Summary:

- Engine manufacturer Rolls-Royce makes most of its money not from the sale of new engines but from engine aftermarket support.

- Aftermarket engine support programmes remove risk of uncertainty to airlines with a set rate of charges.

- New MRO Database from CAPA - Centre for Aviation tracks tracks contracts and opportunities across the maintenance, repair and overhaul (MRO) sector.

In fact a model like this is already deployed in the wider aerospace industry, for example engine manufacturers already makes most of its profit not from selling engines, but from supporting them. While the aerospace world still has aircraft output as its core function, it is having to change its business approach and as much the highly discussed "disruption" is used with airlines, it also applies to aerospace suppliers, which ultimately results in further impacts on airlines.

In a recent Insights analysis, 'Aerospace disruption: China's new role, new revenue streams, MRO, final assembly lines, services', CAPA - Centre for Aviation highlights how aircraft manufacturers are moving down a similar path and looking to grow revenue from services and support, but it is the propulsion market that highlights this the strongest with newer engines effectively sold at cost, with profit made through services.

"As part of this change, services are being redefined," explains CAPA. "Typically, airlines used to pay for engine maintenance as needed, but now - such as with the Rolls-Royce Trent XWB for the Airbus A350 programme - airlines pay a set rate for maintenance based on engine usage, and not how much maintenance, small or big (or overhaul/replacement), is needed."

For airlines and investors, this means more upfront costs as the engines have higher initial maintenance costs but then, later in life, less dramatic cost spikes. This shift is partially a response to some widebody programmes (Boeing 777-200LR/300ER, 777X and A350) having a sole engine supplier.

The sole engine supplier status delivers volumes, and arguably has facilitated closer collaboration, resulting in enhancement to engines - and consequently boosting the overall aircraft programme. However, a downside from the producer's standpoint, is less opportunity to negotiate on price with the airline customer and perhaps highlights how the model has evolved so quickly.

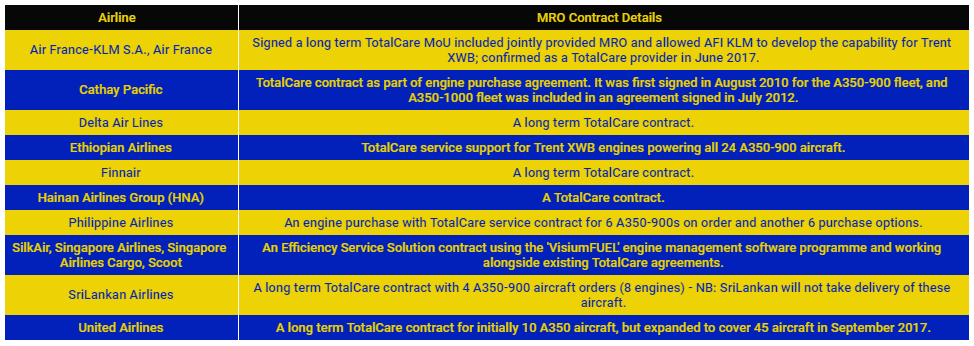

The following extract from the CAPA MRO Database, which covers tracks contracts and opportunities across the maintenance, repair and overhaul (MRO) sector, highlights the strong customer base Rolls Royce has secured with its TotalCare product on the Trent XWB engines that exclusively power the A350.

CHART - Rolls-Royce has notable TotalCare support contracts for the Trent XWB engines that power Airbus A350 aircraft with operators across the globe Source: The Blue Swan Daily and CAPA - Centre for Aviation MRO Database

Source: The Blue Swan Daily and CAPA - Centre for Aviation MRO Database

The sixth generation powerplant, the XWB delivers a 15% fuel consumption advantage over the original Trent engine, it hits current and future emissions and noise targets and naturally airlines want to keep them efficient and operational. And while some airlines and third parties will receive support from their related MRO companies, an aftermarket support package like TotalCare takes a lot of the risk out of the equation.

Rolls-Royce says its TotalCare offering transfers both time-on-wing and shop visit cost risks back to the OEM. "TotalCare is much more than just an engine maintenance plan. It is a service concept based upon predictability and reliability," it explains, and covers predictive maintenance planning, work scope creation and management plus off-wing repair and overhaul activities.