Summary:

- Bordeaux Airport reports a big passenger traffic increase in Apr-2019;

- Several major LCCs now have bases there including Ryanair from the same month;

- The 'billi' LCC terminal is not loved by passengers but it seems to be by airlines.

There was also a return of positive traffic to Paris where there is competition with high-speed rail (23 trains a day each way, with a fastest journey time of just over two hours) (+4.3%). The growth was ultimately driven by the LCC segment, where traffic increased by almost a third (31.1%) - LCCs now account for 58% of all seats.

The strong growth in passenger flows was accompanied by a smaller 9.6% increase in aircraft movements, due to a higher average seat-occupancy rate and the use of larger capacity aircraft by airlines.

One route in particular which is not as well served by competing rail services, Bordeaux - Marseille, has become Marseille airport's third most important service and Bordeaux's fourth-biggest in terms of passenger volume. It is unusual in many European countries for a domestic route between two regional cities to figure so highly in their passenger rankings and especially in the case of Bordeaux where only 40% of seats are on domestic routes.

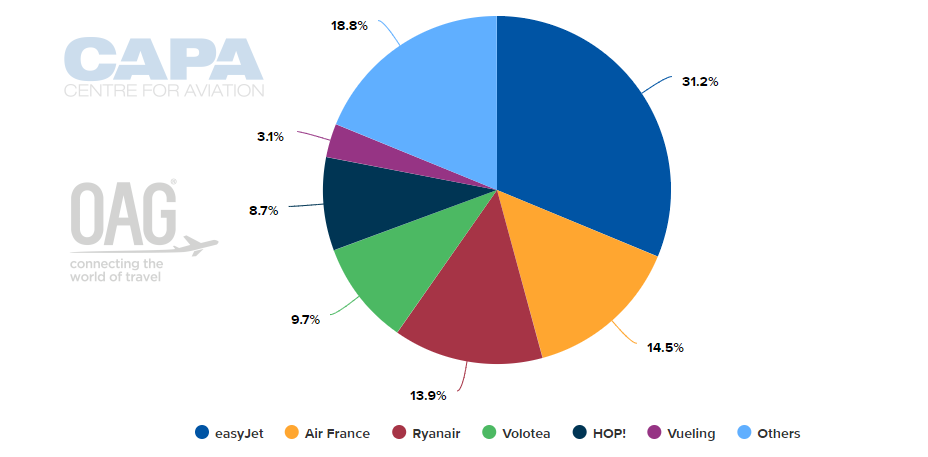

Ryanair only opened its base there - which is only its second in France - at the beginning of Apr-2019, with a network of 29 routes, including 20 new links. The Irish airline will operate a record 37 routes from the start of its winter 2019 schedule, in October. Even so, it is only the third biggest airline by seat capacity (13.9%) behind the much longer established easyJet and Air France mainline (HOP! also has almost 10% of capacity).

CHART - The big news in Apr-2019 was the launch of Ryanair's new base at Bordeaux airport, but it is currently only the third largest operator by seat capacity Source: CAPA - Centre for Aviation and OAG (data: w/c 27-May-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 27-May-2019)

The growth of the low-cost segment generally (+31.1%) in April thus supported this strong momentum. By stepping up its medium-haul services to Germany, Italy, Denmark and Spain, and strengthening its national network with Corsica and Marseille, Bordeaux Airport enhanced its attractiveness.

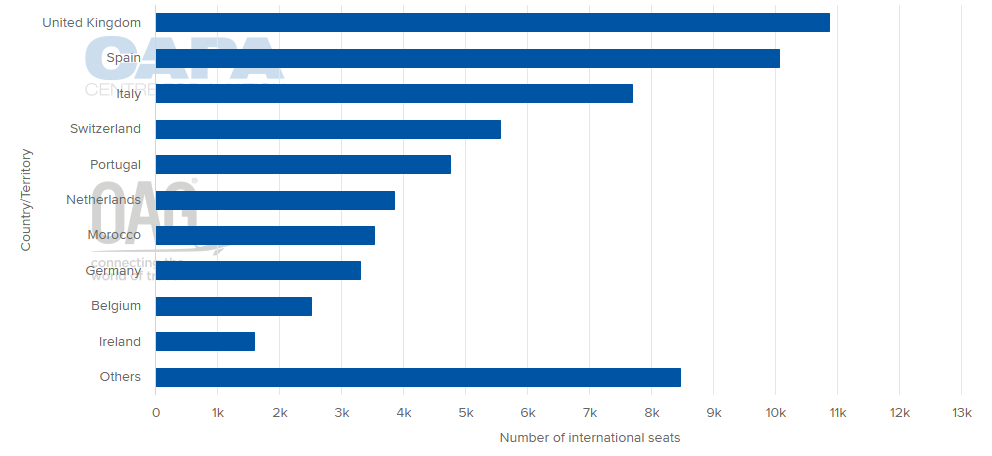

The UK remains the main market (and London Gatwick the main route by seats) - possibly because there are many ex-pats living in the southwest of France; followed by Spain.

CHART - United Kingdom is the largest international market from Bordeaux, followed by Spain and Italy and together the three account from almost two thirds of the airport's international capacity Source: CAPA - Centre for Aviation and OAG (data: w/c 27-May-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 27-May-2019)

One benefit that Bordeaux Airport can offer that most French airports cannot is a dedicated low-cost terminal, known as billi. It has one floor and small check-in and arrivals areas as well as a departures area with six aircraft parking positions which are used for walk-on boarding. The users of Terminal billi since Sep-2017 are easyJet, Ryanair and Wizz Air.

Rightly or wrongly, billi does not have a good reputation online, with many customer complaints about what is undeniably a 'hardship' terminal while also expensive in its concessionary outlets, although such 'hardship' is not unusual in France - Marseille airport's budget MP2 terminal was also considered to be one when it opened.

On the other hand one would assume that if three of the leading budget airlines in Europe shared the same opinion they would make it clear to the airport management; whether they like it or not they will also be judged by the standard of the terminal they use.

Business in April was also boosted by economic events in Bordeaux, especially the week of the 'En Primeur' wine sales at the beginning of the month, attended by thousands of professionals from all over the world, including from the European, Asian and American markets.

It is always valuable for smaller airports to be able to call on regular events to boost services, as Hannover does in the congress/exhibition segment for example. This past weekend, Nice airport, France's busiest after the Paris airports, is benefiting enormously from the concurrent Cannes Film Festival and Monaco Grand Prix while both Baku and Madrid (a primary airport but with no local alternative) are about to witness huge influxes of British football fans for the Europa League and Champions League finals respectively.