Reports began to surface in late Nov-2018 that Air France and recently appointed Air France-KLM CEO Benjamin Smith were considering the shut down as a way of strengthening the Air France brand. Indeed, the announcement forms part of a milestone agreement that has followed many months of negotiations with cabin crew, who have repeatedly lamented salary and work conditions of the hybrid compared with its mother.

Strike action undertaken by inter union syndicates in 2018 severely hampered Air France and led to slowed growth compared with KLM. Specifically, 550 cabin crew of Joon are expected to be transferred into Air France during 2019, according to cabin crew union representative SNPNC.

Joon launched services to Berlin, Barcelona and Lisbon on 01-Dec-2017, taking on destinations such as Istanbul, Naples, Oslo and Rome Fiumicino in mid Mar-2018. Long haul destinations now include Cairo, Cape Town, Fortaleza, Mahe, and Mumbai, with Tehran announced to be reduced to seasonal service after summer 2019.

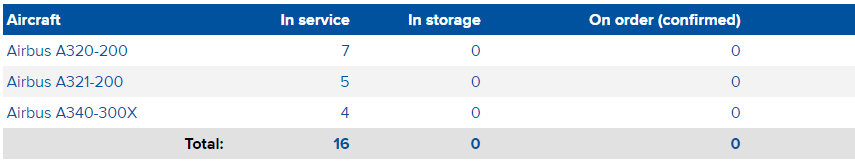

According to the CAPA Fleet Database, Joon operates a fleet of 16 Airbus aircraft, 12 A320 family narrowbodies and four A340 widebodies. Air France has 21 A350s on order, around 10 of which were meant for Joon as it transitioned to an all A350 long haul fleet to replace less efficient A340s on long haul routes.

TABLE - The Joon fleet consists of a mix of Airbus narrowbody and widebody aircraft Source: CAPA - Centre for Aviation Fleet Database

Source: CAPA - Centre for Aviation Fleet Database

According to reports, previous plans to ultimately operate an A350 only fleet will now change so that deliveries, and presumably long-haul routes operated by Joon, will be absorbed into Air France by around Jun/Jul-2019. The Joon livery is however expected to remain on Joon aircraft until 2021: the first six A350s are reportedly going to retain Joon livery, potentially creating further confusion for customers as to the wrap up of Joon as a brand in the next few years.

Aside from targeting the so-called millennial market, the business concept behind Joon revolved around establishing a new competitive company which could somehow tap into the low-cost market without sacrificing certain full-service aspects of Air France. It was expected costs could be reduced on medium and long-haul routes on which Air France saw consistent losses, and routes previously abandoned due to non-viability reopened under the Joon brand.

These costs were unrealistically expected to be passed onto crew, in particular cabin crew whose pay is around 40% lower than that of Air France counterparts, and to a lesser extend Joon pilots. Not only did this create fierce opposition from the outset, but it failed bring on any considerable decreases in airfares.

Initiatives such as announcing "child seating" targeting families rather than young travellers in late 2018, or touting the carrier as an "innovation laboratory", simply didn't make any sense and didn't lead to passing on any cost benefits for consumers. Joon's Twitter feed was also relatively silent for long periods of time, despite specifically marketing to those age groups who might make use of social media more than others.

Stating the Joon brand "was difficult to understand from the outset" for all those involved and "weakened the power of the Air France brand" is an important admission for the carrier to make and paves the way to not only rebuilding trust with unions but also turning to strengthening Air France's position in Air France-KLM group.

According to traffic results released by Air France-KLM, growth at Air France has slowed compared with its Dutch counterpart, which saw a 4.5% jump in passenger traffic in 2018 to 34.2 million and a stable load factor of just over 89%.

Air France-KLM already has a reliable LCC brand in Transavia for short haul low cost travel in Europe, which saw a 7.2% jump in 2018 traffic and load factor rising to 92%, and may even have the potential to pick up some longer routes Joon has shared with Air France depending on fleet integration moving forward.

Joon's legacy will be one of confusion. The decision taken by Air France shows not only renewed strength in the new management of Air France under Benjamin Smith and newly appointed Air France CEO Anne Rigail, as well as an improvement in the working relations with unions and management. But with the name living on for at least a couple of years, a visible reminder of the Joon exercise will be clear to see.