In terms of international traffic growth, APAC posted a 9.4% increase for the year, marking the first time the region had led all other regions since 1994. Although APAC is growing as a whole, a range of dissimilar markets with different demands exists, according to levels of economic maturity, geography and general preferences.

Loyalty programmes in APAC are subject to these same values - according to Mastercard, which recently published a white paper entitled: 'Achieving Advocacy and Influence in a Changing Loyalty Landscape'. Mastercard's report covers loyalty programmes in Australia, China, Hong Kong, India, Indonesia, Japan and South Korea.

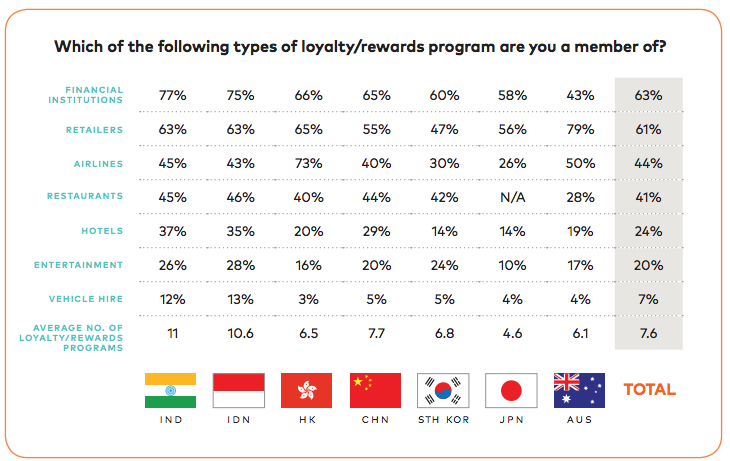

In total, the average consumer is a member of 7.6 loyalty/reward programmes - with India's 11 programmes per person leading the charge:

Source: Mastercard

Source: Mastercard

In total, airline loyalty programme memberships are held by 44% of consumers.

On a country basis, however, a very different picture is painted: 73% of Hong Kong consumers are part of an airline loyalty programme, compared to just 26% of Japanese consumers. The drop after Hong Kong is also considerable - with Australian consumers amounting to the second highest percentage at 50%. Still, airlines are the third most popular category for loyalty programmes in APAC.

The retail sector and financial institutions both enjoy the highest aggregates of consumer participation, at 63% and 61%, respectively. As for the highest country representatives in the sectors, 79% of Australians are part of a retail loyalty scheme and 77% of Indian nationals are part of a financial institution loyalty programme.

Analysis of the data shows there is an uneven "loyalty landscape" in the Asia Pacific, with markets at very different points on the maturity curve. Markets like Australia, Hong Kong, Japan and South Korea are highly mature; programmes in these markets are well established but face the challenge of continuing engagement from an expectant, and sometimes "jaded", consumer.

Contrarily, emerging markets like China, Indonesia and India present an opportunity to capitalise on the unquestionable appetite for loyalty among the "burgeoning middle classes", according to Mastercard.

But are loyalty programmes working?

Loyalty programmes ultimately exist to influence behaviour in a way that is favourable to the programme operator. In general, a programme will seek to influence three main behaviours: payment behaviour, shopping behaviour and travel behaviour.

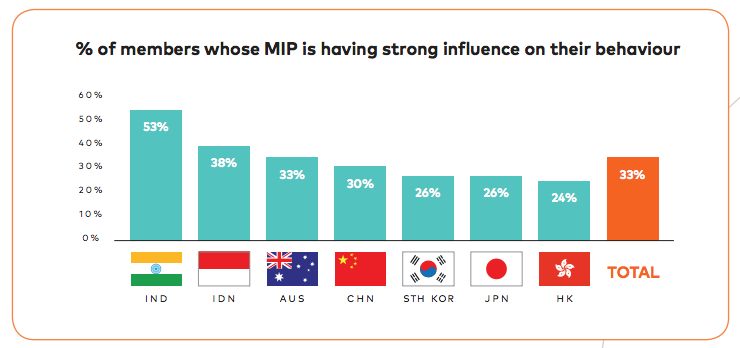

Mastercard found that each consumer has what they consider to be the "most important" programme (MIP), which naturally means the programme that is most likely to influence a decision by the consumer. Each country reported differing levels of influence on their behaviour from their MIPs:

Source: Mastercard

Source: Mastercard

Despite programmes carrying levels of influence, however, Mastercard notes that rewards are becoming "harder to earn", especially in mature markets. While there are still opportunities across APAC for loyalty programmes to "drive influence", this is only true for programmes that facilitate "positive engagement" with members. This means delivering member experiences that actually matter to consumers.

Digitisation - surprisingly, still a huge opportunity

Overall, the most particularly shocking finding from Mastercard was that 40% of APAC consumers cannot interact with their MIP online, and only 40% can do so via a mobile app.

Take Australia for example: only 17% of Australian programme members can manage their account on both a website and mobile app.

Indian and Indonesian consumers are most connected, and when asked to report their satisfaction level with the use of technology in their MIP, they were also the most likely to report a high level of satisfaction.

Mastercard emphasises that providing access to a programme via BOTH website and mobile app has a significantly affirmative effect on customer satisfaction.