Summary:

- Mexico's Grupo Aeroportuario del Pacifico (GAP) has been selected as the provisional preferred bidder to operate Kingston Norman Manley International Airport (KNMIA);

- GAP is already is the biggest company in the consortium running the rival Sangster International Airport at Montego Bay, on the other side of Jamaica;

- The island's airport infrastructure has been set up for the two airports to compete against each other and now they will do so under the same management;

- Despite concessions made to the concessionaire it has a job on to grow traffic at Kingston Airport while possibly cannibalising its own existing business.

GAP was not an original consortium member there. They were: YVR Airport Services (now Vantage Airports Group) (Canada); Agunsa (Chile); Ashtrom (Israel); and Dragados (Spain). Subsequently, shares in MBJ Airports Limited were transferred to two key principals: Spain's Abertis infraestructuras SA and what became Vantage Airports Group. Then Abertis exited the airports business and GAP, by way of acquiring 100% of Desarrollo de Concesiones Aeroportuarias, which was held in its totality by Abertis and which held a 74.5% stake in MBJ Airports, became the senior partner there, in 2015.

This is important for two reasons. Firstly, GAP said immediately that it would invest USD35 million in Sangster International Airport over the next five years through modernisation projects. Moreover, when the second procedure to privatise KNMIA was initiated at the end of 2016 (the first having failed) a great deal of emphasis was put on how traffic could be won at KNMIA from Montego Bay when the Jamaican capital does not have anything like the same touristic attractions.

In other words they were being set up to compete against each other and now they will do so under the same management if and when GAP's bid is confirmed (probably in Nov-2018). A little like London Heathrow and Gatwick airports, or Madrid and Barcelona or Frankfurt and Munich, or even New York JFK and Boston Logan competing against each other but under the same foreign concessionaire.

KNMIA is owned by the Airports Authority of Jamaica (AAJ) and is currently operated by NMIA Airports Ltd, a wholly-owned subsidiary. It is located close to the country's main sea port and handles mainly VFR traffic, since the majority of tourists use Sangster.

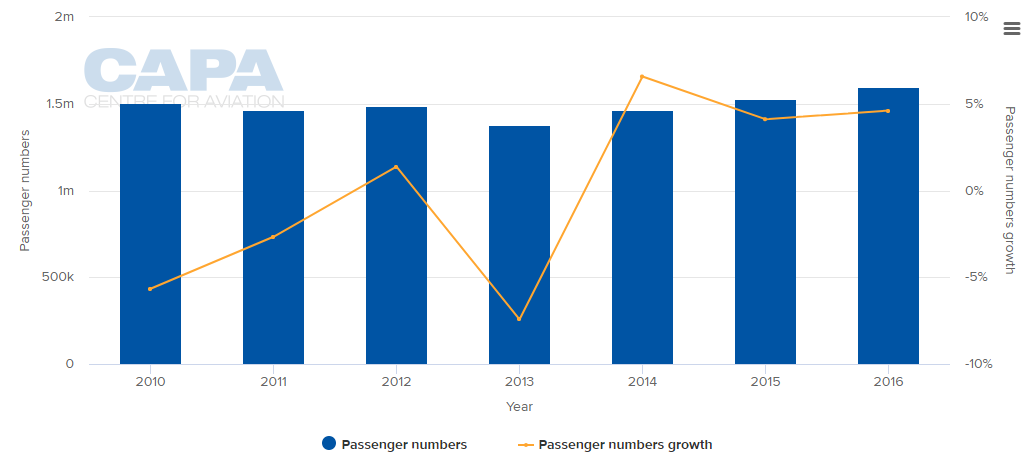

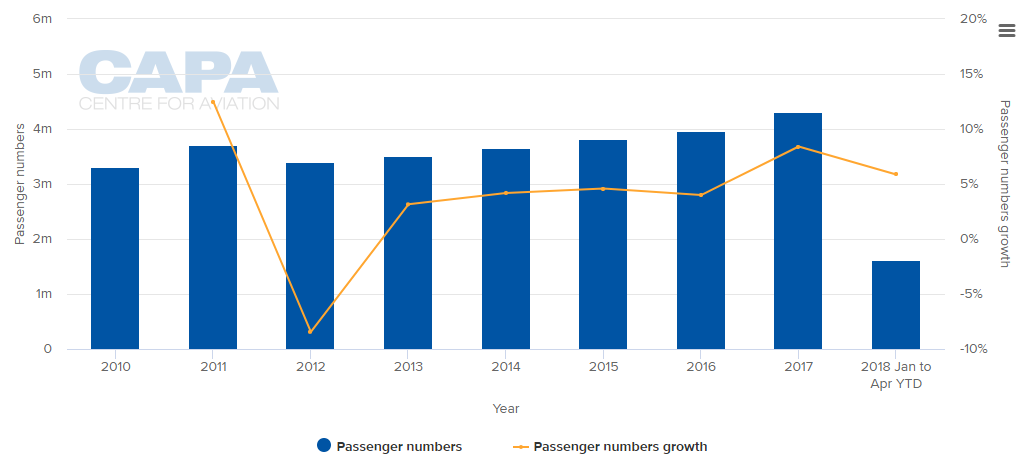

CHART - Traffic demand data for Kingston (top) and Montego Bay (bottom) suggest that apart from being the larger airport, the latter has also been growing more consistently in recent years

Source: CAPA - Centre for Aviation and Montego Bay and Kingston International Airport reports

Source: CAPA - Centre for Aviation and Montego Bay and Kingston International Airport reports

During 2017, KNMIA registered passenger traffic representing 27% of the country's total passenger traffic, while the Montego Bay airport served the remaining 73%. In terms of markets, 70% of passenger traffic comes from the US and Canada, 16% from the Caribbean and 14% from Europe. That is a large gap to narrow, by GAP or anyone else.

When KNMIA came back on to the market and was proposed to a crowded breakfast meeting at an airport investment conference in Lisbon in Nov-2016 the upfront fee had been reduced to USD5 million and the mandatory CapEx requirement to USD110 million, of which USD50 million must be spent in the first three years.

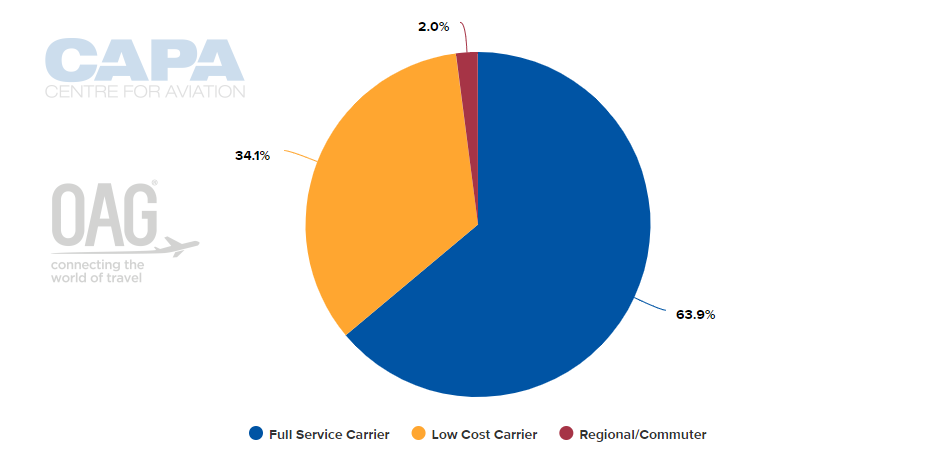

The objective was made clear at the time by KNMIA's representatives and consultants, i.e. to claw back some of that traffic from Sangster on the western side of the island and perhaps to increase LCC penetration, although that already stood at 26% (seat capacity) and has since increased to over a third.

CHART - LCC penetration has been on the rise at Kingston Norman Manley International Airport and currently accounts for just over a third of system seats Source: CAPA - Centre for Aviation and OAG (data: w/c 17-Sep-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 17-Sep-2018)

The Airport Authority's CEO candidly admitted that growth had been "anaemic" in recent years but that the authority was confident that passenger traffic could be raised from 1.5 million ppa to 3 million by 2018. It is perhaps no coincidence that such actual figures are not available to the public. It is as if the world ended in 2016!

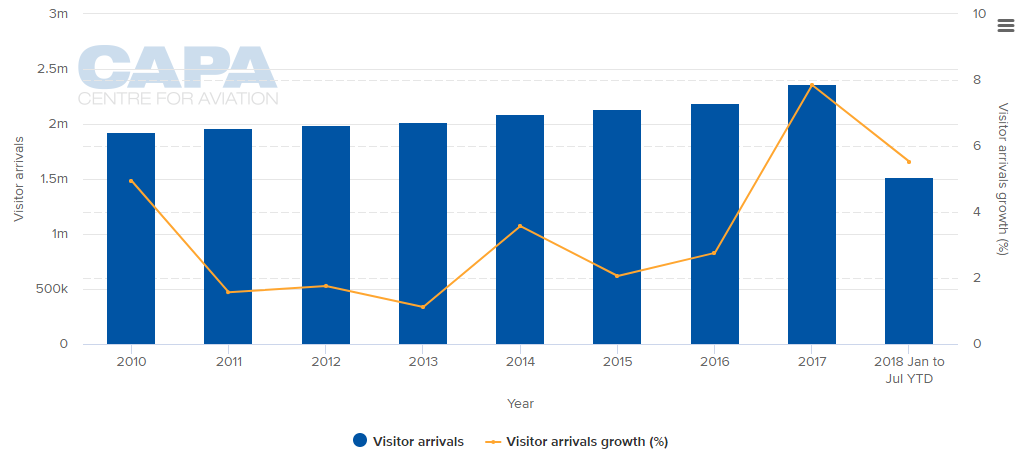

The principle attraction to investors was the fact that tourism structure has been increased considerably, with the hotel stock having risen to 33,000 rooms, while new highways now link the eastern side (Kingston) of the island with the western side (Montego Bay) where the tourism product is concentrated.

CHART - Tourism is crucial to the Jamaican economy and it grew strongly in 2017 Source: CAPA - Centre for Aviation and Jamaica Tourist Board

Source: CAPA - Centre for Aviation and Jamaica Tourist Board

Although GAP received notification of its status as provisional preferred bidder, certain terms within the concession agreement remain to be defined with the Government of Jamaica. While that is going on GAP must brace itself for the task of taking on an airport on the 'wrong' side of the island and of persuading airlines to land there so their passengers in the main can be ferried to the other side, 180 km (112 miles) by road, while not using the local airport, where it is already the major shareholder in the consortium that runs it.