Highlights:

- The Tokyo - Los Angeles city pair is the largest market between continental North America and Asia based on non-stop seat capacity;

- In 2008, no airline had more than a daily service between Tokyo and Los Angeles, but less than ten years on ANA now has three flights per day on the city pair;

- From fragmentation to today's joint venture definition - a decade ago saw seven daily Tokyo-Los Angeles flights from seven airlines;

- ANA's introduction of a second daily Tokyo Narita-Los Angeles flight appears to be a textbook case about the A380's market opportunity.

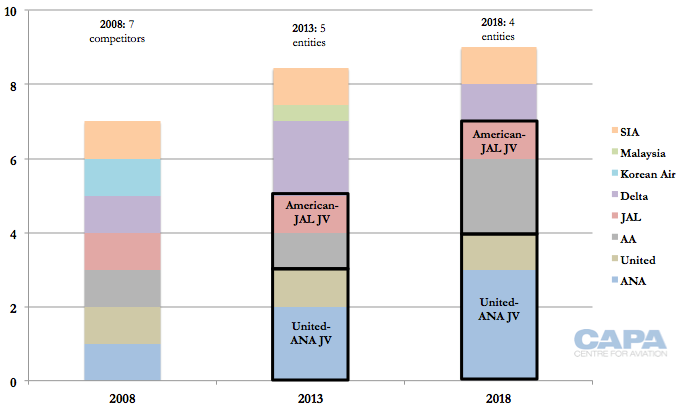

Over the past decade the market's changes reflect the state of the trans-pacific market and wider aviation trends. 2008 saw seven daily flights from seven airlines while 2018 sees nine daily flights from four entities: the ANA-United and JAL-American JVs and then Delta and Singapore Airlines. JV concentration has grown. Two fifth freedom operators have exited.

ANA's launch in Oct-2017 of a second daily Tokyo Narita-Los Angeles flight added to its existing Tokyo Haneda-Los Angeles service, giving ANA three daily flights between Tokyo and Los Angeles. This gives ANA more flights than any other operator, but the more remarkable aspect is that a single airline has such a presence. In 2008, no airline had more than a daily service between Tokyo and Los Angeles.

By 2013, ANA had two daily flights between Tokyo and Los Angeles. So too did Delta, but Delta subsequently decreased its presence to a single daily flight. American added Tokyo Haneda-Los Angeles service to supplement existing Tokyo Narita-Los Angeles service, giving American two daily flights.

IMAGE - ANA advertisement to promote its Los Angeles network Source: ANA

Source: ANA

Over the past decade, the Tokyo-Los Angeles market has seen three fifth freedom operators, only one of which remains. Korean Air exited and instead used its fifth freedom traffic rights to serve Tokyo-Honolulu. Malaysia Airlines had a brief service from Kuala Lumpur to Los Angeles via Tokyo, with the Tokyo stop replacing a previous routing through Taipei. Malaysia exited Los Angeles as part of a wider and drastic network reduction.

Singapore Airlines has remained with a daily service. Capacity peaked in 2012 with A380 deployment. However SIA commenced reconfiguration works to add more premium seats, increasing revenue opportunity but decreasing capacity. This followed SIA's decision to end non-stop ultra-long-haul, all-premium A340-500 services to Los Angeles and Newark.

SIA's introduction of Singapore-San Francisco non-stop A350-900 service was followed by a wider network re-jig that saw SIA replace the A380 on Tokyo-Los Angeles with a 777-300ER, further decreasing capacity. SIA's 2018 capacity presence on Tokyo-Los Angeles is 56% its peak in 2012 with high-density A380s.

Some airlines might be interested in fifth freedom services from Tokyo to Los Angeles, but Japan generally restricts access to the Tokyo market. Garuda Indonesia was hoping to launch a Los Angeles service via Tokyo but could not attain daily traffic rights. In comparison, a number of airlines have access to fifth freedom traffic rights out of Osaka Kansai, which ANA and JAL do not serve as well as they do Tokyo. However the Osaka market is not as high-yielding, and so far has not generated interest.

A decade ago saw seven daily Tokyo-Los Angeles flights from seven airlines. The implementation of the American-JAL and United-ANA joint-ventures lead the change in market dynamics. 2013 saw 8.5 daily Tokyo-Los Angeles flights, but across six competitors (the JV partners American-JAL, United-ANA and then individual airlines of Delta, Malaysia and SIA). 59% of flights were under a JV.

2018 has seen more frequency growth with nine daily flights available. But 78% of these are from either the American-JAL or United-ANA JVs. Competition over the past decade has effectively been reduced from seven entities to four: American-JAL, United-ANA, Delta and Singapore Airlines.

CHART - Tokyo-Los Angeles typical daily flights by operator: 2008, 2013 and 2018 Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

ANA's introduction of a second daily Tokyo Narita-Los Angeles flight appears to be a textbook case about the A380's market opportunity. ANA's two Tokyo Narita-Los Angeles flights depart Tokyo exactly one hour apart, and then depart Los Angeles again one hour apart.

There is thus an argument that the two flights, both on 777-300ERs, should be combined to an A380 service. This may suit the passenger profile of the service, but an A380 would fall short on cargo space, a significant revenue contribution out of Asia.

Flight times mean that a single aircraft cannot operate a daily Tokyo-Los Angeles-Tokyo rotation. Further aircraft would be required, meaning ANA would have to find other A380 opportunities across its network - none of which may present themselves the same way Tokyo-Los Angeles does.

ANA will take delivery of three A380s but for service to Hawaii, which necessitates a more leisure-oriented configuration than Los Angeles.