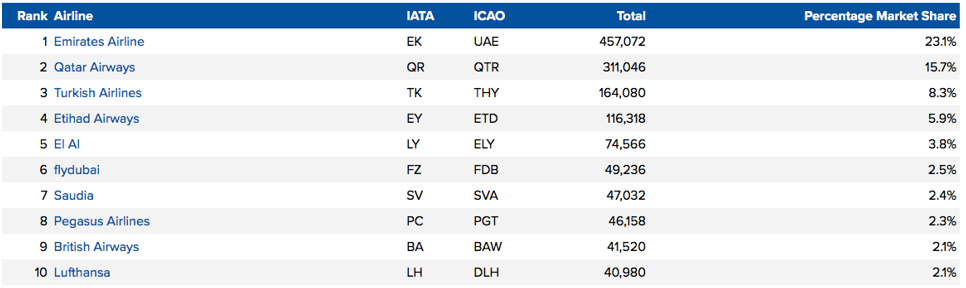

However, Saudia's presence in Europe is relatively small. It is the 83rd largest airline in the European market based on current seat capacity. In the Europe-Middle East market Saudia is seventh largest.

CHART - Emirates has nearly 10 times as much weekly seat capacity in the Europe-Middle East market than Saudia and Qatar has nearly seven times as much Source: CAPA - Centre for Aviation and OAG (data: Europe-Middle East schedules for week commencing 12-Nov-2018)

Source: CAPA - Centre for Aviation and OAG (data: Europe-Middle East schedules for week commencing 12-Nov-2018)

While Europe is a popular outbound destination from Saudi Arabia, Europe has much less inbound traffic than Asia or Africa. Saudia's total international traffic consists of roughly one-third inbound religious pilgrimage traffic, one third inbound labour traffic and only one-third outbound traffic.

Only 4% to 5% of Saudia's international traffic is sixth freedom. Sixth freedom accounts for the majority of traffic at the other top four Middle East carriers (Emirates, Qatar and Etihad) and these carriers naturally rely much more on Europe given their focus on network traffic.

Emirates has 43 nonstop passenger destinations in Europe, which accounts for 30% of Emirates' total seat capacity (based on OAG schedules for w/c 12-Nov-2018). Qatar has an even larger European network, with 49 destinations, and a higher European capacity share of 34%. Smaller Etihad has 20 destinations in Europe, which accounts for 29% of its seat capacity.

Saudia currently has only 12 destinations in Europe, which accounts for 12% of Saudia's international seat capacity. Europe accounts for 6% of its total capacity as Saudia has a large domestic operation; Saudia Arabia is the only Middle East country with a significant domestic market.

Saudia will focus more on Europe as it expands and increase sixth freedom traffic. However, Saudia has no aspirations to follow Emirates, Qatar, Etihad and Turkish Airlines in becoming a super connector. Saudia expects its portion of sixth freedom traffic will double or triple over the next few years - which would still make it a relatively small competitor in Europe-Asia and other sixth freedom markets.

READ MORE... on Saudia's new narrobody lie-flat product read this recent analysis from CAPA Saudia adds lie-flat on narrowbody A320ceos and A321neoLRs

Saudia adds lie-flat on narrowbody A320ceos and A321neoLRs

The growth in sixth freedom traffic to/from Europe will be driven from a mix of capacity increases to existing destinations and new destinations. Saudia is particularly looking at new destinations in the UK, where it now only serves London and Manchester, using new Airbus A321neoLRs.

Emirates, Etihad and Qatar have eight, nine and six destinations in the UK respectively. As Saudia starts pursuing more sixth freedom traffic and begins operating A321neoLRs it will have the connecting traffic and the right aircraft type to effectively serve secondary UK destinations.

The A321neoLR, which will be delivered from 2020, will give Saudia the range to reach all of the UK. Its current narrowbody fleet can only reach continental Europe - and Saudia uses A320ceos to six of its 10 destinations in continental Europe (Geneva, Frankfurt, Milan, Munich, Rome and Vienna). Its other six European destinations (Ankara, Istanbul, London, Madrid, Manchester and Paris) are served with widebodies.

Saudia is slightly reducing capacity to its six narrowbody Europe destinations as it retrofits seven A320ceos with a new lie-flat narrowbody product. The first of these aircraft, which feature 20 lie flat business class seats and 90 economy seats with new seatback IFE, entered service recently on the Jeddah and Riyadh to Geneva routes. The other six aircraft are being retrofitted over the next six months and will be deployed to Frankfurt, Milan Munich, Rome and Vienna (all of which are served from both Riyadh and Jeddah except Vienna, which is only served from Jeddah). These aircraft now have 20 recliner style business class seats and 96 economy seats; Saudia therefore is reducing capacity by 5% post retrofit.

However, Saudia plans to up-gauge services to Geneva, Frankfurt, Milan, Munich, Rome and Vienna to A321neoLRs as they are delivered in 2020 and 2021. Saudia has not yet announced a configuration for its A321neoLRs, which will also feature lie-flat business class seats. As Saudia is committed to acquiring 15 A321neoLRs, it will use around half of the fleet for existing European destinations. The rest of the fleet will mainly be used to launch new destinations that are not within A320ceo range - eastern India is a possibility as well as the UK.

Saudia also plans to redeploy the seven lie-flat equipped A320ceos to launch new destinations in continental Europe after the A321neoLRs take over services to the six existing continental European destinations. This will further enable Saudia to close the gap with its Middle Eastern rivals in terms of number of Europe destinations. It will also enable Saudia to further increase freedom traffic to/from Europe - in both cabins.

Saudia does not currently attract much business class sixth freedom traffic but by offering an all lie-flat product in Europe - as well as to connecting destinations in Asia - it will start pursuing this segment. The new terminal at King Abdulaziz International Airport in Jeddah, which will feature significantly improved lounges when it is fully opened in Mar-2019, will also be a gamechanger for Saudia.