Summary:

- Latvia's Riga Airport is seeing passenger numbers grow at an unprecedented rate - an increase of +17.4% year-on-year for the first seven months of 2018;

- ACI reports Riga International Airport was the second fastest growing European airport in the five million to 15 million passengers per annum category in 2Q2018;

- In Jul-2018 - and for the first time in its history - Riga Airport handled more than 700,000 passengers per month;

- With a huge presence from airBaltic it is established as the main transit hub for the Baltics. But other airports in the region are also growing and there is no room for complacency.

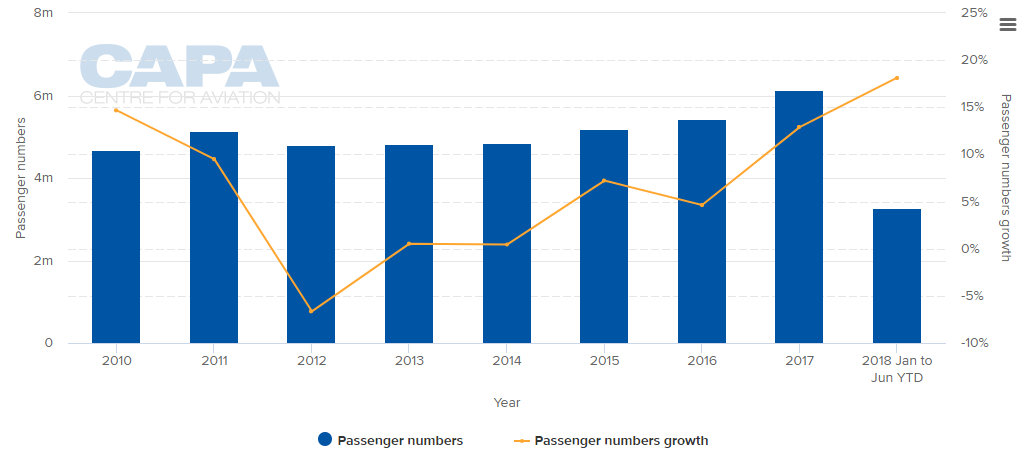

In Jul-2018 - and for the first time in its history - Riga Airport handled more than 700,000 passengers per month. airBaltic remains the market leader, with passengers increasing by +20% and with a market share of 54.3%. Growth has been consistent from 2012 (0.5%) to 2017 (12.9%) but so far this year it is around half again as great as in 2017.

CHART - Passenger numbers at Riga International Airport have been on the rise since 2013 and this year are growing at a decade high Source: CAPA - Centre for Aviation and Riga International Airport reports

Source: CAPA - Centre for Aviation and Riga International Airport reports

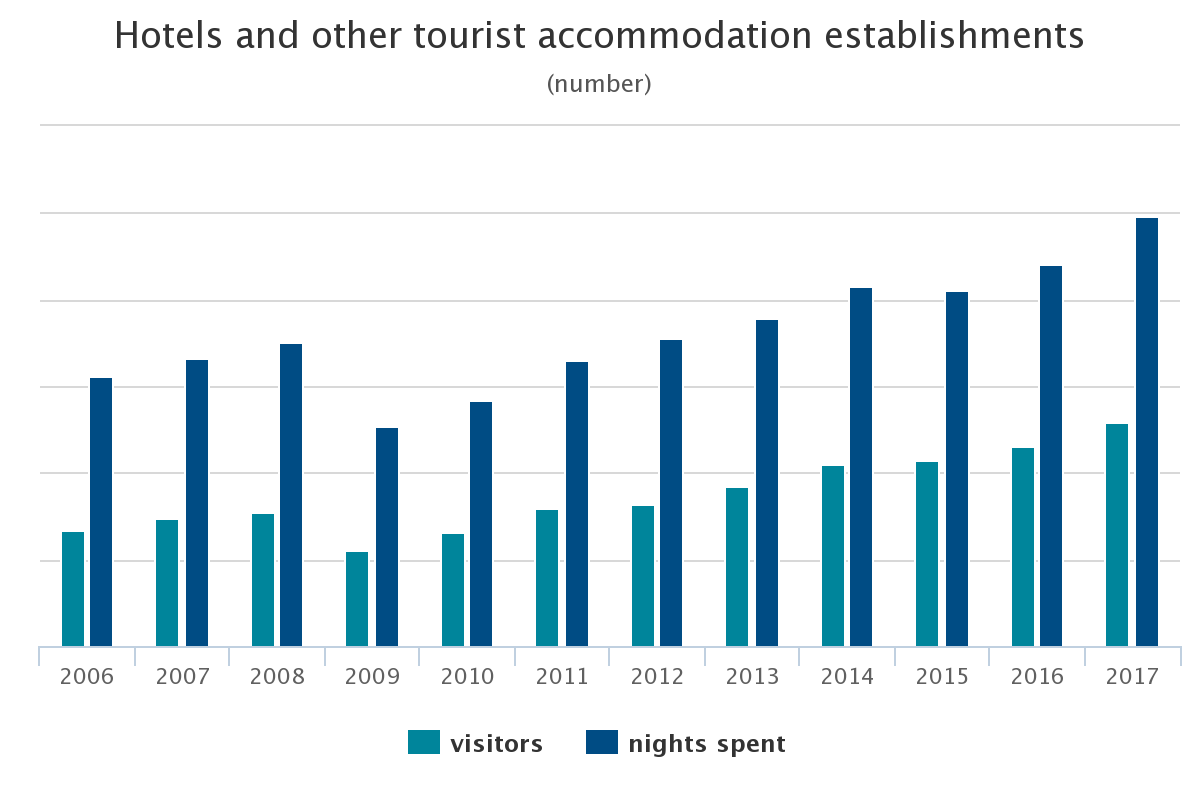

Tourism is undoubtedly a factor. In 2017, the number of visitors staying in Latvian tourist accommodation establishments accounted for 2.58 million, which is an increase of +11.9% compared to 2016. The number of foreign visitors amounted 1.78 million, which is +13.0% more than 2016.

CHART - Tourism is a key driver of Riga's growth, as the main gateway to Latvia and visitors staying in Latvian accommodation is rising Source: Central Statistical Bureau of Latvia

Source: Central Statistical Bureau of Latvia

Data from the Central Statistical Bureau of Latvia shows just over a third (34.9%) or 620,600 of foreign visitors were from the neighbouring countries - Russia (13.6%), Lithuania (10.2%), Estonia (9.1%) and Belarus (2.1%). However, Germany (241,000), Finland (114,900), and the UK (95,400) were well represented, and significant increases were recorded from Canada (+490%), Israel (+41.8%), Denmark (+16.6%), Austria (+15.7%), and France (+15.6%). The largest number of foreign visitors actually stayed in Riga itself (78.2 %).

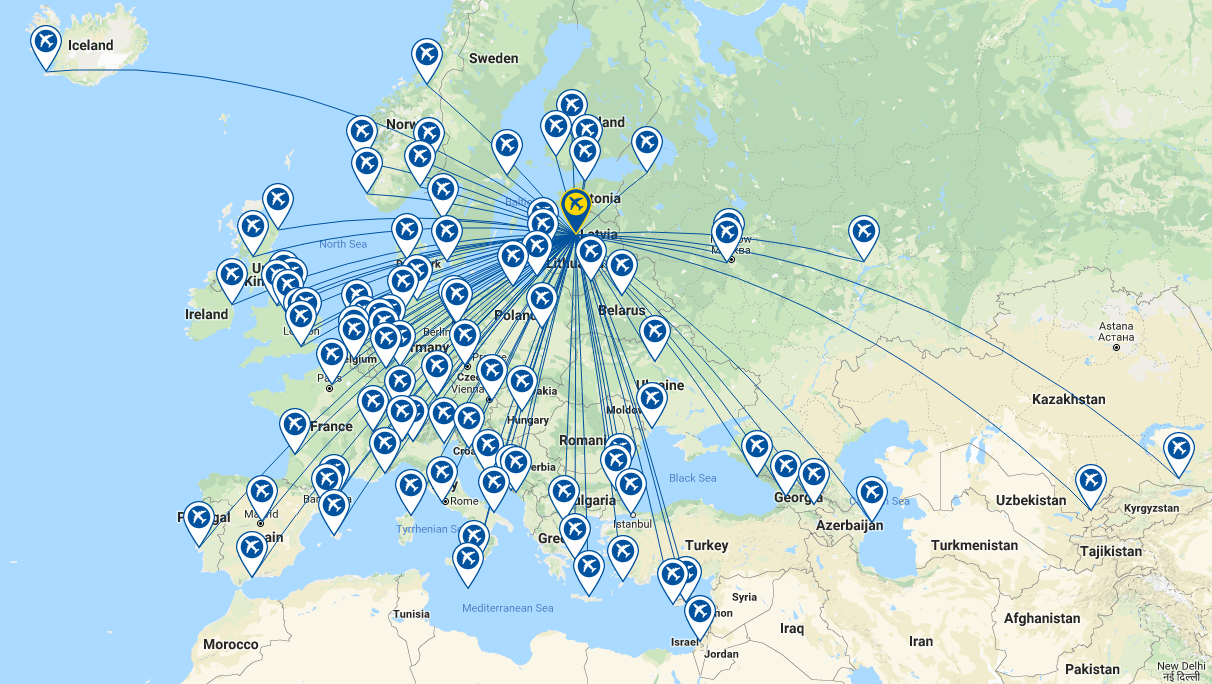

These statistics are reflected in the provision of aircraft seat capacity. All of it is within Europe, and to a much lesser degree the Middle East and West Asia. There are no transatlantic, South and Southeast Asia or African services. The huge growth in visitors from Canada suggests that market may be worth investigation.

MAP - The Riga International Airport is dominated by European routes, but also extends from Iceland in the northwest, Israel to the south and Kazakhstan and Uzbekistan to the east Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Another factor is the revival of the economy. Latvia's economy experienced GDP growth of more than 10% per year during 2006-07, but entered a severe recession in 2008 amidst the slowing world economy. Triggered by the collapse of the second largest bank, GDP plunged by more than 14% in 2009 and, despite strong growth since 2011, the economy took until 2017 return to pre-crisis levels in real terms. Strong investment and consumption helped the economy grow by more than +4% in 2017. Latvia also joined the euro zone in 2014 and the OECD in 2016.

Riga is also acting increasingly as a transfer airport. Almost 30% of passengers transferred via Riga Airport in the period. London, Moscow and Helsinki were the most popular destinations in the first seven months of 2018. As domestic seats account for only 0.2% of the total that transfer activity was almost exclusively international.

Riga is fundamentally a low-cost airport, dominated by airBaltic, which is regarded by CAPA - Centre for Aviation as a hybrid LCC. Over 80% of Riga's seats are on budget airlines, 57.4% on airBaltic with Ryanair and Wizz Air the next two largest.

The volume of cargo serviced at Riga Airport has increased considerably - by almost +31%, reaching 16,300 tons.

The airport is fully owned by the Latvian government. There is no grinding shift towards privatisation by concession as there is in neighbouring Lithuania.

Riga maintains a steady leader position among the Baltic airports, handling a claimed 44% of the total number of passengers and 52% of the total cargo volumes.

But it should not sit on its laurels. Passenger numbers at Vilnius Airport in the Lithuanian capital grew by +14.3% in 2016 and by +31.6% in Jan to Jul-2018 though its runway was closed for repairs in the summer of 2017. Tallinn's Lennart Meri Airport in Estonia grew by +19.2% in 2017 and by +15.2% in Jan to Jul-2018.

The battle is still on to establish outright precedence in the Baltic States.