Source: Nasdaq.com

There are many factors that affect the impact on airlines of lower fuel prices. One obvious impact is from the exchange rate: oil prices are quoted in US dollars, so costs are higher when the AUD is lower.

However, after a low start, this year the AUD has remained fairly strong, in the range of 0.73-0.77cents.

Source: xe.com

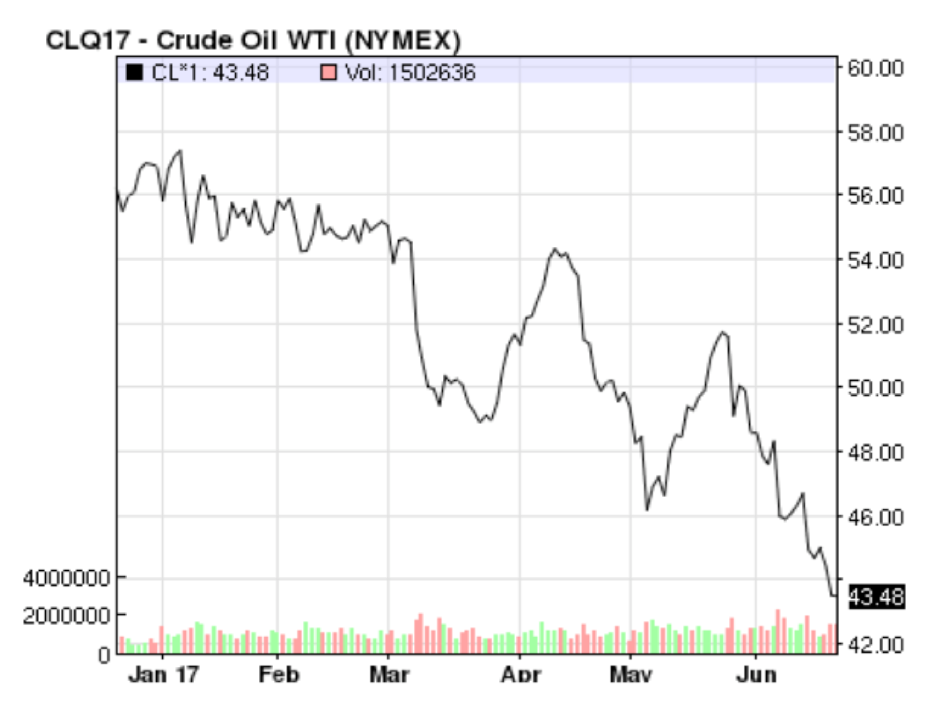

As a result, oil prices in AUD are significantly lower than they were six months ago - around 20% cheaper.

Net total costs are down about 4% this year

The next parameter in this equation is that an airline's fuel costs account for around 20% of costs (a proportion that obviously changes according to the price of fuel, as well as the cost profile of the airline. Thus, fuel constitutes a larger proportion of costs for an airline that has low costs).

Qantas for example, in 1H2017, to 31-Dec-2016, generated AUD8.2 billion in revenues. Its total expenses were AUD7.2 billion, of which AUD1.5 billion was on fuel, or just under 21%.

So, at face value, a 20% reduction in 20% of the production costs should mean an overall cost reduction of around 4%. That's a healthy saving. In fact it is pretty much the profit margin that most airlines aspire to make (sad isn't it!).

But that's at face value.

It gets more complicated - doesn't it always?

Airlines usually hedge their future fuel costs

First of all, airlines don't always leave themselves fully exposed to the vagaries of the market. Their treasury divisions usually prefer to hedge their prices, effectively locking in a price for the future; that comes at a cost, as there's always a premium to pay for the certainty.

The price of certainty can also be to leave an airline in trouble if prices go down and they haven't bought the right sort of hedge product. Ask Cathay Pacific; it was caught with high priced hedges when prices slumped and it cost billions in "mark to market" charges to their financial suppliers, similar to a margin call.

The result therefore is that short term price changes in the price of oil don't necessarily flow through immediately. Not in full anyway - airlines don't usually hedge all of their future fuel costs.

And for good reason they tend to be pretty cagey about how much they disclose - for example, Qantas again, for the 1H2017 report, noted "For 2016/17 the Group's hedging profile is positioned such that the worst case total fuel cost is $3.2 billion with 65 per cent participation rate in lower fuel prices (at current forward market price total fuel cost for 2016/17 is $3.1355 billion)".

But that does imply that a good proportion of Qantas' fuel is unhedged too.

Airlines also hedge their financial costs

For an international airline there's a natural currency hedging effect because it generates revenues in a number of foreign currencies. Domestic airlines don't have this advantage (it's usually an advantage anyway).

On the costs side, the majority are in USD. This includes lease costs, fuel of course and many others. But many are also in the home currency, like wages and other domestic supply costs.

So, for the same reason that they hedge fuel prices, they buy financial instruments that protect them against major currency fluctuations. Again there are pluses and minuses, but again the impact is to flatten the impact short term changes.

That ain't all….

The treasury function can then get a bit three dimensional.

First of all, airlines of course don't burn crude oil. They burn a highly refined lighter part of the barrel. This costs more than oil, although it does tend to track oil prices fairly closely most of the time.

Sometimes that margin spread - called a crack spread (from the cracking process) - can blow out, as it did when oil prices hit USD150 a few years back. One of the ingredients of the fluctuations is down to how much demand there is for crude. For example, if there is high demand for crude, there isn't a lot of the barrel left for refined jet fuel, so the crack spread widens.

Then, airlines will often need to hedge both oil and jet fuel prices, and with currency hedges involved, the picture becomes increasingly complex.

Beyond that it all becomes a bit arcane.

The bottom line: Good news!

Anyway, the bottom line is that lower oil prices are good news for airlines. And that in principle, there has been a significant reduction in fuel costs over the past six months. At least part of the Australian airlines' costs will have benefited from that already, with more to come - as long as the AUD remains steady and oil costs stay low.

The general "feeling" - and don't give any credence whatever to anyone who professes to know where oil prices will go - is that oil will remain down and even go further down. But all those "consensus" predictions aren't worth the paper (or bytes) they're written on.

The Middle East, where most of the production is, is highly unstable. And even though US fracking tends to keep a lid on the upside, the oil price market is also heavily influenced by sentiment.