The fifth annual edition of the survey, which includes responses from senior balance-sheet lenders, CMBS lenders and providers of subordinate debt financing, represent the source of the majority of all hotel debt originated in the United States of America (USA) in 2017, with loan balances in excess of USD10 million.

Overall, the 2017 edition of the Lender Survey reflects stable credit risk spreads balanced by a cautious outlook of peaking asset values-all in an environment with underlying expectations of further near-term interest-rate increases.

"We really noticed more optimism throughout the entire survey," says Joseph Rael, director of financial performance at benchmarking specialist STR. "Most lenders still believe asset values are near the peak, but more are optimistic about the next 12 months than they were at the beginning of 2017."

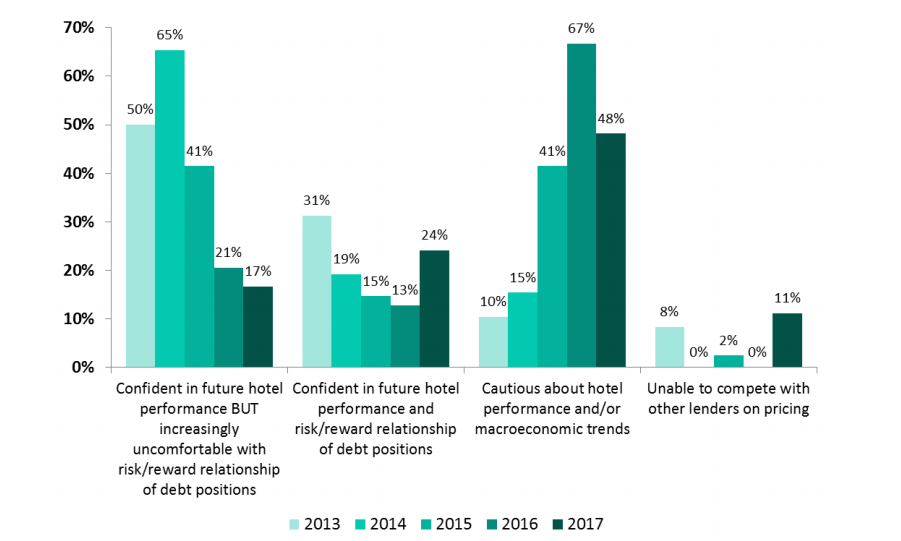

CHART - Lenders remain cautious about hotel lending with 48% responding that they are cautious about hotel performance and/or macroeconomic trends. However, lenders are less cautious than in 2016 when 67% of respondents answered with caution Source: Hotel Lender Survey

Source: Hotel Lender Survey

Key findings from the survey include:

- None of the surveyed lenders believe hotel values will increase significantly in the next 12 months;

- More than 60% of respondents expect hotel values to remain flat during the next 12 months, while 9% of respondents anticipate values to decrease slightly during that period;

- Almost 70% of lender respondents expect the overall hotel lending volume of the next 12 months to remain consistent with the previous 12 months;

- More than two-thirds of lenders expect moderately wider credit spreads in 2018;

- More than half of the surveyed lenders indicated that location and quality of real estate is the single most important "gating" criteria for financing requests;

- For the fourth consecutive year, lender respondents cited the potential for a U.S. economic slowdown and/or faltering general macroeconomic growth as the most feared threat to their hotel loan portfolio;

- By a wide margin, urban areas continue to be viewed as the least risky to provide financing for hotels;

- Economy, Independent and Luxury products are considered to carry the most financing risk;

- Senior lenders require, on average, a minimum debt yield of 9.1% on underwritten cash flow for an existing hotel. That average minimum is down from 10% last year;

- Among property classes, Economy receives the least amount of interest from lenders who provide construction financing;

- Less than 10% of lenders will consider any kind of construction financing. Among those that will finance construction, most indicated that they would provide non-recourse construction loans. This is a reversal of last year when 20% of respondents stated they needed full recourse guarantees, and 10% expected more than 50% of the total loan amount.

READ MORE: View the full findings of the Hotel Lender Survey