In a recent report tracking corporate spend on ride hailing services in its systems, travel expense software company Certify concluded although Uber continues to dominate its rivals in the corporate market, its share during 3Q2017 fell for the first time since Certify began tracking ride sharing data.

Uber's share notched down 1% to 54%, while Lyft grew its share by 3% to account for 11% of all rides in Certify's ground transportation category. It was the largest quarter-to-quarter gain for Lyft since its inclusion in Certify's regular quarterly reports.

Certify's data show Lyft had a lower average cost and higher rating than both Uber and taxis. Uber's average costs were USD6.53 higher than Lyft's and traditional taxi rides were cost an average USD10.32 more than Lyft.

CHART - The Certify data snapshot shows that overall ride costs have declined slightly with only Uber seeing a small average fare increase

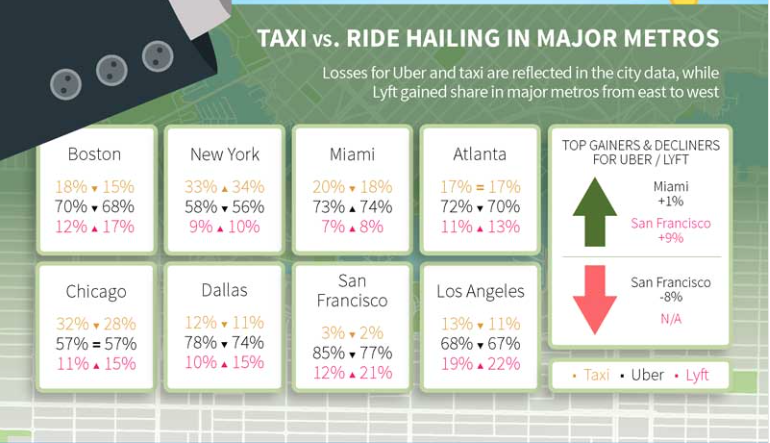

Lyft continues to gain traction in many major US metro markets, holding the largest shares in Los Angeles and San Francisco at 22% and 21%, respectively.

Recently, Lyft took an important step in broadening its reach among corporate travellers by forging a new partnership with Carlson Wagonlit Travel (CWT). The agreement delivers on-demand ground transportation travel to CWT's business travellers in the US.

During May-2017, Lyft debuted a new portal, Lyft for Business, which allows for the management of ride and expense permissions for individual team members, offers both scheduled and on-demand rides for business travellers and has an option for companies to create an account where all team members can bill their rides directly.

As Lyft continues to build its traction among corporate travellers and ride hailing overall continues to grow, "car rentals and taxi services have felt the sting of the hyper-competitive market", said Certify.

During 3Q2017, both taxi and car rental lost another percentage point to fall to 7% and 28% of all rides, respectively, according to Certify's analysis of its transaction data.

"Ultimately, business travellers now have more control and choice than ever before, and traditional services such as taxi and car rental will continue to face pressures in this evolving market because of it," Certify concluded.

While Uber's share fell slightly in Certify's 3Q2017 analysis, the ride sharing company "remains the number one vendor in business travel ground transportation and the most expensed brand of any category in the Certify system", the company concluded. "More than double second place Starbucks as a share of transactions".

CHART - The impact of ride hailing apps on traditional taxi usage is differing significantly across major metro areas in the United States of America

Looking more closely at the aviation sector and the growth of Uber and Lyft is having a direct impact on airport's and the cash tap that is airport parking and car rental. Data from the US Federal Aviation Administration shows that USD4 billion in fees were collected by airports last year for parking. Ground transportation income represented over 40% of the USD9.6 billion in airport revenue from sources other than airline fees with funds collected from rental car companies adding almost USD1.8 billion to that total.

CAPA - Centre for Aviation last year completed an in-depth report on Transportation Network Companies (TNCs), their modus operandi and how they are evolving globally - especially in their relations with the airport sector.

READ: AIRPORTS AND UBER: Transportation Network Companies now more welcome at airport