Summary:

- Low Cost Carrier (LCC) air capacity into Australia from destinations across Asia will return to modest growth in the recently launched summer 2018/2019 period;

- The number of LCC seats will rise by around 8,000 for the period from late Oct-2018 through to late March-2019, a +0.62% rise on the previous summer period;

- Analysis by The Blue Swan Daily of OAG schedule data shows that LCC share of capacity could fall to a six-year low, based on current published schedules.

Looking back over a ten-year period this is the second slowest rate of growth in summer LCC capacity from Asia to Australia, only beaten by summer 2015/2016 when capacity growth of just +0.57% was recorded. It follows a winter schedule when non-stop LCC capacity in this market actually declined -5.34% versus winter 2017 to a two-year low, albeit still more than double the capacity recorded at the start of the decade.

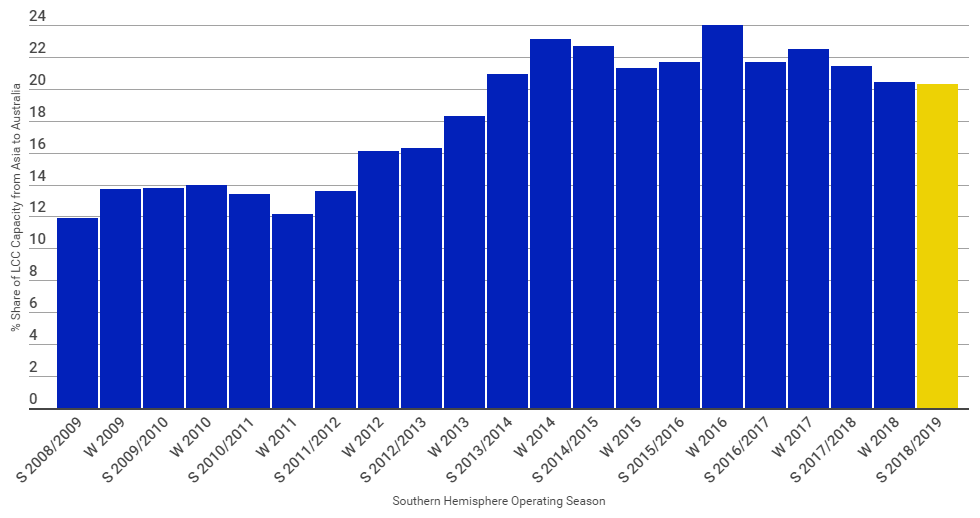

The LCC share of capacity from Asia and Australia has also more than doubled over the past ten years from just 11.93% in summer 2008/2009 to a peak of 23.98% in winter 2016. But, it has subsequently shrunk as non-LCC capacity in this market has grown at a much faster rate. Overall, non-stop seats into Australia from Asia this summer will increase +6.23% buoyed by a +7.76% rise in non-LCC capacity. In fact, analysis by The Blue Swan Daily of OAG schedule data shows that LCC share of capacity could well fall to a six-year low, based on current published schedules.

CHART - LCCs have taken an increasing share of capacity from Asia to Australia over the past ten years, but existing flight schedules suggest that this summer it could shrink to the lowest level since winter 2013 Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

Singapore, China, Indonesia, Hong Kong and Malaysia are the largest Asian markets for capacity into Australia in summer 2018/2019 and all will see an increase in one-way capacity versus summer 2017/2018, Singapore by a lofty +11.94%. Japan is expected to overtake Thailand as the sixth largest market by seats, due mainly to the latter's -12.99% decline in non-stop seats into Australia, while the Philippines, South Korea and Taiwan make up the rest of the top ten markets by capacity.

In terms of LCC seats during the period, Indonesia tops the list, ahead of Malaysia, Singapore, Japan and the Philippines. But Malaysia has the largest concentration of LCC capacity accounting for more than half (51.22%) the total seats available into Australia from the country.

Indonesia follows closely behind with a 48.03% LCC share with around a third of capacity from the Philippines (36.62%) and Japan (32.87%) flown by LCCs and around a quarter of the inventory from Vietnam (26.94%). The Thailand - Australia (LCC share: 18.44%) and Singapore - Australia and (LCC share: 15.32%) are dominated by mainline operations, while LCCs account for just 1.39% of capacity from China to Australia.