Summary:

- British Airways' parent (International Airlines Group) snaps up former Monarch Airlines slots at London Gatwick and Wizz Air buys slots at London Luton but Birmingham and Manchester allocations have opened the doors to number of operators.

- As congestion issues continue to blight the London market, Birmingham and Manchester are likely to see an increasing focus of new UK flights, particularly long haul links.

- Manchester and Birmingham lie respectively at the heart of the 'Northern Powerhouse' and 'Midlands Engine'; two loosely-defined areas that are seeking to capture or recapture industrial and commercial business from London and the southeast of England.

With both London Heathrow and Gatwick airports operating at very close to capacity for much of the day, it is perhaps not surprising that it was an entrenched airline group at Gatwick, IAG, that acquired Monarch's slots there; after all British Airways is fighting a rearguard action in the face of an onslaught from Norwegian, which has around half the Gatwick capacity and frequencies of BA now. Monarch did not operate at Heathrow so there are no slots to disburse there.

There is no such congestion at airports such as Birmingham and Manchester, both of which seek to benefit from the interminable procedure to formalise the construction of a third runway in the south of England, one that even now is still open to question. Realistically it will take a minimum of 10 years from now to build and put into operation an additional runway there and any airline that seeks to obtain or increase market share in the UK while the going is good (there is no guarantee that it will be next week, never mind this time next year) needs to look beyond London.

While Gatwick talks about handling 50 million passengers a year on a single runway at the same time as "continuing to deliver the best passenger experience" one has to wonder just how far it can go, particularly when almost two-thirds of its capacity is on low-cost carriers that require rapid turnaround. A useful analogy is with the world athletics 100-metre record. The male record has stood for eight years and the female one for 29 years. You can only go so far, so fast. A point has been reached in both cases where 'operational improvements' become very difficult to achieve.

The two major non-London airports in England, Manchester and Birmingham respectively, not only have plenty of spare capacity now, at least outside the peak periods; they are laying the groundwork for future capacity enhancement with infrastructure investment.

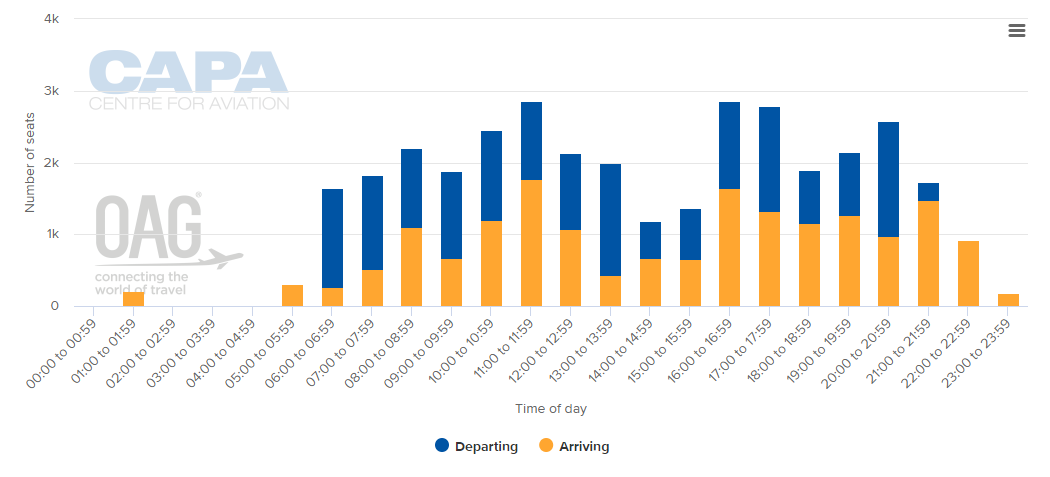

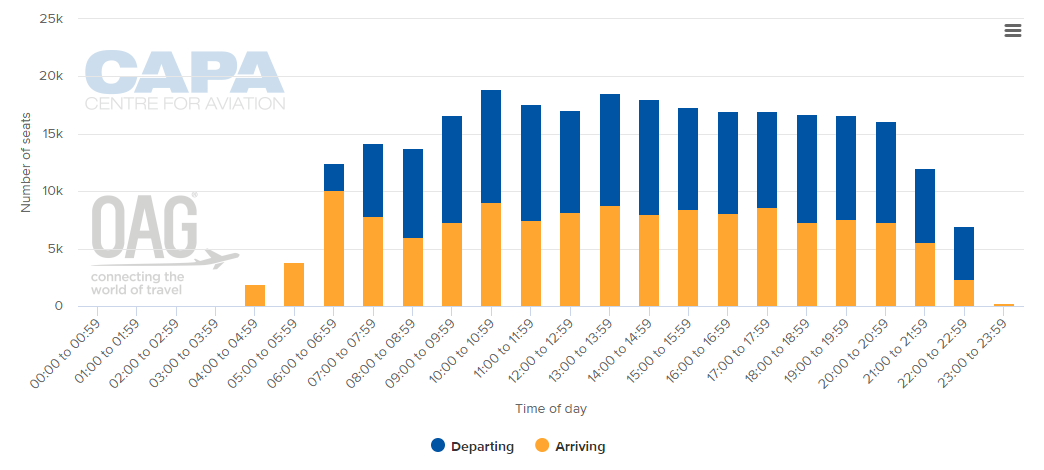

CHART - A closer look at seat capacity by the hour charts for Birmingham (top) and Manchester (middle) airportsshows a very different profile to that for London Heathrow (bottom)

Source: CAPA - Centre for Aviation and OAG (data: 11-Dec-2017)

Source: CAPA - Centre for Aviation and OAG (data: 11-Dec-2017)

The peak demand at both airports is clear, with spare capacity available in the early afternoon and evening in particular. Similar options do not really exist at Heathrow.

The two cities lie respectively at the heart of the 'Northern Powerhouse' and 'Midlands Engine'; two loosely-defined areas that are seeking to capture or recapture industrial and commercial business from London and the southeast of England and in both cases the current government displays at least lukewarm support for the notion. Development of the airports will be in tandem with the construction of high-speed rail services and Manchester is currently the more aggressive of the two as it covets the opportunity to help transform the north into one of the best-connected regions in Europe.

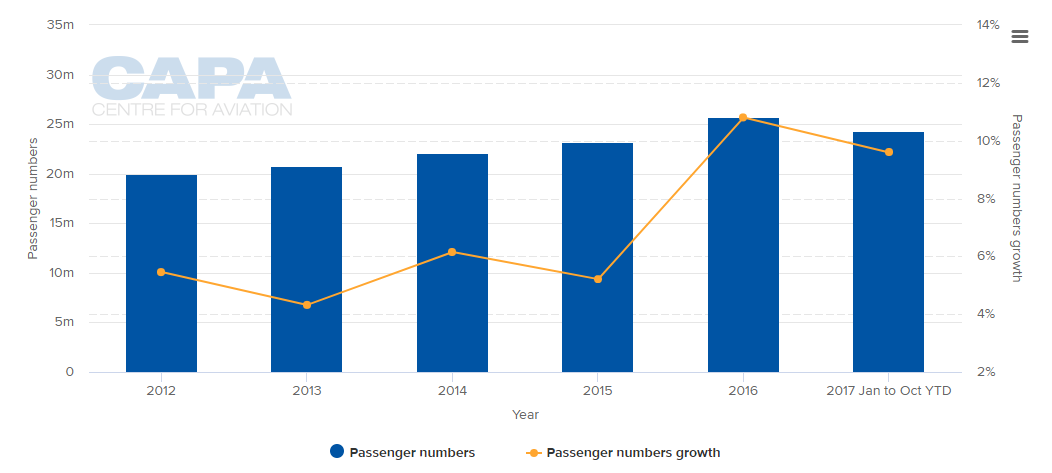

At Manchester, where passenger numbers should easily exceed 27 million in 2017, expenditure of GBP1 billion is earmarked to expand Terminal 2 (which was partly mothballed when it first opened), and to connect it directly to a revamped Terminal 3, with the ancient Terminal 1 to close. Work has commenced and will pick up pace throughout the winter season. Runway capacity at the only non-London airport to have two runways is already adequate for up to 50 million ppa.

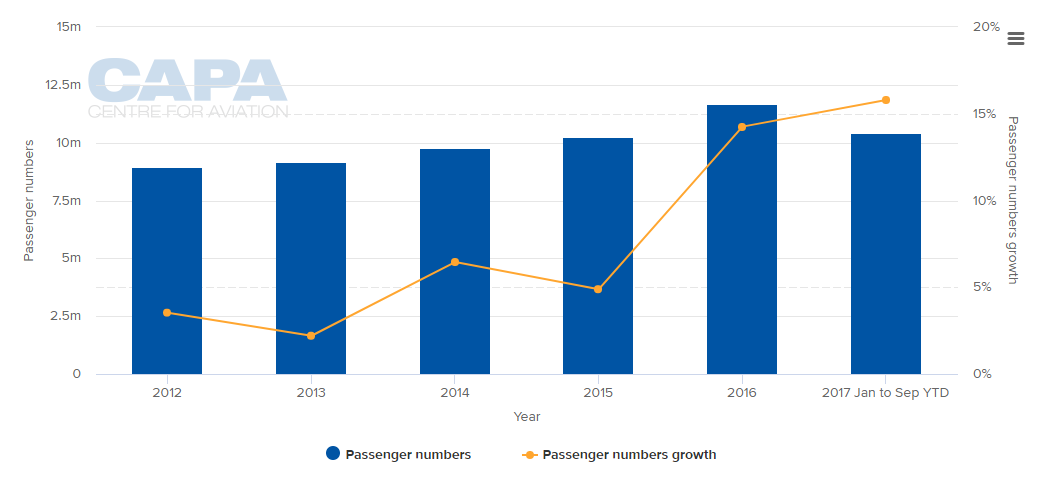

At Birmingham, which will be the first to acquire high-speed rail directly to the airport, a revised master plan to 2030 is in preparation. With a runway extension completed in 2014, Birmingham was able to claim that it could handle an extra 30 million passengers a year in its submission to the Airports Commission.

CHART - Traffic at Birmingham (top) and Manchester (bottom) airports has been growing at a much faster rate than at London Gatwick and London Heathrow over the past couple of years

Source: CAPA - Centre for Aviation and airport reports

Source: CAPA - Centre for Aviation and airport reports

Both the airports received backing from credit ratings agency Moodys last week, on the grounds that projects have been designed so that they can be deferred or postponed to match trading conditions; they will in most cases boost tariffs; and they are being financed at historically low rates.

At Manchester, the Monarch slot reallocation alone means that seven airlines will now be able to operate new services and improve timings on some of their existing routes while easyJet, Ryanair and Jet2.com intend collectively to base an additional 11 aircraft there in summer 2018.

There will be comparable growth at other regional airports, particularly Bristol, a city that economically ranks alongside Manchester and which is attracting firms, especially in the financial sector, that are quitting London but which do not wish to move north, and possibly Leeds-Bradford, depending on the ambitions of its new owners. But the odds are in favour of the greatest degree of non-London growth being at Manchester and Birmingham respectively, during the next decade and perhaps even at the expense of London.