Summary:

- Malaysia will introduce the world's first Real Estate Investment Trust for airports, moving emphasis for airport financing and development to a user-funding model;

- Financial sector reaction has been mixed; analysts predict a neutral outcome for MAHB but it is a venture into unknown territory;

- In a separate development overseas travellers in Malaysia will have to pay a levy from next summer on top of current service charges.

This would mark a notable change in system from one of government-supported expenditure to that of a user-funding model. Mr Eng reported the REIT will be established once the government finalises a new regulated asset base and user fees structure for airports. It will be a form of asset securitisation.

A REIT is an entity, usually a company, which owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, including offices, shopping centres, hotels, factories, apartment blocks and hospitals, and some engage in financing real estate.

REITs can be publicly traded on major exchanges, public but non-listed, or private. The two main types of REITs are equity REITs and mortgage REITs (mREITs) In Nov-2014, equity REITs were recognised as a distinct asset class in the Global Industry Classification Standard by S&P Dow Jones Indices and MSCI.

As of Jul-2017 there were 18 REITs in Malaysia and the total asset value (Dec-2016) was MYR48.8 billion (USD11.7 billion). But REITs are fairly rare in the airport sector though, anywhere. One was considered for the expansion of Hong Kong International Airport around a decade ago and following President Trump's 'Infrastructure Plan' in the US earlier in 2018 there was speculation that one or more might be set up there, so that more companies could own airport terminals and lease them back on a long-term basis.

For now this Malaysian REIT is believed to be the world's first airport Trust and its purpose is to shift the aviation industry towards a self-sustainable model that does not have to depend on the government's expenditure for future upgrades and expansion.

The administration of airport-related affairs in Malaysia has it that the government owns all the physical assets of airports in the country, taking money from a federal pool to finance airport infrastructure, while MAHB is the concessionaire that operates and manages the airports, until 2035.

While neighbouring countries such as The Philippines, Indonesia and Vietnam are actively seeking foreign private corporate investment through concessions and leases there has not been the same commitment in Malaysia.

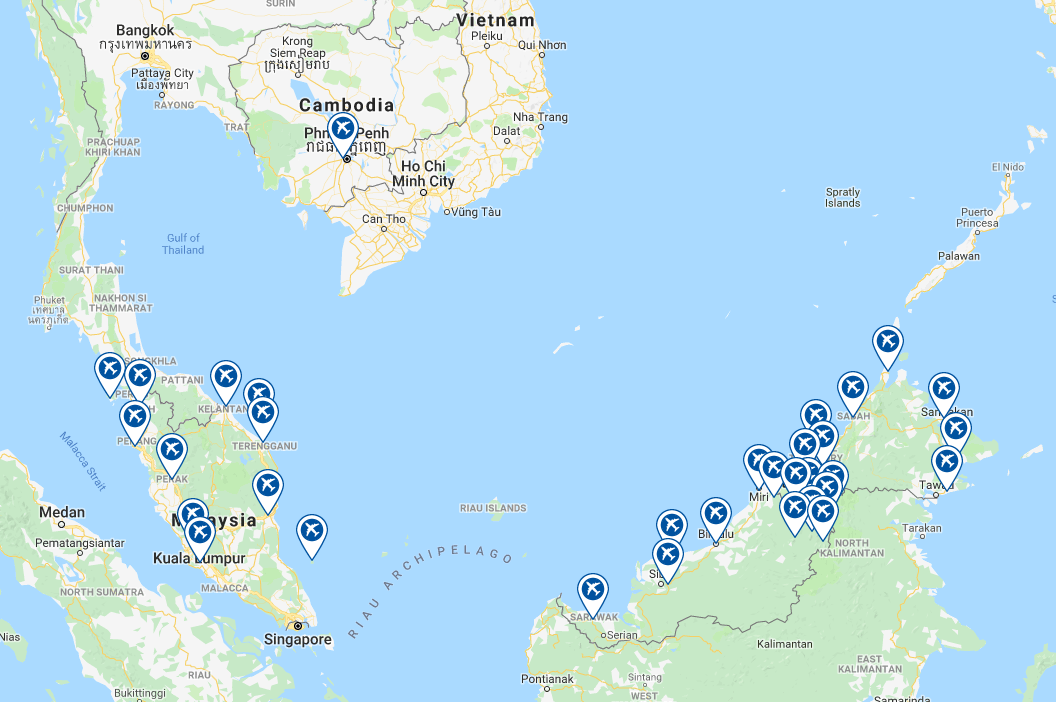

MAP - The Malaysia Airports Holdings Berhad (MAHB) portfolio has a local focus, but also includes the airports of Istanbul Sabiha Gokcen in Turkey and Delhi Indira Gandhi International in India Source: CAPA - Centre for Aviation

Source: CAPA - Centre for Aviation

In the wake of the announcement shares in MAHB lost as much as 12%. There is no immediate impact on MAHB however, as the only change is to the recipient of the MAHB user fees once the REIT is established. The REIT will not benefit MAHB's shareholders, but neither will it change the economic value of MAHB in any way. Indeed, local analysts believe the government's proposed REIT may be "neutral" for MAHB in the near term.

Through the REIT, funds generated would in theory be channelled back for the development of the aviation industry in general. The immediate stock market reaction, that funds could be used to support other aspects of the aviation business apart from airports and the fact that this is the first serious attempt to establish an airport REIT, anywhere, suggests a different story. Time will tell.

In a separate, but connected, development the government will impose a levy for all passengers travelling overseas by air, starting on 01-Jun-2019 - MYR20 (USD4.8) for passengers travelling to ASEAN member countries and MYR40 (USD9.6) for other countries. This will raise the overall cost of international travel for air passengers, as the current passenger service charge is MYR35 and MYR73, respectively.

Collectively these increases and the high cost of processing visas is causing concern as Malaysia is fast becoming an expensive tourist destination.