Summary:

- As one of the most constrained areas in Europe, the London airports system is always a challenge for airlines to gain access or increase operations;

- Slot specialist ACL acknowledges that "capacity has become a scarce resource that is depleting fast," but reveals 31 extra daily slots will be available in summer 2019;

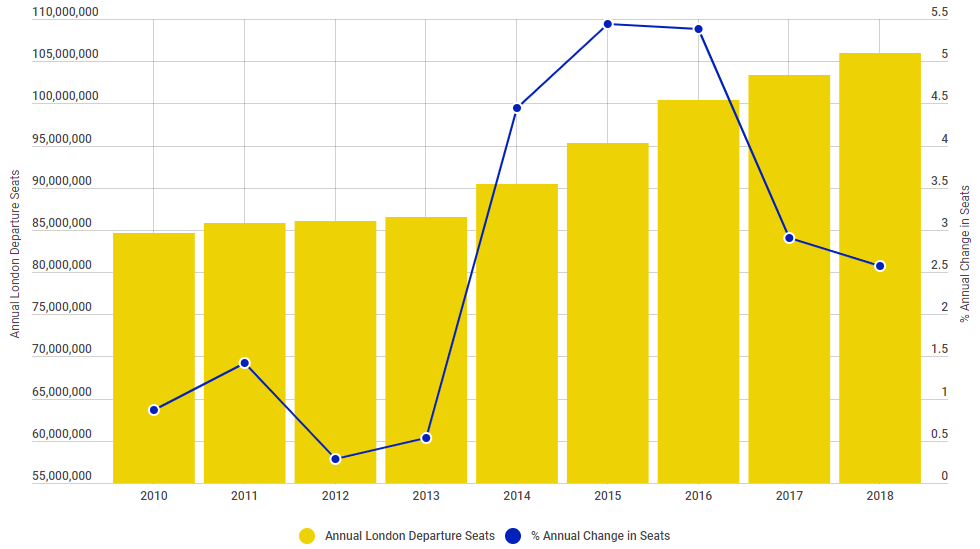

- The Blue Swan Daily analysis shows that scheduled commercial departure capacity from the UK capital has grown by more than a quarter since 2010, a CAGR of +2.9%.

In support of continued increasing demand, ACL says the airports in the London will still manage to increase runway capacity for the International Air Transport Association (IATA) northern hemisphere summer 2019 scheduling period that will run from 31-Mar-2019 to 26-Oct-2019. It reveals that 31 extra daily slots have been released for the seven months, which may only be equivalent to 0.6% of daily slots, but will provide important growth opportunities.

More than half of these (16) will be at London City airport, whose major constraining factor is stand availability rather than runway availability. London Gatwick and London Luton airports have no net increase in total capacity. London Stansted, whose major constraining factor is not the runway, released the remaining fifteen extra slots across each day. London Heathrow does not have a total hourly runway capacity, and is instead constrained by its annual movement cap.

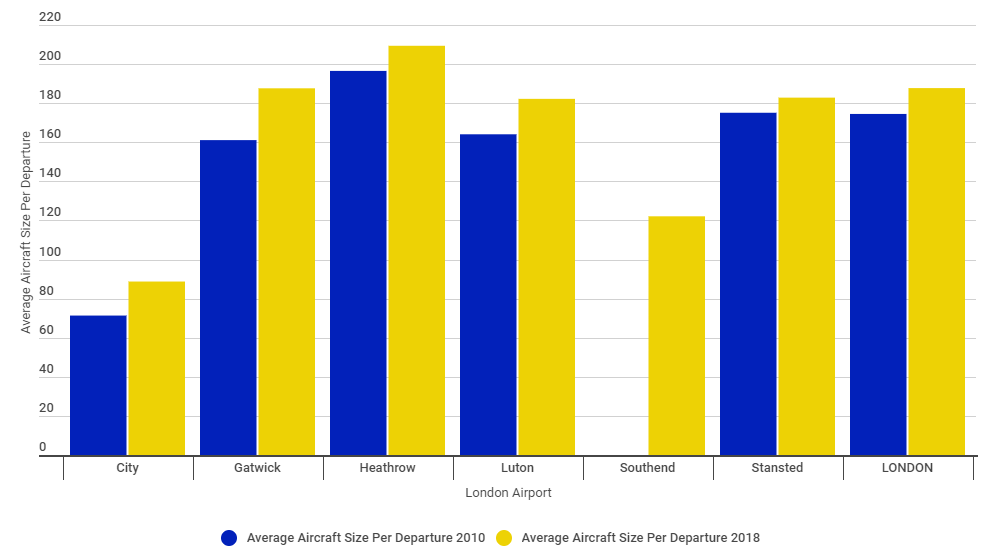

ACL says that following its initial coordination, the number of slots allocated across the London area has increased +1.5% versus summer 2018, a real term increase of over 11,000 slots (equivalent to roughly 26 daily rotations). The capacity restrictions are also pushing airlines to use larger equipment to make best use of the capacity available to them by increasing the number of seats that they are operating for each of their slots.

This is clearly evident when you look at the number of seats allocated by ACL for summer 2019, which has increased by over 3.4 million, an increase of almost +2.5%. All of the London airports will see an increase in the average number of seats per movement of almost +1%. On a specific airport level the largest increase will be at by London City airport, whose projected average seat per movement increases from 85.6 in Summer 2018 to 91.5 in Summer 2019 - a +7% rise.

This data shows that, despite limited opportunity for an increase in runway capacity in the London area, ACL have been able to maximise the utilisation of available capacity and will facilitate continued growth across the five IATA Level Three London airports.

CHART - Annual scheduled commercial departure capacity from the UK capital has grown by more than a quarter since 2010, but rates are slowing after peaking in 2015 Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

The Blue Swan Daily analysis of OAG schedule data for the London airports shows that scheduled commercial departure capacity from the UK capital has grown by more than a quarter since 2010, a CAGR of +2.9%. In total, 21 million additional annual seats have been introduced to the market from London during that timescale, growing to a record 106 million for the current year, the third successive year the 100 million departure seat figure has been surpassed.

The largest rise during the decade has been seen at Luton Airport, where departure capacity has risen +71.2% during the decade. High rates of growth have also been seen at London City (+51.0%), Gatwick (+40.1%), Stansted (+35.1%); Heathrow has also grown despite its long-standing movement cap (+7.8%), while regular scheduled operations have returned at Southend.

While, Luton may have seen the largest percentage growth this decade, Gatwick has seen the largest rise in additional seats from 2010 to 2018 (7.4 million). Growing demand, driven mainly by LCCs and Heathrow's capacity restrictions, has seen the latter's London influence diminish. It may still remain London's main hub airport, but its share of seat capacity has fallen from highs of 53% and 54% during the first half of the 2010s to just 47% in 2017 and 2018.

Supporting the ACL observations, our analysis shows that the average aircraft departure from London airports has grown in size by +7.6% this decade from an average of 174 seats in 2010 to 187 seats this year. This upgauge in capacity has been seen across all airports with Gatwick again seeing the largest rise, a +14.1% increase from 161 seats to 187 seats.

CHART - The average aircraft size used on flights from London has grown from 174 seats in 2010 to 187 seats in 2018 Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG