Summary:

- As Airbnb celebrates ten years of operation its rapid growth is slowing due to increasing competition and concerns over safety and security, claims a new study by eMarketer;

- eMarketer has lowered its projections for Airbnb usage, and now expects the home sharing site to add just 6.1 million users by YE2021;

- The plateauing of Airbnb's growth is occurring as the company aims to broaden its reach among corporate travellers - it aims to double its business passenger customer base from 15% to 30% by 2020;

- Safety and liability remain concerns for business travel managers with GBTA research highlighting 61% of travel professionals are concerned about the inability to collect traveller information from home share bookings.

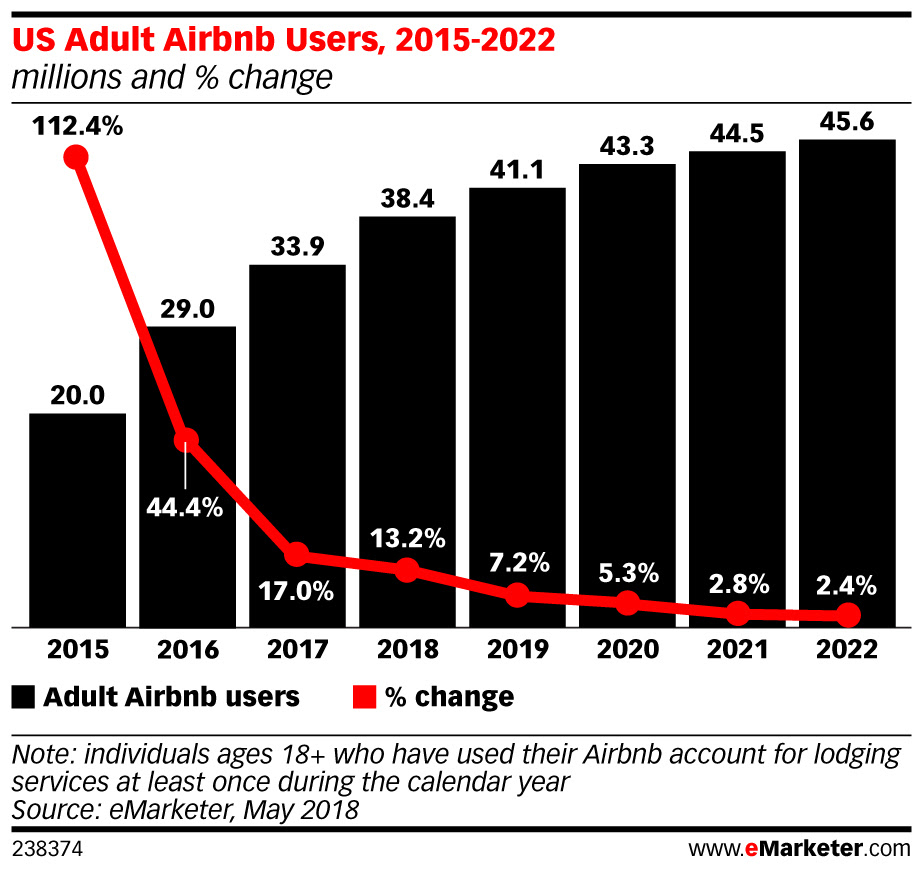

eMarketer has lowered its projections for Airbnb usage, and now expects the home sharing site to add just 6.1 million users by YE2021 versus previous projections of 17.6 million. During 2018 Airbnb's user base should grow 13% year-on-year to 38.4 million; however, eMarketer had previously forecast user levels would reach 43.2 million this year.

"Airbnb saw healthy growth in its infancy because it was often more affordable than hotels," said eMarketer forecasting analyst Jaimie Chung. "However, user growth is plateauing as competition from online travel agents like Expedia and Travelocity grows. Travellers also have lingering concerns about security and privacy following several high-profile incidents."

The plateauing of Airbnb's growth is occurring as the company aims to broaden its reach among corporate travellers, and its executives have stated work is underway to address duty of care concerns. During 2017 Airbnb said it aimed to double its business passenger customer base from 15% to 30% by 2020.

But clearly safety and liability remain concerns for business travel managers. According to research conducted by GBTA, 61% of travel professionals are concerned about the inability to collect traveller information from home share bookings. If those home sharing options were integrated into GDS systems, 52% of travel managers said that would increase the likelihood of including these options in their travel policies.

eMarketer, meanwhile, expects Airbnb to focus on mobile engagement by both new and current users as it taps artificial intelligence and virtual reality to create a more robust app. "The likely goal is to capture more of the 54.3% of smartphone users who research travel or the 31.6% who book trips via smartphones," eMarketer said.