Summary:

- Isavia predicts a big fall in passengers in 2019 at Keflavik International Airport, the main gateway to Iceland;

- The woes of Icelandair and WOW air are mainly to blame, but there are serious tourist issues in Iceland as well;

- Eastern flights could be a new revenue stream but the first service to Delhi was recently suspended just a month after flights started.

The Icelandic national airport and air navigation service provider Isavia forecasts that passenger traffic at the main Keflavik International Airport will decline by 8.7% year-on-year to 8.9 million in calendar year 2019. Transit passengers are expected to decline by almost a fifth (18.7%) to 3.2 million, attributable to the decrease in both the number of destinations served and frequencies to selected destinations.

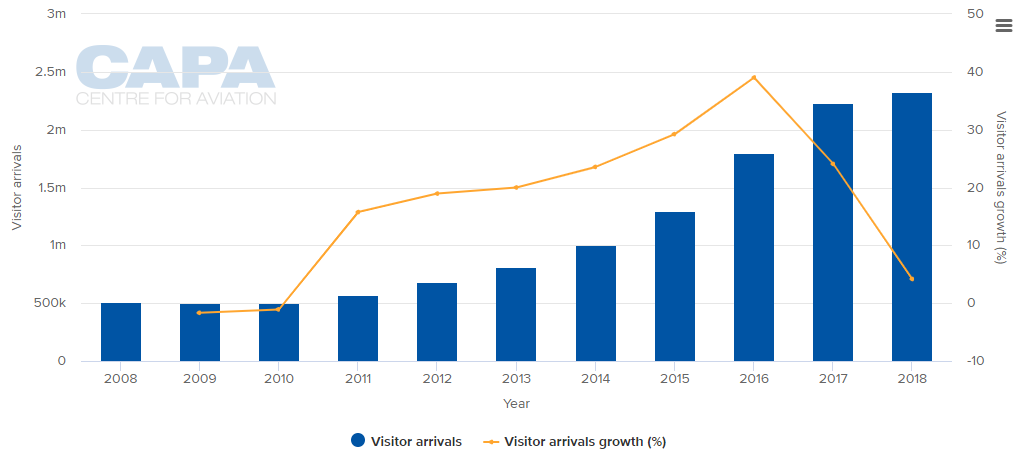

The question is, is this a long-term trend? Is Iceland's tourism bubble about to pop? That bubble is clear when you look at passenger traffic at Keflavik International Airport over the past ten years. Traffic 'growth' in 2009 was a negative -16.4%. In Oct-2008, a financial crisis began, brought about a collapse of the Icelandic banking sector and the value of the Icelandic króna dropped sharply. While it recovered somewhat, at a stroke it made tourist visits to the country far less expensive, but that message took a little time to get through.

Then in Apr-2010 a series of eruptions at the Eyjafjallajökull glacier caused huge disruption to air travel across western and northern Europe while causing little disruption in Iceland itself owing to the prevailing winds. By the time they concluded in Oct-2010 Iceland had been put firmly on the map as a tourist destination owing to the enormous media coverage the country received portraying its pristine, wild beauty.

CHART - These events helped put Iceland on the travel map - 2009 was the last year with a decline in passengers at Keflavik and the annual growth subsequently rose to a giddy 40.4% in 2016 Source: CAPA - Centre for Aviation and Reykjavik Keflavik International Airport reports

Source: CAPA - Centre for Aviation and Reykjavik Keflavik International Airport reports

Icelandair, the national carrier even though it is privately owned and publicly traded through the Icelandair Group, had previously been almost wholly responsible for developing tourism in Iceland, with sub divisions operating hotels, tour companies, ground transport and car rental services.

It had long since established the 'stopover' vacation, offering 1-3 night inclusive stays to transatlantic passengers between Europe and North America, with no addition to the airfare and with inclusive packages available including transfers, accommodation and half-day and full day tours, some of which ended at Keflavik Airport ready for the afternoon wave of departures to North America.

SEE RELATED REPORT: Selling the merits of a stopover - more and more countries are now seeing the value

In the light of the sudden increase in visitors the infrastructure had to catch up fast and new hotels were rapidly built, residents joined the accommodation-sharing boom, surface tourism companies multiplied and a new airline, WOW air, the brainchild of Serial entrepreneur Skuli Mogensen, emerged out of the remnants of Iceland Express in 2012/13, undercutting Icelandair by flying out of European secondary tier airports.

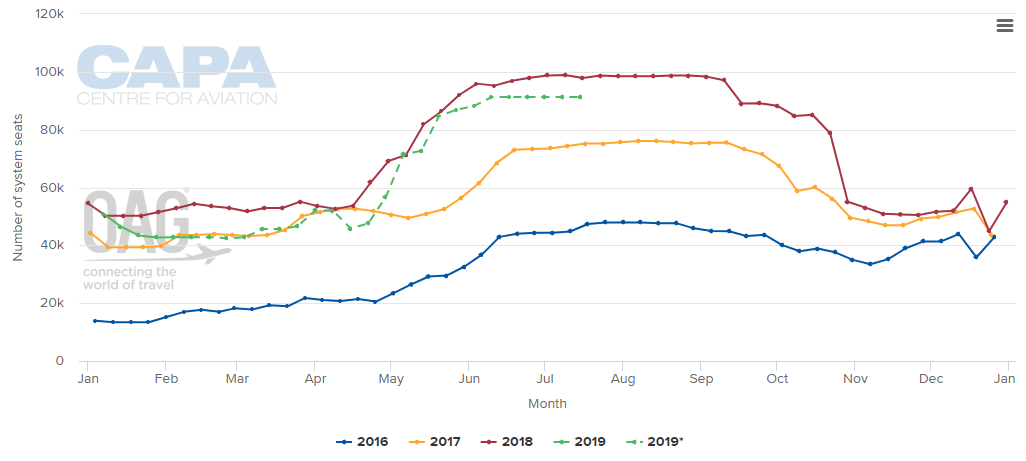

In 2015, and just as Norwegian had done in Norway from 2013, WOW air went intercontinental with flights to the US and Canada, challenging Icelandair with the same basket of low(er) fares, supporting divisions and stopover packages. Its annual passenger capacity more than doubled in 2016 and then increased by 73% in 2017.

CHART - WOW air grew rapidly and supported Iceland's tourism boom, but this rate has proved unsustainable and seen the airline now shrink CAPA - Centre for Aviation and OAG (Note: 2019 schedules are are at least partly predictive up to 6 months ahead)

CAPA - Centre for Aviation and OAG (Note: 2019 schedules are are at least partly predictive up to 6 months ahead)

But that is where it started to go wrong, and for a variety of reasons. Firstly, Icelandair and WOW air started to compete, where they had previously (within Europe) avoided each other, even flying to the same cities in the US. The search for new routes became desperate and some were taken on that were never going to be sustainable. (Again, a parallel might be drawn with SAS and Norwegian Air).

Things got so bad that in Nov-2018, WOW air announced it would merge with Icelandair with the airlines operating as separate brands, but just over three weeks later Icelandair abandoned the plan. Subsequently, Indigo Partners, which has stakes in other low-cost carriers, reached a preliminary agreement to buy 49% of WOW air on condition of the cancellation of routes, aircraft orders and lease deals, an attempt at sale-and lease back of aircraft, and a wholesale reduction of staff numbers.

Icelandair also began to adjust its business planning, suspending routes. Both carriers were impacted by the rise in the price of oil in 2018 and both reported heavy losses during 2018. Of course many other carriers now operate into Keflavik, from Europe and North America but this week's schedules (w'c 11-Feb-2019) show Icelandair and WOW air still jointly account for over 82% of capacity. On that basis, Isavia's forecasts begin to make sense.

But there are other reasons for Isavia to fear 2019. When the merger between Icelandair and WOW air was announced The Blue Swan Daily speculated on the outcome highlighting a lack of accommodation in some parts of the country and overcrowding at the main tourist sites, which is contrary to the Icelandic ethos of environmentalism, among the concerns. Critically, visitor costs have started to rise again. While the value of the króna has depreciated on occasions during 2017 and 2018 a recurring high exchange rate has led to tourists taking shorter trips.

https://corporatetravelcommunity.com/the-icelandair-and-wow-air-merger-could-have-a-big-impact-on-keflavik-airport/

Setting aside these issues within the country one possible saviour could be visitors from the east. That after all is where the increases are coming from, albeit from a small base. In 2018, while visitors from the UK declined by 7.6% and from Sweden by 12.3%, those from China increased by 4.1% with a big surge in December.

But such eastern routes would lack sixth freedom potential and the seamless North America - Europe rotations cannot be replicated on a Europe-Asia basis. WOW air commenced a Delhi-Keflavik service with onward connections to the U.S. on 06-Dec-2018 and suspended it on 20-Jan-2019 owing to its own troubles.