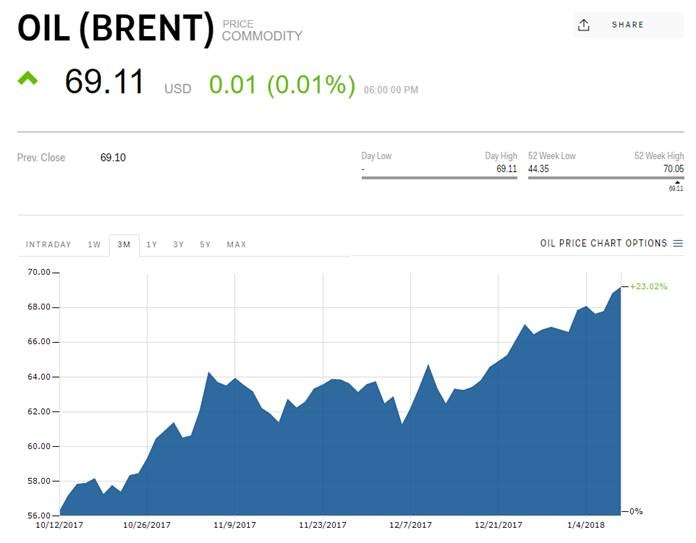

With the price of a barrel of Brent Crude oil now nudging USD70, it's a far cry from the halcyon days of last year, when it fell below USD30. All that might explain why Qantas' share price has slid so rapidly over the past three months. From an all-time high of AUD6.45 on 24-Oct-2017, it closed last night, 11-Jan-2018, at AUD4.89, a 25% fall.

QF share price, 3 months to 12-Jan-2018

Source: Business Insiders

Source: Business Insiders

That's a quick and comfortable conclusion. But there are a few reasons why it could be the wrong one.

First of all, a quick check of airline share prices around the world shows nothing like a similar trend. In fact, most are trading quite steadily and, for example AirAsia - as an LCC, much more affected by fuel prices - has climbed quite steeply recently. At home, tightly held Virgin Australia is seemingly unaffected and Air New Zealand, while its price has dropped a few percentage points recently, is remaining pretty steady.

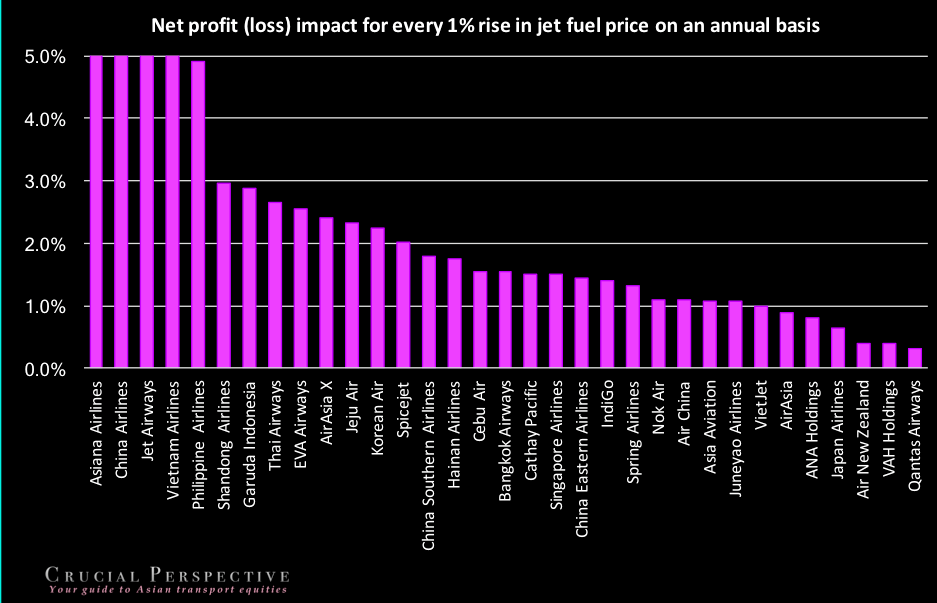

Secondly, Qantas is in fact quite well hedged against increasing fuel costs. A recent analysis by Crucial Perspective suggested that, of all airlines in this region, Qantas is the least affected by rising fuel input costs:

Source: Crucial Perspective

Source: Crucial Perspective

Then there's the matter of oil prices being quoted in USD. So, if the American currency rises strongly against the AUD, Qantas' input costs go up. Now, in fact, the AUD has strengthened against its weakening US counterpart - actually softening the impact of the oil price rise.

(Oil isn't the only input cost that is affected by the AUD-USD rate: around 50% of all financing costs are affected by the level of the USD. In other words, the stronger Aussie dollar should reduce these other costs.)

Undoubtedly higher oil prices are not welcome. But if that isn't a problem for other airlines - when Qantas is in fact better insured against rising costs - what the issue?

Perhaps it's market concerns on the revenue side. Qantas did certainly hit its peak when it reported another very strong profit for FY2017, so the downside was arguably going to be more attractive than the upside.

Qantas generates the great bulk of its profits in the domestic market, so perhaps investors are anticipating uncertainty at home? But here again there are few indicators that suggest a sudden decline in demand or profitability. Nor is Virgin expected to rebound rapidly from its recent quiet period, to trouble its much bigger rival.

Is international causing the shyness?

Internationally things are however changing. There's a new relationship with Emirates, its vital partner, as Qantas pulls out of the Dubai route to Europe and reroutes through Singapore. At the same time, the new Perth-London non-stop commences. There might be some investor concern at a "weakened" Emirates partnership, although both partners staunchly deny this and ensures that the codeshares are still firmly in place.

The new Perth non-stop doesn't seem to be commanding a premium against one-stop routings at this stage (in fact it's selling at a small discount on Qantas' own site), which is a bit of a concern, but that might build up. There's a slight bias towards a greater premium mix on the new 787-9, though not enough to make a massive difference. But it wouldn't have any major negative network impact, despite the hype around it.

And then there is the outstanding issue of an expanded partnership with American on the highly lucrative Pacific, where a 15 hour flight sells at a considerable premium to the 23 hour London service. The US authorities rejected the application first time round, exposing Qantas to greater competition; the parties hope it will be approved on reconsideration, although that is far from certain.

Asian route expansion, with the new Qantas operation via Singapore in 4QFY2018, is going to require some investment before it shows positive ROI, but all in all, that doesn't justify major concerns.

Meanwhile, Jetstar is still going gangbusters by all accounts, so that doesn't seem to be a problem either.

In conclusion, scratching around for the cause of Qantas' price decline, one concern might be the Europe market, where there's a lot of capacity and prices do seem to be bumping along the bottom, to put it mildly.

Overall though, the cause could simply be the Icarus effect; that investors saw too much downside once the share price soared into the mid-AUD6s.