Summary:

- Ryanair has launched its largest ever schedule from London area airports for summer 2019, including 23 new routes and five additional aircraft into its system;

- The growth is despite major concerns from the airline on the possible impact of a hard Brexit on air services in the UK once Britain leaves the European Union;

- Ryanair's London expansion next summer includes a new base at Southend Airport and additional aircraft at Luton airport;

- This summer, Ryanair is the UK's country's third largest operator with a 14.4% share of the nation's frequencies and a 15.9% share of capacity.

Despite the concern, Ryanair has continued to grow its UK activities and this week actually launched its largest ever schedule from London area airports for summer 2019, including 23 new routes and five additional aircraft into its London system. The new schedule sees an additional two aircraft stationed at Luton Airport (up to six 737-800s) and the launch of a three aircraft base at Southend Airport, which is responsible for more than half of the new summer routes.

In total Ryanair plans to operate over 180 routes out of London which it claims will drive 26 million people through Gatwick, Luton, Southend and Stansted airports. The new routes comprise flights from Southend to Alicante, Bilbao, Brest, Copenhagen, Cluj, Corfu, Dublin, Faro, Kosice, Malaga, Milan, Palma, Reus and Venice; Luton to Alicante, Athens, Barcelona, Bologna, Cork and Malaga; and Stansted to Kiev, Lviv and Nantes.

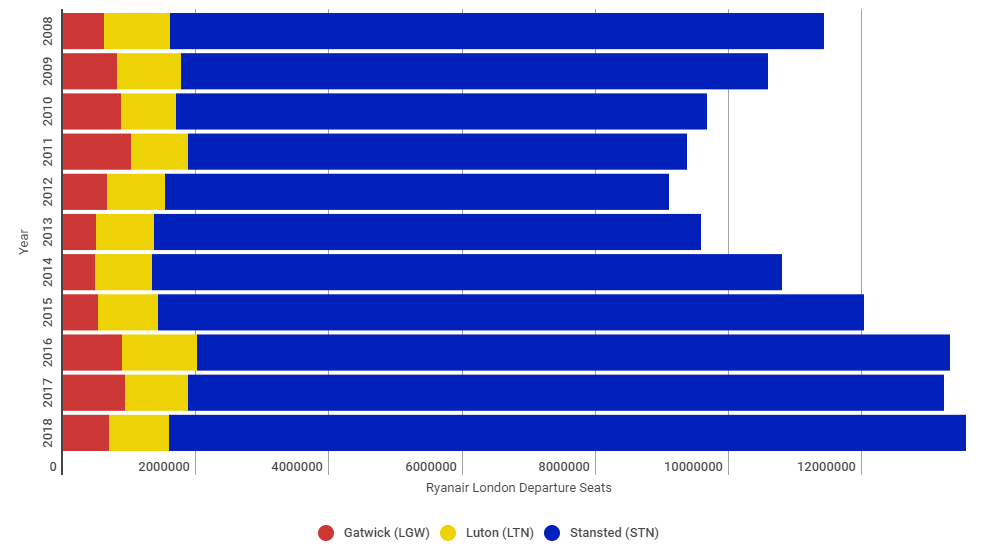

CHART - Ryanair has grown its system capacity in the London market this year despite concerns over Brexit Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

One would consider that Ryanair has been exaggerating the Brexit threat. Mr O'Leary says that despite the London network expansion that the carrier remains "concerned at the increasing risk of a hard (no-deal) Brexit in March 2019," and that while it hopes that a 21-month transition agreement from Mar- 2019 will be agreed, recent events in the UK "have added uncertainty," and it believes "that the risk of a hard Brexit (which could lead to flights being grounded for a period of days or weeks) is being underestimated".

The uncertainty has already seen rival easyJet establish a new operating unit, easyJet Europe, in Austria, where it is now the largest airline, and fellow LCC Wizz Air now has a UK operating certificate to safeguard its operations into the UK from Central and Eastern Europe. In fact alongside aircraft being switched from the UK to Austrian register to fly under the new flag, the airline has also highlighted that it could shift 1,400 UK pilots to Austria due to concerns that UK licences could no longer be valid within the EU.

UK trade body ADS has again urged the European Commission to allow for technical discussions to take place between the UK Civil Aviation Authority (CAA) and European Aviation Safety Agency (EASA) to prepare for Brexit. In a second letter to the Commission, the group, which represents the interests of companies in the UK aerospace, defence, security and space sectors, it states that technical discussions between the CAA and EASA "are needed to make sure there is adequate preparation that will avert significant disruption to European and global aerospace and aviation once the UK leaves the EU". It adds that this preparation is needed for either potential scenario - that a withdrawal agreement is ratified for the UK's exit from the EU, or that no deal is agreed before withdrawal.

An earlier request in a joint letter with the General Aviation Manufacturers Association (GAMA) in Jun-2018 was rejected the following the month. It is understood that the UK Government has also made requests for these technical discussions to take place, but that the European Commission has so far blocked this preparatory step.

Back to Ryanair and The Blue Swan Daily analysis shows it has every right to be concerned. A closer look at the UK aviation system this summer shows that it is the country's third largest operator with over 175,000 flight frequencies and over 33 million seats. The flight schedule data from OAG shows this to be a 14.4% share of national frequencies and a 15.9% share of capacity. It is the largest operator by capacity at Birmingham, Bournemouth, East Midlands, London Stansted and Manchester airports and the second largest airline at Belfast International, Bristol, Edinburgh, Leeds Bradford, Liverpool John Lennon and Newquay airports.