Perth Airport CEO Kevin Brown has confirmed that negotiations are continuing with airlines to launch direct services to Japan - specifically, to Tokyo.

The Blue Swan Daily understands the airport is also interested in potential new routes to China and India. Mr Brown believes "there's lots of opportunities there, and direct flights create a stimulus in the market, maybe by 40-50%, just because it's easier for people to jump on those routes". He concedes, however, that a potential Japanese route would be more likely for launch in 2019 than in 2018.

In terms of direct capacity between Australia and Japan, only 6000 seats have been added since mid-2011. Just four airlines operate between the countries.

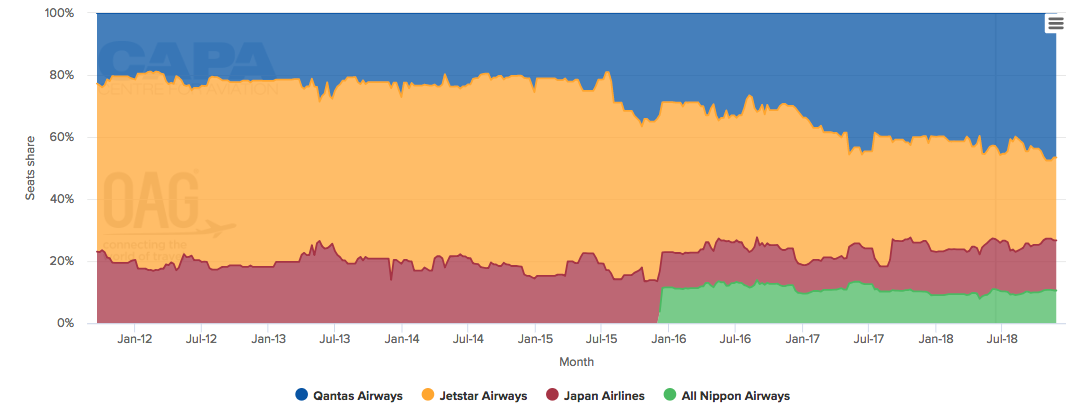

The market was generally dominated by Jetstar Airways, however more recently the Qantas Group has chosen to shift capacity more to its mainline operations. For the week commencing 18-Jun-2018, Qantas will offer almost 7000 seats between Australia and Japan, accounting for 44% of the total market of 16,000 seats:

Australia-Japan capacity share from 2012 to Jul-2018

Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Perth Airport's route development negotiations do not include Qantas, according to local media, and are instead being held with Japan Airlines (JAL) and All Nippon Airways (ANA). JAL serves both Melbourne and Sydney from its Tokyo Narita hub, and ANA operates from Tokyo Haneda to Sydney.

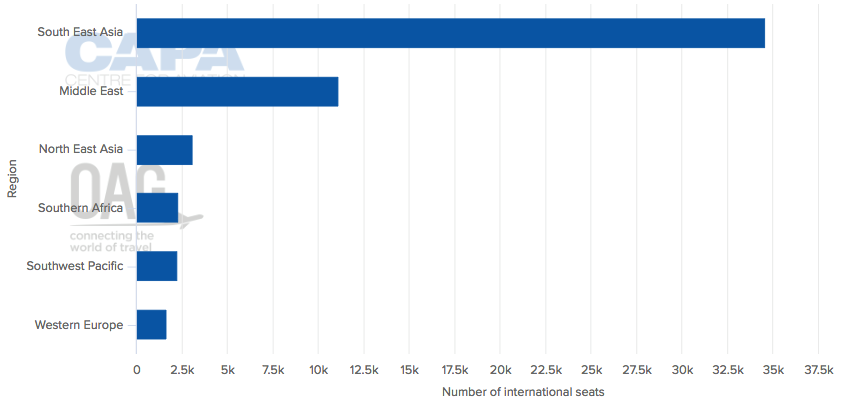

A direct route to Japan is the first step for Perth Airport to capitalise on a growing North Asian aviation market. The facility already has a strong capacity offering to Southeast Asia, however it only serves two destinations in North Asia: Guangzhou and Hong Kong.

As a result, Perth Airport's international departing seats are heavily skewed towards Southeast Asia, with approximately 34,500 seats offered on a weekly basis. Seats to North East Asia total just 3000:

Perth Airport international departing seats by region: w/c 11-Jun-2018

Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

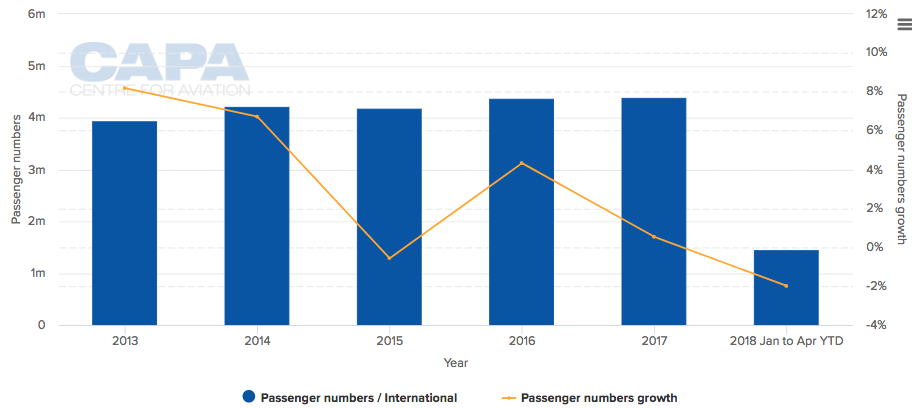

Perth Airport's route development target for North Asia reflects the need to diversify operations, with the airport having experienced consecutive yearly traffic regression since 2014.

The declines are relatively marginal, with the steepest being a 2.2% decline incurred in 2015. However, an assessment of Perth Airport's international traffic paints a different picture - with there having been traffic growth in the past three of four years. The airport's traffic decline originates from a stagnating domestic market, and Perth Airport has steered growth toward international services to compensate:

Perth Airport international traffic has increased in three of the past four years

Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Who would operate a new Perth-Tokyo service?

With the Perth-Japan route more likely for a 2019 or even 2020 launch, a service by JAL or ANA may not be what Perth Airport is really targeting. As noted above, Jetstar has reduced its capacity between Australia and Japan for Qantas to expand, meaning more premium seats are available at the same time as low cost seats have declined.

Interestingly, JAL has recently announced plans to launch a new low cost long haul subsidiary, which would operate with high-density Boeing 787-8 aircraft.

JAL strategy development Vice President Hiroyuki Uehara, speaking at the CAPA LCCs in North Asia Summit on 12-Jul-2018, said destinations to be served by the new unnamed carrier could include "everything in range of the 787-8". JAL is in talks with Boeing about possibly converting some of its existing 787s specifically for its low cost unit, or ordering new aircraft, with a decision expected in approximately 12 months. Two 787s would be added every year after the carrier launches in 2020.

This firmly places Perth as a potential target for the new low cost long haul operator. Perth Airport would also be the beneficiary of more low cost capacity, which currently only accounts for 23.1% of the airport's international seat count.

To find out more, join us at the 2018 CAPA Perth Aviation & Corporate Travel Summit. Register here.