Central and Eastern European LCC Wizz Air is among those that have been quick out of the blocks, not just relaunching a limited schedule, but also expanding its network to take advantage of new market opportunities. It is not alone, network development discussions are regularly taking place between airlines and airports. While schedules may look very different from the days before the latest coronavirus spread and there will be some big losers, that doesn't mean some markets will not gain.

For example, Virgin Atlantic is shutting down its London Gatwick operation (at least temporarily, it claims, as it seeks to keep hold of valuable slots) and British Airways could follow. Maybe bad news for the airport and local passengers, but Virgin Atlantic's suggestion that it will move services to Heathrow could mean that Orlando may gain a long-cherished link to the UK's main gateway.

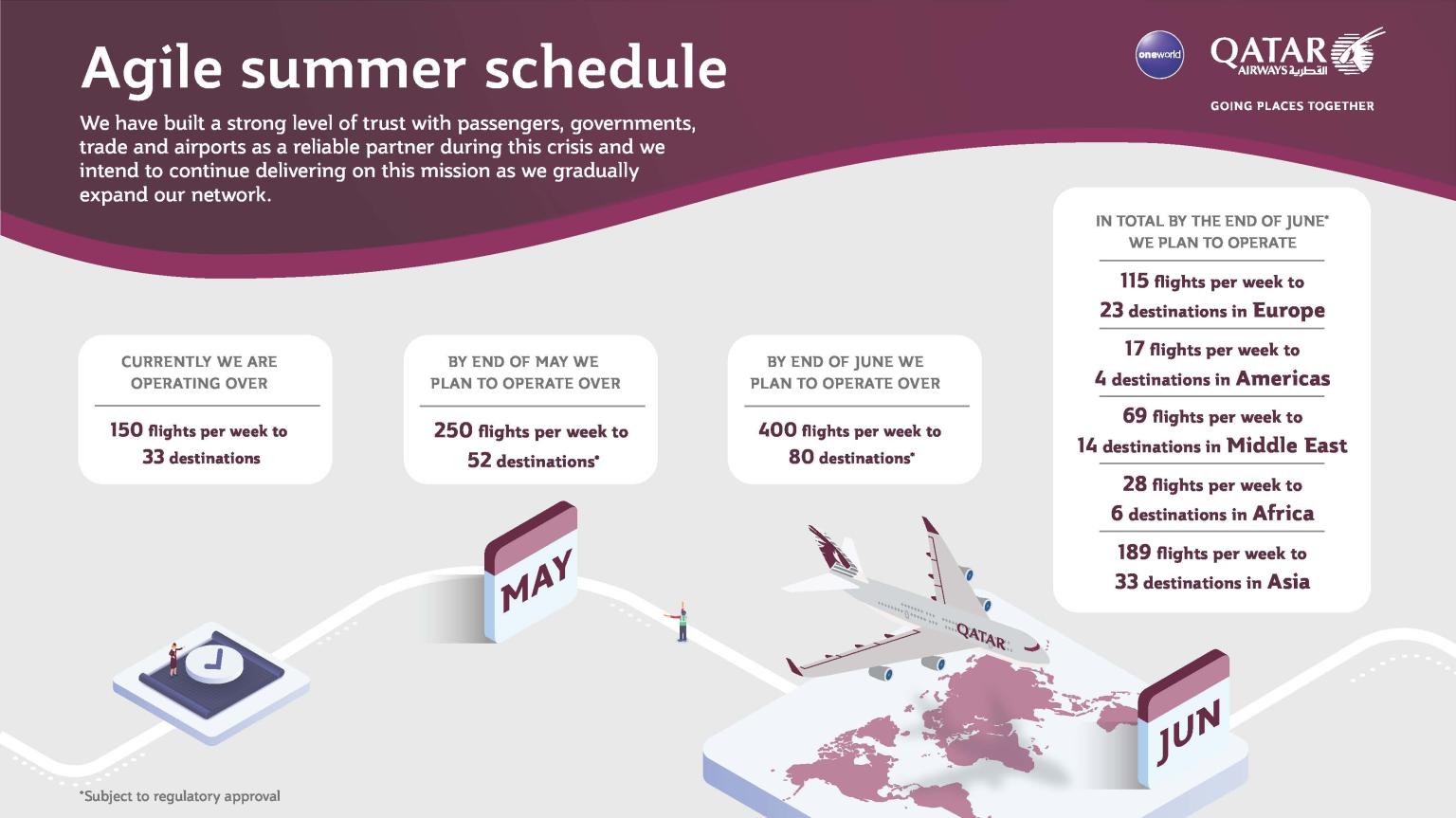

Qatar Airways revealed this week that it plans to begin a phased approach to the expansion of its network in line with passenger demand and the expected relaxation of entry restrictions globally. The airline will increase its interim network from 30 destinations to 52 destinations by the end of May-2020, resuming services to cities such as Manilla, Amman and Nairobi.

By the end of Jun-2020 and subject to regulatory approval, the carrier aims to increase to 80 destinations including 23 in Europe, four in the Americas, 20 in Middle East/Africa and 33 in Asia Pacific. The gradual expansion will focus initially on strengthening connections between Qatar Airways' hub in Doha with global hubs of partner airlines including London, Chicago, Dallas and Hong Kong, along with reopening a number of business and leisure destinations such as Madrid and Mumbai.

Similarly, International Airlines Group (IAG), parent of British Airways, Iberia and Aer Lingus, has suggested a "meaningful" return to operations from Jul-2020. Its CEO Willie Walsh, whose retirement has now been delayed from Jun-2020 to Sep-2020 said: "We are planning for a meaningful return to service in Jul-2020 at the earliest, depending on the easing of lockdowns and travel restrictions around the world." However, he warns that IAG does "not expect passenger demand to recover to the level of 2019 before 2023 at the earliest".

These airlines are not alone, but right now they are the exception rather than the rule and the big question remains if there is genuine demand to fill resumed routes.

Latest surveys appear contradictory, but that is statistics for you. One may say there is an increase in sentiment to travel, another the same day may highlight that people are too scared to leave their homes. What is certain is there are numerous businesses across the world - beyond just those directly involved in the travel and hospitality industries - whose survival hangs on the recovery of air transport and that is both for corporate and leisure travel.

For example, while Spain may be relaxing its restrictions many hoteliers have warned they will struggle to open without essential flows of visitors from the United Kingdom. Just like with air services it takes two to tango and the recovery of local industry can be reliant upon the freedom of movements from abroad. Until then adaptability is key and finding new ways to do business.

A couple of recent surveys on UK travellers share some similar positive sentiments and that is encouraging. An Advantage Travel Partnership's survey suggests that a significant 86% of British consumers are willing to travel abroad despite the presence of Covid-19. Notably, more than three quarters say holiday budgets for the next 12 months will either remain unchanged or increase with those aged under 30 at least twice as likely as any other age group to increase their holiday budget.

Similarly, Overseas Leisure Group, a luxury travel operator in 34 countries across the globe, has shown a pent-up demand for hotels and resorts to open their doors in time for the summer holiday season as its own survey of UK consumers revealed a series of positive trends in tourism for the immediate future and remainder of the year.

Despite concerns over the continued spread of Covid-19 and a potential second wave of infections its results show four in five (80%) British travellers are already making plans for their next holiday and more than a third (41%) would happily consider a holiday as early as this summer.

Almost nine in ten (87%) consider the travel market to be on pause rather than permanently transformed and four in ten (42%) even said they are ready to make a reservation now if it was risk free (no deposit or cancellation fee). More than nine in ten (91%) say they would happily journey by air for their next holiday.

Encouraging? Yes! But, we must remember there are "lies, damned lies, and statistics", a phrase regularly touted to describe the persuasive power of numbers, particularly the use of statistics to bolster weak arguments. We will only fully understand if the demand is there once markets start to open. It remains a classic chicken and egg situation, even if the sentiment appears to be there from each side.