Russian airports collectively handled some 207 million passengers in 2018, according to figures collected by Rosaviatsiya. The year 2018 was the first time in Russia's aviation history that the number of air passengers exceeded the 200 million mark, again with an 11% improvement on 2017. Furthermore, Russian airlines collectively carried more than a half of all travellers in 2018 - some 116.1 million people, achieving a 10.5% improvement on the previous year.

According to CAPA data, the Russian Federation has 1,186 aircraft in service as of 28-Oct-2019, with 120 in storage and 374 on order. That Russian aircraft supply is perhaps slightly weaker than it should be. Germany's population for example is 56% of that of Russia but its fleet (746 aircraft) is 63%.

Where infrastructure is concerned, Moscow's three airports of Sheremetyevo, Domodedovo and Vnukovo, which are also the country's busiest, continued to handle the bulk of traffic in 2018, collectively serving more than 96.7 million passengers, which accounts for 46.7% of all the nation's civil air traffic.

In 2018 the market share of the three Moscow airports marginally decreased by 0.6 percentage points on 2017, which is partly explained by the decline of Domodedovo's operational performance in 2018 when it handled 29.4 million passengers, a drop of 4% on the previous year.

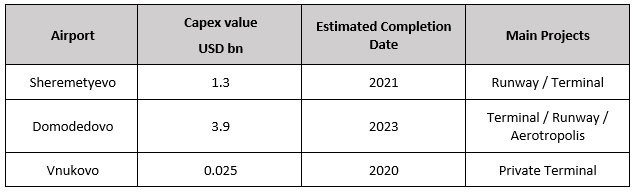

Again according to CAPA data, the amount of construction work going on at those airports amounts to USD5.2 billion, as follows:

Main projects at primary Russian airports, capex value and expected completion dates

Source: CAPA Airport Profiles

Source: CAPA Airport Profiles

The country's fastest growing airport, however, is none of these.

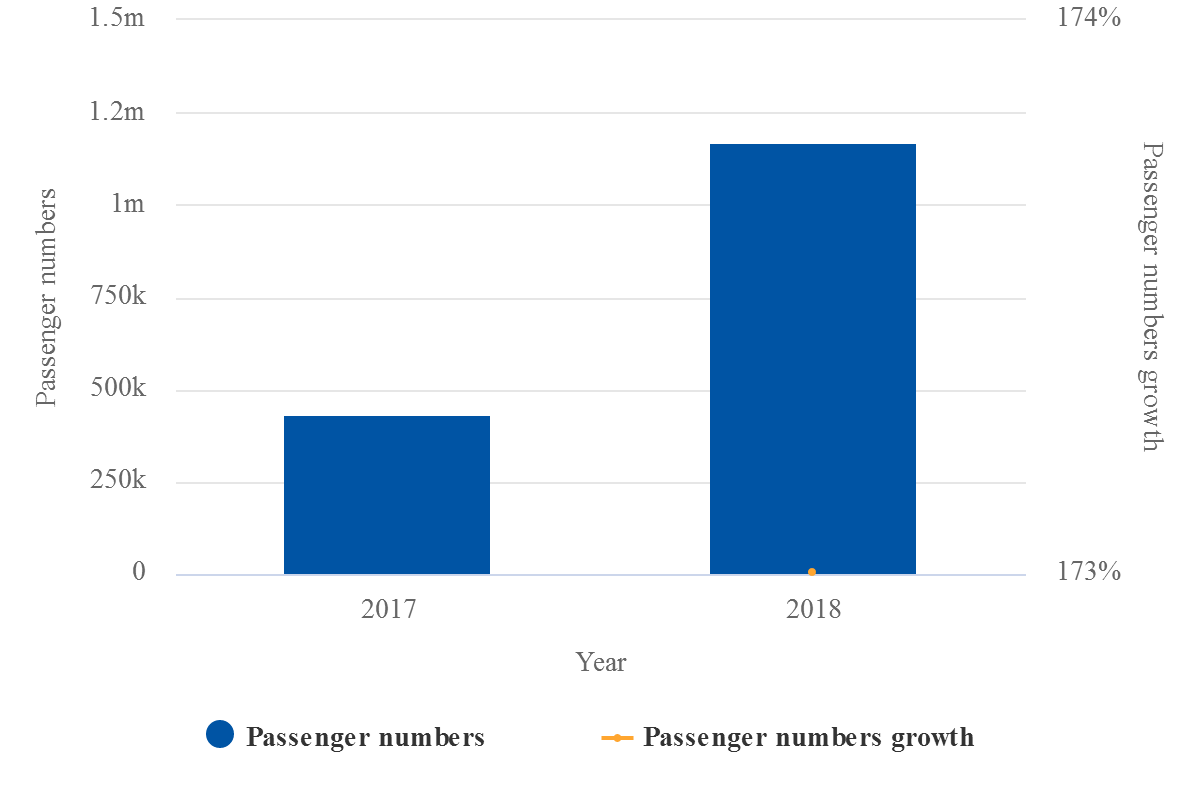

Rather, it is Moscow Zhukovsky, located 25 km from the capital but enjoying a beneficial 'non-Moscow' status. Its traffic last year grew by 173% over 2017, reaching 1.1 million passengers.

Zhukovsky's biggest asset is its 'regional' status - a unique position whereby it is able to support Russia's biggest air transport market while avoiding the constrictions of bilateral international agreements for lucrative new international routes serving the capital.

Moscow Zhukovsky International Airport passenger numbers: 2017-18

Source: CAPA - Centre for Aviation and Moscow Zhukovsky International Airport reports

Source: CAPA - Centre for Aviation and Moscow Zhukovsky International Airport reports

Capex there (USD320 million through to 2023) is being put into a second passenger terminal and a new cargo terminal.

Overall, reconstruction work is to be conducted at 66 airports by 2024. Mr Neradko added that "The issue of airport infrastructure modernisation can only be resolved with the consolidation of resources of federal executive bodies, regional government and efforts of businesses", and noted that there are problems relating to infrastructure development, including the late provision of funds, as well as logistical and seasonality problems in the Far East Federal District.

With regard to "efforts of businesses" the growing impact of the private sector in Russian airports must not be overlooked - especially that of Novaport, Basic Element (Basel Aero) and Airports of Regions - and the possibility of including runways in concession agreements is to be considered by Rosaviatsiya.

The CAPA Airport Construction Database lists 92 Russian airports with infrastructure projects, of which the largest outside Moscow are at St Petersburg (USD975 million); Saratov (USD487.5 million); and Simferopol (USD476 million).

The most interesting development outside Moscow is at St Petersburg, where its owner/manager, Northern Capital Gateway, expects Pulkovo Airport to compete with European airports upon the introduction of fifth freedom rights specifically for the airport. It is hoping to attract airlines operating to and from Asia, the Middle East and North America via the airport. The introduction of fifth freedom rights there is also expected to support long haul and domestic network development, and stopover programmes at what is possibly the most attractive Russian city for foreign visitors.

The prospect of Pulkovo Airport being granted such rights was explored in an earlier Blue Swan Daily article from Jul-2019.

See other report: Blueswandaily.com/saint-petersburg-airport-calls-for-an-open-skies-regime-of-its-own-as-it-approaches-the-20mppa-barrier/

Pulkovo has experienced passenger growth rates of more than 21% in the past three years (in 2017), though that has sunk to 8% in 1-3Q2019. That growth is partly owing to the efforts of the Aeroflot-owned Podeba, the only LCC in Russia and one that accounts for more than 13% of the capacity there now.

Pulkovo has a complicated ownership structure following a 30-year PPP agreement in 2010: Northern Capital and its holding company Thalita Trading Limited, comprising Fraport, VTB Bank, the Cypriot investor Koltseva Holdings Ltd and Copelouzos Group/Horizon Air Investments of Greece, later supplemented by the Qatar Investment Authority, the Russian Direct Investment Fund, Mubadala Development Company, Baring Vostok Private Equity Fund V and Thirty-Seventh Investment Company as Fraport and VTB Bank sold part or all of their stake.

With the Moscow airports also undergoing a privatisation process it would appear these complex transactions may become the norm in Russia, and in the majority of cases so far they have led to significant investments being made, which is what Rosaviatsiya wants.